If you strip away all the buzzwords and tech hype, one clear fact remains: software jobs in the United States are on track to grow by about 15 percent through 2034, as noted by the BLS. That growth rate is several times faster than the average for all occupations.

Even more important than the percentage is the scale behind it. We are not talking about a few thousand new roles. We are talking about hundreds of thousands of additional jobs, plus more than 100,000 openings every year once retirements and career switches are included.

The median pay sitting above $130,000 per year makes this one of the rare career paths that combines strong job security, high income potential, and long-term relevance.

This is no longer a niche industry. Software has become a basic economic infrastructure role, similar to electricity or transportation in past decades.

The Core Numbers That Define the Next Decade of Software Work

Let’s first put the key facts into one clean overview.

Software Job Growth and Pay Overview

| Category | Value |

| Projected growth through 2034 | ~15 percent |

| Estimated new jobs added | ~267,000+ |

| Average annual job openings | ~129,000 per year |

| Median salary for software developers | ~$133,000 per year |

| Median salary for QA and testing roles | ~$100,000+ per year |

| Average growth for all occupations | ~3 percent |

This table alone explains why software continues to dominate career planning conversations. Growth is roughly five times faster than the national average, and pay is more than double what most U.S. workers earn.

Why Software Job Growth Is Structurally Different From Past Tech Booms

Older tech booms were often driven by short waves of innovation. Personal computers. The internet. Smartphones.

Each wave created fast growth, followed by slowdowns once markets matured. The current software growth cycle behaves differently because it is not tied to one product category.

Today, every industry is a software industry:

- Healthcare depends on medical platforms.

- Logistics depends on tracking software.

- Retail depends on inventory and personalization systems.

- Finance depends on automation and fraud detection.

- Manufacturing depends on embedded software and robotics.

This means the demand for software workers is now distributed across the entire economy instead of being concentrated in Silicon Valley alone.

Hospitals, trucking companies, insurance firms, and even small local manufacturers now compete for developers and QA specialists.

This structural shift is what makes the 15 percent growth projection more stable and less speculative than past tech cycles.

The Hidden Driver: Replacement Demand Is Almost as Important as Growth

One of the most misunderstood facts about software hiring is that not every job opening comes from industry expansion. A large portion comes from:

- People retiring

- People moving into management.

- People switching industries.

- People are burning out and leaving the field.

When you combine new job creation with replacement demand, you end up with roughly 129,000 job openings per year.

That number explains why hiring pressure stays high even during slow economic periods. Companies may freeze new projects, but they still need to replace skilled workers who leave.

This is why software hiring rarely collapses the way some other industries do during downturns.

Salary Reality: What Software Pay Actually Looks Like Across the Market

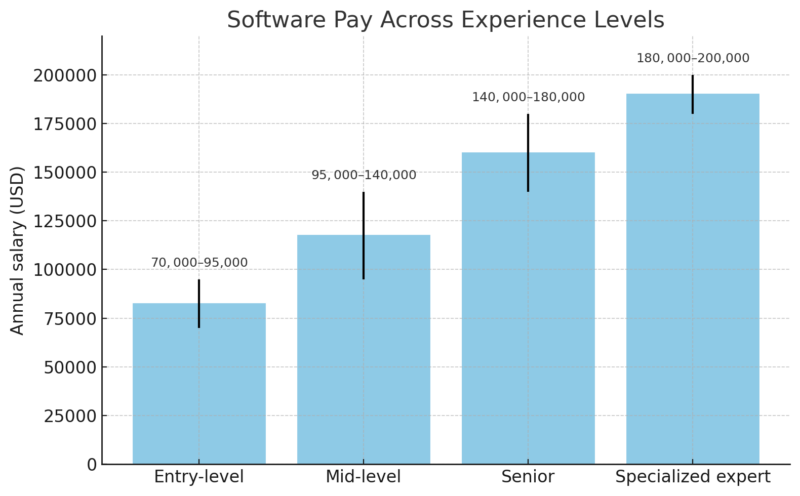

The median salary of $133,000 often sounds abstract. What it really means is:

About half of the developers make less. About half make more.

Here is a realistic income distribution based on what we already discussed:

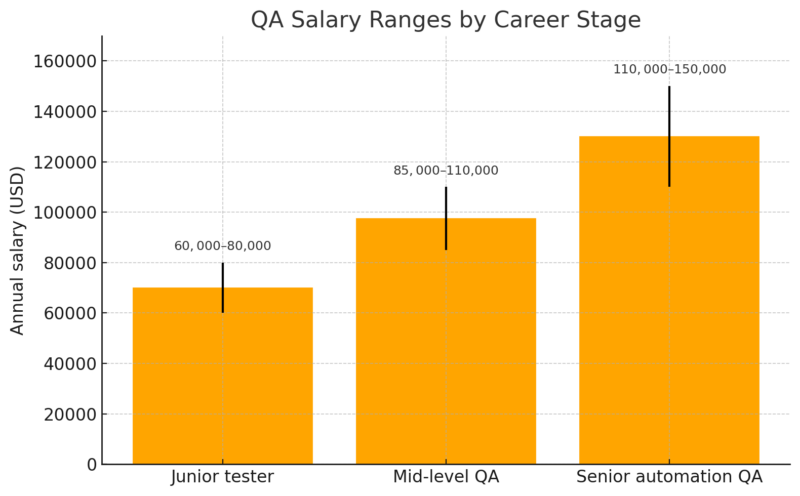

QA and testing roles generally sit lower on the scale but still far above national wage averages:

This creates a rare income ladder where even entry-level workers enter the upper income brackets of the U.S. economy within a few years.

Why Software Jobs Are Still Growing Despite AI and Automation

A common fear is that AI will reduce the number of software jobs. The data points in the opposite direction. Automation increases demand for software workers because:

- Every automation system needs to be built.

- Every automation system needs testing.

- Every automation system needs maintenance.

- Every automation system creates new data systems.

Instead of replacing developers, automation reshapes what developers work on. Many of tomorrow’s software roles will focus on:

- System integration.

- Security and compliance.

- Automation validation.

- Data pipelines.

- AI monitoring and optimization.

This is one of the reasons why testing and quality assurance roles remain in high demand. As systems grow more complex, mistakes become more expensive.

This is one of the reasons why testing and quality assurance roles remain in high demand. As systems grow more complex, mistakes become more expensive.

In real-world development environments, this is also why dedicated testing platforms such as testRigor, as a software testing tool, are used to reduce manual workload, improve automation coverage, and speed up quality validation across large application stacks.

The Geographic Shift of Software Employment

Another major change behind the 15 percent growth is geographic. Software work is no longer tied only to a few expensive tech cities. Remote and hybrid work permanently changed hiring patterns.

Companies now recruit developers from:

- Mid-size cities.

- Rural areas.

- Lower-cost states.

- Former manufacturing regions.

For workers, this means something very real: six-figure tech income without six-figure housing costs in many cases. This geographic flexibility is one of the biggest lifestyle advantages software careers now offer.

Software as an Economic Shock Absorber

Software hiring behaves differently during recessions than many other industries. Demand rarely drops to zero because:

- Banks still need digital systems.

- Governments still need IT infrastructure.

- Healthcare still needs software platforms.

- Utilities still need automated control systems.

Even during economic slowdowns, software layoffs tend to be unevenly distributed by specialization, not by occupation as a whole. Core developers, infrastructure engineers, and testers stay in demand even when consumer-facing tech contracts.

This makes software work one of the most resilient white-collar career paths available.

Entry Barriers Are Falling While Pay Stays High

Another reason software employment grows so fast is that entry barriers are no longer tied strictly to four-year degrees. Many workers now enter through:

- Bootcamps.

- Self-study.

- Internal company upskilling.

- Technical schools

- Military retraining programs.

This widens the labor pool while still keeping salaries high due to continuing demand. Very few industries allow that kind of access to upper-income jobs without requiring sixteen years of formal education.

How Long This Growth Cycle Is Likely to Last

A 15 percent growth projection over ten years is already large. But the more important signal is that this growth is tied to digital dependency, not consumer trends. As long as economic systems remain software-based, demand remains structurally protected.

Software is no longer a luxury tool. It is the control layer of modern economies.

That suggests that software job growth is likely to extend well beyond a single decade, even if growth rates eventually stabilize.

What This Means for Different Groups of People

For Students

Software remains one of the safest long-term career investments available. The combination of strong demand, flexible work location, and high income makes it unusually efficient from a return-on-education perspective.

For Career Switchers

The steady 129,000 annual openings mean there is constant room for newcomers. People entering from engineering, business analysis, healthcare IT, and even logistics have strong transition pathways.

For CompaniesTalent competition will remain structurally high. Retention, flexible work conditions, and internal upskilling programs will matter more than raw recruiting volume.

Bottom Line

@techroastshow software engineers in 2025 vs 2026 #techie #softwareengineer #siliconvalley #sanfrancisco #programmerlife #roastbattle #darkhumor #techroastshow ♬ original sound – socially inept

A projected 15 percent expansion in U.S. software jobs by 2034, combined with over 100,000 openings every year and six-figure median pay, places software among the most stable, scalable, and financially rewarding career paths available today.

This is not a speculative boom. It is a structural transformation of the labor market where software has become a permanent economic backbone rather than a temporary innovation cycle.

Related Posts:

- Microsoft’s $96.5 Million CEO Payday After 15,000…

- Global Healthcare Simulation Market Projected to Hit…

- Population Health Management Market Projected to…

- Anxiety and Depression Statistics - CBT Effective…

- Fair Pricing Act Could Set First Cap on Hospital…

- New Evidence Revises Civil War Death Toll According…