Recent federal data shows a dramatic surge in the use of GLP-1 medications within the Medicare system.

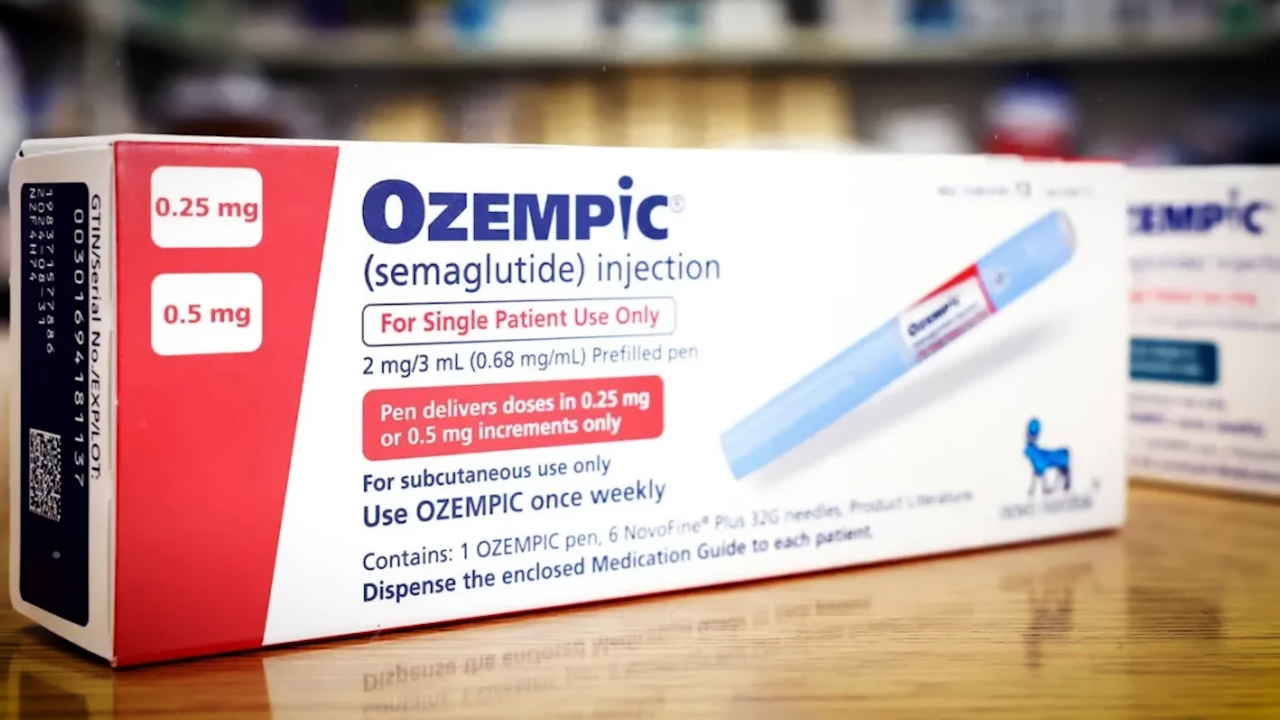

These drugs, widely known for treating type 2 diabetes and increasingly recognized for weight loss and cardiovascular benefits, are rapidly reshaping prescription trends and healthcare spending.

While Medicare still does not broadly cover obesity treatments using GLP-1s, policy changes now underway suggest access could expand significantly over the next few years.

Table of Contents

ToggleRapid Growth In GLP-1 Use Among Medicare Patients

Medicare coverage already includes GLP-1 drugs for conditions such as type 2 diabetes, cardiovascular disease, and sleep apnea.

However, legal restrictions still prevent coverage specifically for weight loss, even though clinical research increasingly supports their effectiveness in obesity treatment.

New CMS data analyzing Medicare Part D claims from 2019 through 2024 highlights how quickly adoption has grown. Newer drugs like semaglutide and tirzepatide dominate prescriptions, while older GLP-1 therapies are gradually losing market share.

Medicare GLP-1 Usage Growth (Selected Drugs)

Drug (Brand)

Primary Approval Year

Users Earlier Period

Users 2024

Trend

Ozempic (semaglutide)

2017

<150,000 in 2019

~2 million

Massive growth

Mounjaro (tirzepatide)

2022

~54,000 in 2022

~1 million

Extremely fast adoption

Victoza

2010

Previously common

Declining

Older therapy replaced

Byetta

2005

Widely used earlier

Declining

Legacy drug

The introduction of oral GLP-1 formulations may push utilization even higher, since pills are often easier for patients than injections.

Spending Skyrockets Despite Rebates

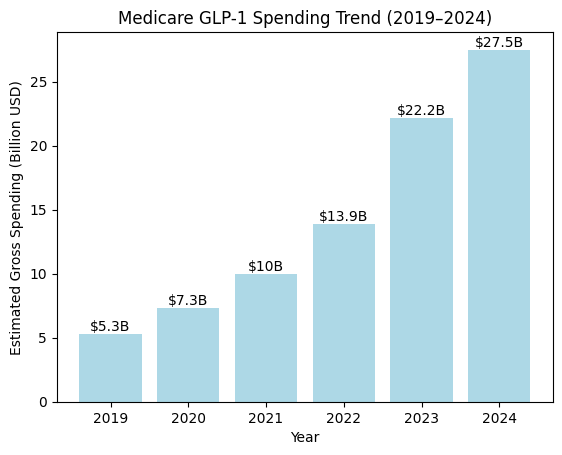

Spending has increased sharply alongside prescription growth. Gross Medicare Part D spending on GLP-1 medications rose roughly fivefold between 2019 and 2024.

Medicare GLP-1 Spending Trend

However, gross spending does not reflect negotiated rebates. Industry estimates suggest rebates can exceed 50 percent for diabetes therapies.

When adjusted for these rebates, net Medicare spending in 2024 likely sits closer to $14 billion rather than the headline $27.5 billion figure.

Semaglutide-based drugs alone account for over half of total spending, reflecting both strong clinical performance and aggressive patient demand.

Claims Volume Surges Across The System

Prescription claims illustrate the same upward trajectory. Between 2019 and 2024, GLP-1 claims under Medicare quadrupled.

GLP-1 Claims Growth Under Medicare Part D

Metric

2019

2024

Total GLP-1 claims

4.8 million

21.8 million

Ozempic claims

~524,000

>10 million

Mounjaro claims

~122,000 (2022)

~5.1 million

Ozempic alone shows an average annual growth rate above 80 percent, while Mounjaro adoption has been even faster since its 2022 approval.

Policy Changes Could Expand Access

To address the gap in obesity treatment coverage, CMS is launching a pilot program called BALANCE (Better Approaches to Lifestyle and Nutrition for Comprehensive Health). This initiative aims to:

The model begins with Medicaid participation in 2026 and may expand to Medicare by 2027. Participation from drug manufacturers and health plans remains voluntary, but the initiative signals a clear policy shift.

At the same time, Medicare’s drug price negotiation program is expected to introduce lower negotiated prices for certain GLP-1 medications:

These price adjustments could offset some of the spending increases tied to broader access.

What This Means for Patients and Healthcare Costs

GLP-1 supplements are being advertised as more affordable alternatives to blockbuster weight-loss drugs. Here’s what doctors think about them. https://t.co/4PT1p0FQwk

— TODAY (@TODAYshow) September 20, 2024

Several forces are now converging:

If coverage expands significantly, utilization will almost certainly rise further. However, negotiated pricing mechanisms may help contain long-term costs.

Healthcare analysts increasingly view GLP-1 therapies not just as diabetes drugs but as a broader metabolic health intervention. That perception shift is already influencing prescribing patterns and policy discussions.

Bottom Line

GLP-1 medications have moved from niche diabetes treatments to one of the fastest-growing drug categories in Medicare.

Usage, claims, and spending have all surged in just five years. With policy changes and price negotiations approaching, the next phase will likely focus on balancing expanded patient access with sustainable healthcare spending.

Related Posts:

- Tattoos and Cancer - Surprising New Data Shows a 29%…

- Alabama’s Population Growth in 2024: Out-of-State…

- Utah Ranks in Top 5 Growth States as US Population…

- US Population Hits 340.1 Million, Marking Highest…

- Apple Pay vs Google Pay in the US 2025 - Usage…

- Why Ozempic and GLP-1 Work Wonders for Some People…