Healthcare costs in the U.S. continue to climb each year, placing increasing pressure on individuals and families. According to a recent Bankrate survey, nearly 27% of adults have no emergency savings, while only 29% could cover three months of expenses.

For many, that means unexpected medical bills can be devastating. That’s why tax-advantaged savings vehicles like Health Savings Accounts (HSAs) have become so crucial.

An HSA allows individuals with a high-deductible health plan (HDHP) to set aside pre-tax dollars for qualified medical expenses, including co-pays, prescriptions, dental, and vision care.

Each year, the IRS updates HSA contribution limits, deductible thresholds, and out-of-pocket caps to reflect economic changes and inflation.

Key Takeaways

What Are the 2025 HSA Contribution Limits?

According to IRS Revenue Procedure 2024-25, the HSA contribution limits are increasing for 2025. This adjustment allows account holders to save more pre-tax dollars toward medical expenses.

Coverage Type

2025 Contribution Limit

2025 Catch-Up (Age 55+)

2024 Contribution Limit

Self-only Coverage

$4,300

+$1,000

$4,150

Family Coverage

$8,550

+$1,000 per eligible spouse

$8,300

These contribution limits represent the total amount that can be contributed to an HSA in a calendar year, including both employee and employer contributions.

For example, if your employer contributes $1,000 toward your HSA in 2025 and you have self-only coverage, you may contribute an additional $3,300 on your own to stay within the $4,300 limit.

Catch-Up Contributions for Age 55+

If you’re 55 years or older by the end of the tax year, you are eligible to make a catch-up contribution of $1,000. This is designed to help individuals approaching retirement boost their health savings.

Married couples where both spouses are 55 or older and covered under a family HSA can each make a catch-up contribution, but each spouse must have their own HSA to do so.

For example:

Pre-Tax Advantage and Tax Filing Implications

Contributions to an HSA can be made through payroll deductions (pre-tax) or directly (post-tax, then deducted when filing taxes). Either method results in lower taxable income, helping you save on federal taxes—and in some cases, state taxes as well.

Additionally, HSA funds roll over year to year with no expiration, and you can invest your balance for long-term growth.

How HSA Contribution Limits Work

The IRS applies limits on a calendar-year basis, and contribution eligibility is prorated by month.

This means you can only contribute a portion of the annual maximum if you’re only enrolled in an HSA-eligible HDHP for part of the year.

Proration Example

Let’s say you’re enrolled in a self-only HDHP for 7 months in 2025:

$4,300 / 12 months × 7 months = $2,508.33

Catch-up contributions follow the same logic:

$1,000 / 12 months × 7 months = $583.33

Last-Month Rule

If you’re enrolled in an HSA-eligible HDHP as of December 1, you can contribute the full annual limit.

But beware: under the IRS “last-month rule,” you must stay HSA-eligible through the next calendar year (called the testing period) or risk income taxes and a 10% penalty on excess contributions.

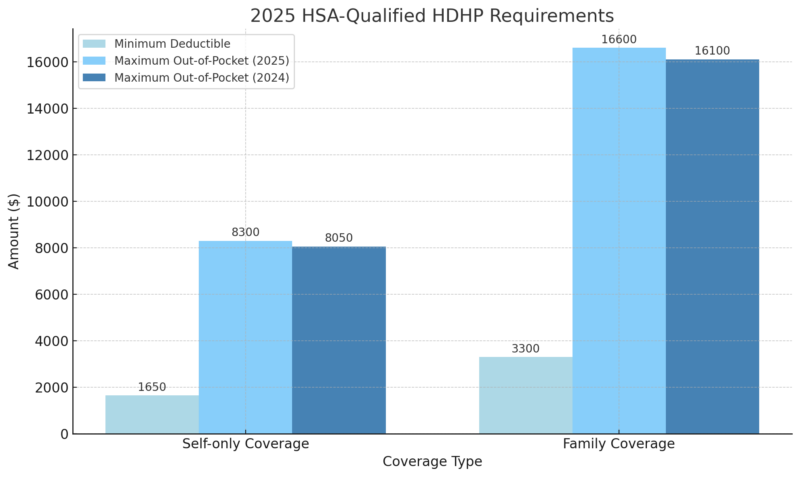

2025 HSA-Qualified HDHP Requirements

To contribute to an HSA in 2025, you must be enrolled in an HSA-qualified high-deductible health plan (HDHP).

The IRS sets annual thresholds for minimum deductibles and maximum out-of-pocket (OOP) expenses, determining whether a plan qualifies as an HDHP.

These updated thresholds represent a $50 increase in deductibles for self-only coverage and a $250 increase in the out-of-pocket maximum. For family coverage, deductibles rose by $100, while out-of-pocket limits increased by $500 compared to 2024.

These adjustments reflect rising healthcare costs and inflation and are intended to preserve the integrity of HSAs by ensuring they remain tied to genuinely high-deductible plans.

To remain eligible, your plan must meet both the minimum deductible and stay under the maximum out-of-pocket cap.

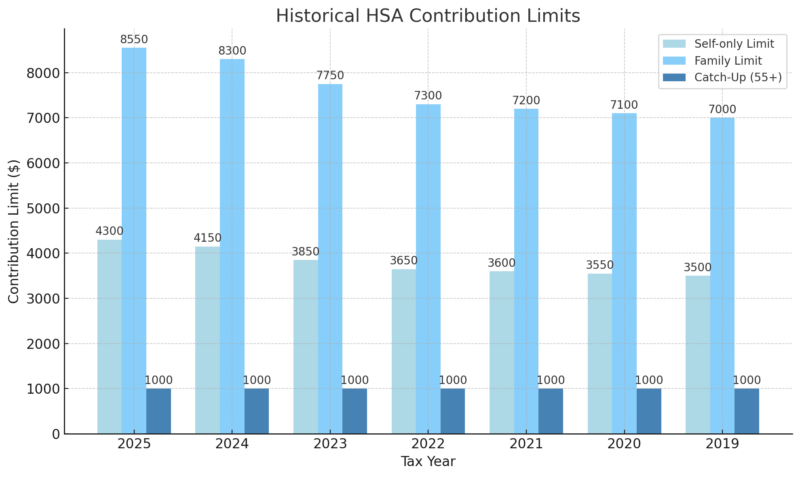

Historical Contribution Limits

Here’s a look at how HSA contribution limits have evolved in recent years:

According to IRS Publication 969, these amounts are adjusted annually based on the cost-of-living index.

Eligibility Rules for 2025

To be eligible to contribute to an HSA, you must:

Tax Penalties and Compliance

Failing to follow IRS guidelines can result in unexpected tax penalties that reduce the financial value of your HSA. Here’s what to watch out for:

1. Excess Contributions

If you contribute more than the annual IRS limit to your HSA—whether through payroll deductions, personal deposits, or a combination of both—you may be subject to a 6% excise tax on the excess amount. This tax applies each year the excess remains in your account.

However, you can avoid the penalty by withdrawing the excess contribution (and any earnings on it) before the tax filing deadline, typically April 15 of the following year. Be sure to notify your HSA provider that the withdrawal is being made to correct an excess contribution.

2. Spending on Ineligible Expenses

HSA funds must be used for IRS-qualified medical expenses to retain their tax-free status. If you use your HSA for non-qualified purchases:

According to Fidelity Investments, these penalties can significantly reduce the savings benefits of your HSA. That’s why it’s crucial to track your contributions and ensure that all HSA spending aligns with IRS-approved medical expenses.

For a complete list of what qualifies as an eligible medical expense, consult IRS Publication 502 or visit IRS.gov.

HSA vs. FSA vs. HRA: What’s the Difference?

Feature

HSA

Health Care FSA

HRA

Ownership

Individual

Employer

Employer

Rollover

Yes

Limited (max $660 in 2025)

Yes (varies by plan)

Contribution Source

Employee & employer

Employee

Employer

Max Contribution (2025)

$4,300 / $8,550

$3,300

Employer-defined

Portability

Yes

No

No

Medicare Eligibility

Disqualifies new HSA

No effect

No effect

Additional 2025 IRS Limits for Related Benefits

The ABLE account contribution limit for 2025 is $19,000, and certain employed ABLE account beneficiaries may make an additional contribution. Learn more from the #IRS at https://t.co/Wj8AmAV4KU

— IRSnews (@IRSnews) April 9, 2025

In addition to Health Savings Accounts (HSAs), the IRS also sets annual contribution limits for several other tax-advantaged benefit accounts that help individuals and families save money on healthcare, dependent care, transportation, education, and family planning costs.

Here’s a breakdown of the 2025 IRS limits for these related benefits:

Benefit Type

2025 IRS Limit

Limited-Purpose FSA (LP-FSA)

$3,300

Dependent Care FSA (DC-FSA)

$5,000 (joint) / $2,500 (married filing separately)

Commuter Benefits (Transit/Parking)

$325/month per benefit

Tuition Reimbursement

$5,250

Adoption Assistance

$17,280

Limited-Purpose FSA (LP-FSA) – $3,300

An LP-FSA is compatible with an HSA and can be used to cover dental and vision expenses only.

This allows you to preserve your HSA funds for broader medical costs or long-term savings. The LP-FSA is ideal for individuals who want to maximize tax savings by combining it with an HSA.

Dependent Care FSA (DC-FSA) – $5,000 per household

This account helps working parents and guardians pay for eligible childcare expenses for children under age 13, or a dependent adult incapable of self-care.

The limit is $5,000 per household or $2,500 per spouse if married and filing separately.

Commuter Benefits – $325/month per benefit

Employees can set aside pre-tax dollars to cover commuting costs such as parking and public transit.

The monthly limit for 2025 is $325 per category, meaning you can save on both parking and transit costs separately.

Tuition Reimbursement – $5,250

Employers can offer tax-free educational assistance to employees up to $5,250 annually.

This can be applied toward tuition, fees, books, and other qualified education expenses, helping employees upskill without increasing their taxable income.

Adoption Assistance – $17,280

Adopting a child is a costly process, and the IRS allows employers to provide up to $17,280 in tax-free assistance per eligible adoption in 2025.

Covered costs may include adoption agency fees, legal, court, and travel costs.

Methodology

- We analyzed IRS Revenue Procedure 2024-25 to confirm the official 2025 HSA limits.

- We reviewed historical data from IRS Publication 969 to compare yearly trends.

- We incorporated survey data from Bankrate and insights from Fidelity Investments for real-world context.

- We cross-referenced eligibility rules and tax implications from IRS Publication 502.

- We summarized updates to related benefits like FSAs, DC-FSAs, and commuter benefits for a comprehensive view.

- The article was structured to be reader-friendly, informative, and actionable for both individuals and employers.

References:

- Bankrate – Emergency Savings Report

- IRS.gov – IRS Revenue Procedure 2024-25

- IRS.gov – Publication 969: Health Savings Accounts and Other Tax-Favored Health Plans

- IRS.gov – Publication 502: Medical and Dental Expenses

- Fidelity – Health Savings Account (HSA) FAQs

- IRS.gov – When to File

- Cigna – What Is an Out-of-Pocket Maximum?

- HSA Bank – HSA Member Resources

Related Posts:

- Idaho Population Growth in 2025 - Everything You…

- El Paso Population 2025 - What You Need To Know

- Population Data for Rhode Island 2025 - What You…

- Arkansas’ Population in 2025 - Everything You Need to Know

- Nevada’s Population in 2025 - Everything You Need to Know

- Charlotte Population 2025 - What You Need to Know