The average retirement age in the U.S. is currently 62, but this varies across states (ranging from 61 to 66) and often differs from when people expect to retire, which is typically 65-66.

Social Security’s full retirement age is now 67 for those born after 1960, while Medicare eligibility begins at 65.

Rising life expectancy, economic factors, and healthcare costs are shifting retirement timelines, making it essential to plan early, diversify your retirement investments, and understand your state’s cost of living before retiring.

Current Average Retirement Age in the U.S.

The average retirement age in the US is 65 for men and 62 for women. Even if retirement is in the future, it’s important to consider factors that might contribute to your decision. Here’s what you should know about how retirement can impact your health: https://t.co/8I4pe4ZXMF pic.twitter.com/vLnKIleUTI

— Jefferson Health (@TJUHospital) July 19, 2024

A 2024 study confirms that the average retirement age in the U.S. is 62, while many workers plan to retire at 65 or later. Interestingly:

- In 1991, the average was 57.

- Today, retirees believe the ideal age is 63.

- There is a consistent gap between expected (66) and actual (62) retirement ages due to health issues, layoffs, or caregiving needs.

- Fewer adults are retiring early:

- Retirement between the ages of 50-54 dropped from 9% to 6%.

- Retirement between the ages of 55-59 dropped from 19% to 11%.

Life expectancy increases have extended the average retirement period from 12.8 to 18.6 years for men and from 16.6 to 21.3 years for women since 1970, requiring larger savings for a sustainable retirement.

Average Retirement Age by State

| State | Average Retirement Age |

| Alabama | 62 |

| Alaska | 61 |

| Arizona | 63 |

| Arkansas | 62 |

| California | 64 |

| Colorado | 64 |

| Connecticut | 65 |

| Delaware | 64 |

| Florida | 63 |

| Georgia | 62 |

| Hawaii | 65 |

| Idaho | 63 |

| Illinois | 64 |

| Indiana | 63 |

| Iowa | 65 |

| Kansas | 65 |

| Kentucky | 62 |

| Louisiana | 62 |

| Maine | 64 |

| Maryland | 65 |

| Massachusetts | 65 |

| Michigan | 63 |

| Minnesota | 64 |

| Mississippi | 62 |

| Missouri | 63 |

| Montana | 63 |

| Nebraska | 64 |

| Nevada | 63 |

| New Hampshire | 65 |

| New Jersey | 65 |

| New Mexico | 63 |

| New York | 65 |

| North Carolina | 63 |

| North Dakota | 64 |

| Ohio | 63 |

| Oklahoma | 62 |

| Oregon | 64 |

| Pennsylvania | 64 |

| Rhode Island | 64 |

| South Carolina | 63 |

| South Dakota | 64 |

| Tennessee | 62 |

| Texas | 65 |

| Utah | 64 |

| Vermont | 65 |

| Virginia | 64 |

| Washington | 64 |

| West Virginia | 61 |

| Wisconsin | 64 |

| Wyoming | 63 |

| Washington, DC | 67 |

Retirement Age Reflects Economic Structure

States with physically demanding industries (manufacturing, agriculture, mining) often show lower retirement ages:

- Alaska (61), West Virginia (61), Louisiana (62), Kentucky (62)

- Physical strain and job hazards lead to earlier retirements, often driven by health limitations.

Conversely, states with knowledge and service-based economies reflect later retirement ages:

- Washington, DC (67), Massachusetts, New Jersey, Connecticut, and New York (all 65)

- These regions have higher rates of white-collar workers, often working longer by choice or financial necessity.

Cost of Living Influences Retirement Timing

High cost-of-living states often correlate with later retirement due to the need for larger savings:

- California (64), Hawaii (65), New York (65)

- Residents need more saved before comfortably retiring, delaying exit from the workforce.

Lower cost-of-living states can allow earlier retirements:

- West Virginia (61), Arkansas (62), Mississippi (62)

- Reduced living expenses, affordable healthcare, and housing lower the required savings threshold.

Health Care Access and State Policies Matter

States with better healthcare access and higher healthcare costs see delayed retirements as individuals maintain employment for insurance coverage until Medicare at 65:

- Maryland, Massachusetts, Vermont, and New Jersey (65)

In contrast, those in states with Medicaid expansion and cheaper local healthcare options may retire earlier:

- Kentucky (62), Arkansas (62), Oklahoma (62)

Gender and Demographics Impact State Averages

Women generally retire earlier than men (average 63 vs. 65 nationally), affecting states with higher female workforce participation in certain sectors, according to IZA.

Additionally, states with aging populations, such as Florida (63), may see earlier retirements as communities cluster around senior-friendly infrastructure.

Implications for Retirement Planning

- Where you live deeply impacts when you can retire.

Retirees in high-cost states need to account for housing, healthcare, and tax differences that may require working until 65+. - Health drives earlier retirement more than choice in many states.

Nationwide, about 31% retire earlier than planned due to health issues, while 32% retire early due to employer-related changes (Source: EBRI, SSA studies). - Longer life expectancy requires longer planning.

With retirement spanning 18-22 years on average, early retirement without adequate savings can risk outliving funds. - Access to Social Security and Medicare plays a significant role:

- Social Security can start at 62 but is reduced by up to 30% vs. age 67.

- Medicare begins at 65, encouraging many to delay retirement until coverage begins.

How Much Do You Need Saved to Retire Comfortably

| State | Estimated Savings Needed |

|---|---|

| Alabama | $780,000 |

| Alaska | $1,292,753 |

| Arizona | $900,000 |

| Arkansas | $740,000 |

| California | $1,612,716 |

| Colorado | $1,000,000 |

| Connecticut | $1,080,000 |

| Delaware | $950,000 |

| Florida | $950,000 |

| Georgia | $820,000 |

| Hawaii | $2,212,084 |

| Idaho | $850,000 |

| Illinois | $970,000 |

| Indiana | $820,000 |

| Iowa | $800,000 |

| Kansas | $800,000 |

| Kentucky | $750,000 |

| Louisiana | $770,000 |

| Maine | $1,144,038 |

| Maryland | $1,050,000 |

| Massachusetts | $1,645,764 |

| Michigan | $890,000 |

| Minnesota | $950,000 |

| Mississippi | $730,000 |

| Missouri | $810,000 |

| Montana | $840,000 |

| Nebraska | $810,000 |

| Nevada | $920,000 |

| New Hampshire | $1,113,994 |

| New Jersey | $1,163,566 |

| New Mexico | $820,000 |

| New York | $1,292,753 |

| North Carolina | $860,000 |

| North Dakota | $800,000 |

| Ohio | $850,000 |

| Oklahoma | $725,000 |

| Oregon | $1,050,000 |

| Pennsylvania | $900,000 |

| Rhode Island | $990,000 |

| South Carolina | $850,000 |

| South Dakota | $790,000 |

| Tennessee | $810,000 |

| Texas | $890,000 |

| Utah | $910,000 |

| Vermont | $1,153,051 |

| Virginia | $950,000 |

| Washington | $1,145,540 |

| West Virginia | $712,913 |

| Wisconsin | $860,000 |

| Wyoming | $810,000 |

| Washington, DC | $1,200,000 |

To illustrate these differences, consider the suggested savings needed to retire comfortably at age 65 in five states representing both high and low cost-of-living environments. In Hawaii, retirees are advised to have saved $2,212,084 to maintain a comfortable lifestyle throughout retirement.

This figure reflects the state’s high cost of living, driven by expensive housing markets, elevated grocery prices due to shipping costs, and above-average healthcare expenses. The picturesque environment and warm climate may draw many to Hawaii, but the price tag requires substantial planning and disciplined saving to avoid financial stress in retirement.

Massachusetts follows with a suggested savings of $1,645,764, reflecting the state’s high housing and healthcare costs, especially in cities like Boston. Retirees in Massachusetts often face higher property taxes and living costs, requiring a more substantial nest egg to cover essentials while still enjoying the lifestyle they envision for their retirement years.

California, another high-cost state, comes close behind with a suggested retirement savings amount of $1,612,716. The Golden State’s allure of coastal living, warm climate, and diverse cultural opportunities makes it a popular choice for retirees, but these benefits are coupled with one of the highest housing costs in the country, requiring retirees to prepare accordingly if they wish to maintain a stable lifestyle without sacrificing their financial security.

New York, known for its vibrant cities and rich cultural environment, requires retirees to have around $1,292,753 saved to retire comfortably. The state’s high taxes and healthcare expenses contribute to the elevated figure, particularly for retirees wishing to remain in or near urban centers such as New York City, where living costs are substantially higher than in rural areas of the state.

On the opposite end of the spectrum, West Virginia offers a much lower suggested savings amount of $712,913 for a comfortable retirement. The state’s low housing costs, affordable healthcare, and lower overall living expenses contribute to its reputation as a retirement-friendly location for those seeking a more budget-conscious lifestyle.

Retirees can maintain a good quality of life with less financial strain, potentially allowing for earlier retirement while still covering essential needs.

The stark contrast between the top and bottom states highlights the impact location has on retirement planning. Retirees in high-cost states like Hawaii and California must plan for housing costs that can consume a significant portion of their retirement income, often requiring a higher savings rate and potentially delaying retirement to accumulate sufficient funds.

Meanwhile, states like West Virginia provide a more affordable environment, where retirement savings can stretch further, offering retirees the option to retire earlier or live more comfortably on a smaller nest egg.

Social Security and Medicare: What to Know

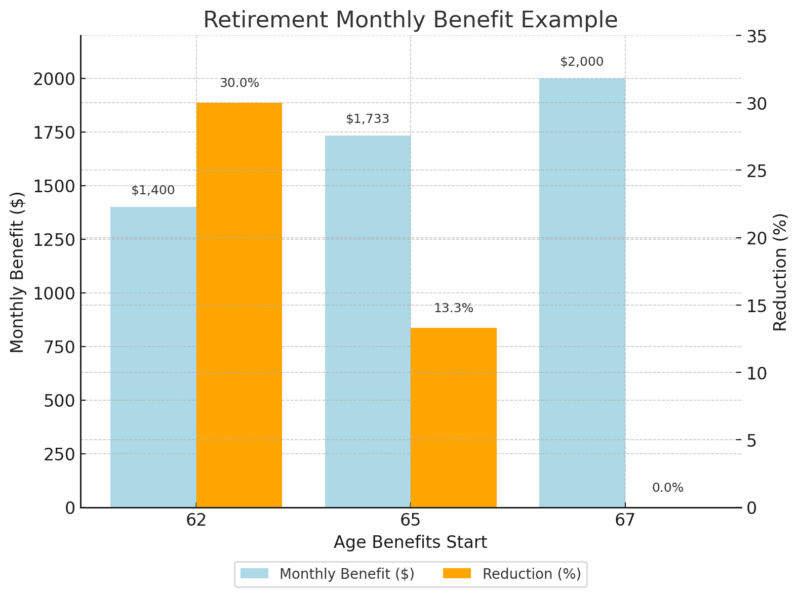

Social Security benefits can be claimed as early as age 62, but doing so comes with a 25-30% reduction in monthly payments compared to waiting until full retirement age, as noted by SSA.

For individuals born after 1960, the full retirement age is now 67, and waiting until this age ensures you receive 100% of your eligible benefit. For those who can delay beyond 67, benefits increase by approximately 5-8% annually up to age 70, offering higher guaranteed income in retirement.

To illustrate, consider a base monthly benefit of $2,000 at full retirement age. If benefits begin at age 62, the payout reduces to $1,400 per month, while starting at 65 provides $1,733 monthly. Waiting until 67 secures the full $2,000 per month, ensuring maximum benefits throughout your retirement years.

Retirement Monthly Benefit Example

Medicare, on the other hand, becomes available at age 65 regardless of your employment status. Enrollment begins three months before your 65th birthday and continues for three months after, providing flexibility to align your healthcare coverage with your retirement date.

Even if you retire earlier, you will need to arrange alternative health insurance until you become eligible for Medicare, making this age a significant milestone in retirement planning.

Why Americans Are Working Longer

In recent years, more Americans have extended their working years, and several factors contribute to this trend. One major factor is the rising Social Security age, as full benefits now require individuals to work until age 67 to receive maximum payouts, compared to previous generations who could retire with full benefits at 65.

Another critical driver is the increase in life expectancy. With retirees living longer, many need additional savings to avoid outliving their funds, and working longer provides the opportunity to accumulate those savings while reducing the number of years funds will be drawn in retirement.

Economic challenges have also played a role. The impact of the 2008 recession, the financial setbacks caused by the COVID-19 pandemic, and the recent inflationary environment have disrupted many individuals’ retirement plans, forcing them to work longer to rebuild depleted savings and secure sufficient funds for a stable retirement.

Interestingly, while many Americans plan to retire at around 66, reality often leads to earlier retirement. Data shows that 31% of early retirements occur due to health issues, while 32% result from company-related changes such as layoffs or restructuring. These unplanned retirements highlight the importance of building flexibility into your financial plan to adapt to unexpected life events.

How to Determine Your Ideal Retirement Age

@radio2000_za What is the right age to retire? #TheRoyalPlayground ♬ original sound – Radio2000_ZA

Choosing the right retirement age is a personal decision shaped by several practical factors. Financial readiness remains one of the most important considerations. Assessing your 401(k), IRA, and overall savings will help determine whether you can maintain your desired lifestyle without financial strain once you stop working.

Health is another critical factor. Longer lifespans may require extended working years to accumulate sufficient funds for a retirement that could span two decades or more, while declining health may lead to earlier retirement despite financial readiness.

Lifestyle goals will also influence your decision. Some individuals aim to retire early to travel extensively or pursue hobbies, while others may prefer to continue working to stay engaged or for financial security.

Your plans for where and how you wish to live during retirement, whether it involves downsizing, relocating to a lower-cost area, or maintaining your current lifestyle, will shape the timing of your retirement.

It is also important to consider your debt situation. Paying off high-interest debts before retiring can ease financial pressure, allowing your retirement income to be directed toward living expenses and lifestyle goals rather than servicing debt.

Market conditions can influence your decision as well. Favorable economic periods can make transitions smoother, providing higher returns on your retirement investments and potentially allowing earlier retirement, while economic downturns may require delaying retirement to preserve or rebuild your nest egg.

Factors Shaping Retirement Age Decision

| Factor | Impact on Retirement Age |

| Financial Readiness | Determines if savings can sustain lifestyle post-retirement |

| Health Status | Longer life may require working longer; poor health may advance retirement |

| Lifestyle Goals | Desire for travel, hobbies, or relocation can shape timing |

| Debt Situation | High debt may delay retirement; a debt-free status may enable earlier retirement |

| Market Conditions | Economic trends can impact portfolio growth and readiness |

Retirement Planning by Age Group

In Your 20s and 30s

- Start saving early to maximize compound growth.

- Prioritize consistent 401(k) and Roth IRA contributions.

In Your 40s

- Increase contributions to 15% of income if possible.

- Balance family expenses with retirement planning.

In Your 50s

- Peak earning years: Maximize catch-up contributions.

- Reassess asset allocation to reduce risk.

In Your 60s

- Fine-tune your plan with a professional.

- Consider when to start Social Security for optimal payouts.

- Ensure Medicare enrollment.

Average Retirement Ages Worldwide: A Shifting Global Landscape

Global life expectancy has risen significantly, moving from 46.5 years in 1950 to 66 years in 2000, with projections suggesting it will reach 76 years by 2050, according to the United Nations Population Division.

This longevity revolution is prompting countries to reconsider their retirement ages, adapting systems designed decades ago to align with longer, healthier lives and the financial realities of supporting aging populations.

In 2023, France enacted a pension reform that will increase the minimum legal retirement age from 62 to 64 by 2030. This change, while allowing those who began work at younger ages to retire earlier, faced significant public backlash, with widespread protests reflecting the tension between financial sustainability and public sentiment.

Similarly, in September 2024, China announced its first major change to statutory retirement ages since the 1950s. The reform will gradually raise the retirement age from 50 to 55 for women in blue-collar roles and from 55 to 58 for women in white-collar positions, while increasing the retirement age for men from 60 to 63.

These changes reflect China’s efforts to manage a rapidly aging population and a shrinking workforce while balancing economic growth and pension system sustainability.

Understanding these shifts provides valuable context for individuals evaluating their own retirement plans, especially as discussions about adjustments to Social Security in the United States continue.

Retirement age trends around the world demonstrate a clear pattern: nations are responding to longer lifespans and financial pressures by extending working years, signaling a global shift in what “retirement age” means.

Current Retirement Ages by Country

| Country | Current Retirement Age |

| Canada | 65 |

| China | 63 for men, 55–58 for women |

| Iceland | 67 |

| India | 60 to 65 |

| Japan | 64 for men, 62 for women |

| New Zealand | 65 |

| Norway | 67 |

| Saudi Arabia | 65 |

| South Korea | 60 |

| Turkey | 60 for men, 58 for women |

| United States | 66 |

Countries like Iceland and Norway have the highest retirement ages globally at 67, reflecting robust healthcare systems and strong pension infrastructures that support extended working lives.

According to Euronews Sri Lanka, with a retirement age of 55, it maintains one of the world’s lowest retirement ages, although many workers in such countries continue informal or part-time work beyond the official retirement age due to economic necessity.

In many Asian countries, including China, India, and South Korea, official minimum retirement ages are in the late 50s to early 60s, yet it is common for individuals to remain employed into their late 60s, driven by cultural expectations, limited pension resources, or personal financial needs.

Conversely, in European countries, the U.S., and Canada, many workers retire earlier than the statutory retirement age, utilizing private savings, pensions, and Social Security to exit the workforce while still healthy enough to enjoy retirement activities.

Methodology

We reviewed 2024-2025 data from the SSA, EBRI, OECD, and the United Nations Population Division. We analyzed average retirement ages in the U.S. and by state, along with cost-of-living-adjusted savings requirements.

We examined global retirement age trends to provide context for U.S. readers. Economic, health, and lifestyle factors were incorporated to explain retirement timing choices. We included tables for clarity and practical reference.

Conclusion

Retirement is more than simply reaching a number on a calendar; it is the culmination of decades of planning, saving, and aligning your goals with your lifestyle.

While the average retirement age in the United States is currently 62, the reality behind when and how you retire is shaped by your health, financial readiness, desired lifestyle, and the state you choose to call home during your retirement years.

This guide has shown how the cost of living varies dramatically across states, with some requiring over $2 million in savings to retire comfortably, while others require less than half that amount.

It has also highlighted how understanding Social Security and Medicare eligibility can help you optimize your benefits, and why many Americans are choosing or needing to work longer to secure financial stability in an era of longer lifespans and shifting economic conditions.

As you look ahead, remember that your ideal retirement age is deeply personal and should reflect your goals, financial situation, and health realities. Take time to regularly review your retirement plan, increase your savings when possible, manage debt effectively, and remain adaptable to changing market conditions.

References

- Center for Retirement Research at Boston College – Will the Average Retirement Age Keep Rising?

- Social Security Administration – Retirement Age Calculator

- United Nations Population Division – World Population Ageing 1950-2050

- Euronews – Europe’s Rising Retirement Ages: One Country Leads, Which Will Follow?

- Springer – Impact of Health on Early Retirement

- Congress.gov – Economic Impacts of the COVID-19 Pandemic

- IZA Institute of Labor Economics – Gender Differences in Retirement Age

- Sabelawski Financial Group – 6 Factors To Help You Determine Your Ideal Retirement Age

Related Posts:

- Idaho Population Growth in 2025 - Everything You…

- 2025 HSA Contribution Limits - What You Need to Know

- El Paso Population 2025 - What You Need To Know

- Population Data for Rhode Island 2025 - What You…

- Arkansas’ Population in 2025 - Everything You Need to Know

- Nevada’s Population in 2025 - Everything You Need to Know