Starting a medical practice in the U.S. is an exciting yet challenging journey that requires a mix of entrepreneurial vision, business acumen, and a deep understanding of the healthcare landscape.

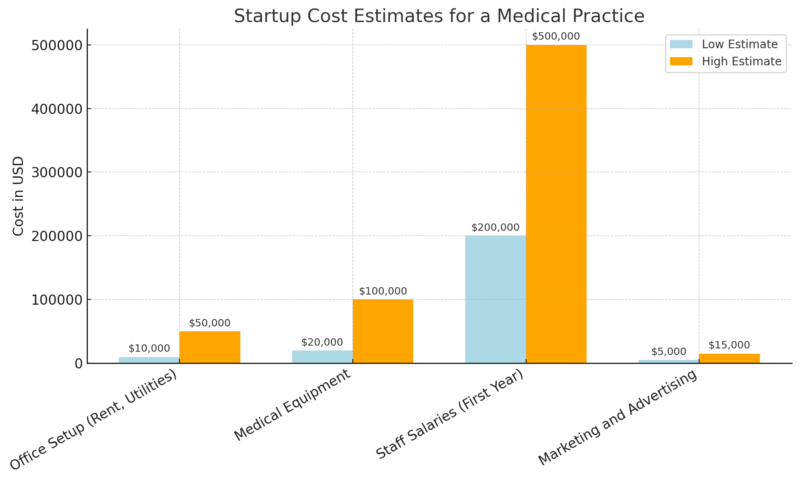

According to the Medical Group Management Association (MGMA), the average cost to open a small medical practice can range from $100,000 to $500,000, depending on factors such as location, specialty, and the scale of the practice.

The process begins with a comprehensive business plan, which is crucial for defining your mission, analyzing the local market, and projecting startup and ongoing costs. With proper financial projections, you’ll have a clear roadmap to secure funding and effectively manage cash flow.

Financing options, such as SBA-backed loans, are available to assist with the substantial capital requirements, but understanding the best fit for your practice is essential. Selecting the appropriate legal structure—whether a sole proprietorship, LLC, or S-Corp—will impact taxes, liability, and growth potential.

Your practice’s location, the equipment you purchase, and the team you hire all play significant roles in determining its long-term success.

According to a 2024 study, medical practices typically spend between $20,000 to $100,000 on medical equipment alone, while staff salaries can cost $200,000 to $500,000 in the first year, making these key investments pivotal in achieving operational efficiency.

In addition, ensuring regulatory compliance with laws such as HIPAA and OSHA is non-negotiable, with penalties for non-compliance ranging from $100 to $50,000 per violation.

Table of Contents

Toggle1. Develop a Good Business Plan

A well-structured business plan is the cornerstone of a successful medical practice. It outlines your practice’s mission, goals, and the strategies needed to reach them, including financial and operational considerations.

Even if you’re not launching a spa, the medical spa business plan provides a smart blueprint for articulating patient demographics, pricing models, and startup costs in a clear, investor-ready format.

Key Components

- Mission and Vision: What do you want your practice to achieve? For example, a family practice might emphasize accessibility and preventative care, while a specialist practice could focus on high-quality treatment for a specific condition.

Market Research: Identify the patient demographics you plan to serve. Analyze the competition, local demand, and identify any underserved areas in your region. - Financial Projections: Clearly outline initial costs (e.g., office setup, equipment, staffing) and expected revenues. According to a 2024 survey by the Medical Group Management Association (MGMA), the average cost to start a small medical practice in the U.S. ranges between $100,000 and $500,000, depending on location and specialty.

2. Secure Financing

Starting a medical practice requires significant capital, typically ranging from $100,000 to $500,000, depending on the practice’s size and specialty.

Fortunately, various financing options are available to help secure the necessary funds.

Financing Options

Option

Pros

Cons

Personal Savings

No debt, full control

High personal risk if the business fails

Bank Loans

Lower interest rates, SBA-backed loans

Requires a strong credit history, collateral

Medical Practice Lenders

Tailored to healthcare businesses

Higher interest rates than bank loans

Using your savings is the most straightforward way to fund your practice. However, it carries a significant risk as you are using your funds to start the business.

This option works well if you have substantial savings or are opening a small, low-overhead practice. The risk here is the potential loss of personal savings if the practice does not generate enough revenue to cover costs in the early stages.

A traditional bank loan is one of the most common methods for securing capital. Typically, bank loans offer lower interest rates compared to other forms of financing.

However, they often require a strong credit history and solid business plans to be approved. Many banks also prefer borrowers to have personal assets or collateral to back up the loan.

Additionally, the U.S. Small Business Administration (SBA) offers loan programs specifically designed for healthcare businesses, including medical practices. SBA-backed loans are attractive because they often feature longer repayment terms and lower interest rates than traditional bank loans.

According to the SBA, the average loan amount for healthcare businesses under the 7(a) program is about $350,000, with terms extending up to 25 years for real estate and 10 years for equipment.

Specialized lenders exist that focus exclusively on healthcare financing. These lenders understand the unique challenges of medical practices and offer loan options tailored specifically to the needs of healthcare professionals. These loans typically cover startup costs, purchase of medical equipment, and other business expenses.

3. Select Your Practice Structure

The legal structure of your medical practice is a crucial decision that impacts taxes, liability, and long-term growth.

Each structure comes with its advantages and drawbacks, so it’s important to choose one that aligns with your business goals and operational needs.

Common Legal Structures

Structure

Pros

Cons

Sole Proprietorship

Simple to set up, full control over decisions

No liability protection, personal asset risk

Partnership

Shared responsibilities, more resources

Shared liability for partners’ actions

LLC (Limited Liability Company)

Liability protection, tax flexibility

More paperwork, more complex setup

S-Corp / C-Corp

Limited liability, tax advantages

More regulatory requirements, complex to manage

Overview of Structures

- Sole Proprietorship: This is the simplest structure, where you operate the practice alone. It offers full control over decision-making but provides no liability protection. This means your assets could be at risk if the practice faces legal issues.

- Partnership: A partnership works well if you plan to open a practice with one or more partners. It allows shared responsibilities and resources, but partners also share liability for any legal or financial issues that arise. Clear agreements between partners can help manage expectations and minimize risk.

- LLC (Limited Liability Company): An LLC offers liability protection, meaning your assets are generally safe from business-related debts. This structure also allows flexibility in how you are taxed, making it a popular choice for smaller medical practices. However, it requires more paperwork and may be more complex to set up compared to a sole proprietorship.

- S-Corp / C-Corp: Both S-Corp and C-Corp offer strong liability protection and may provide tax advantages, especially for larger practices. S-Corp allows profits to pass through to personal tax returns, avoiding double taxation, while C-Corp taxes the company separately. These structures are more complicated and expensive to maintain, with additional regulatory requirements.

4. Register Your Business and Obtain Necessary Licenses

Before you can start treating patients, it’s crucial to ensure your practice is properly registered and meets all regulatory requirements. Failure to do so can lead to penalties, legal issues, or even the closure of your practice.

Essential Registrations

Registration

Requirement

Timeframe

State Registration

Register your practice as a legal business entity with the state.

Varies by state; usually takes 1-3 weeks.

Medical License

Obtain a medical license from your state’s medical board.

Varies; often 6-8 weeks for approval.

DEA Registration

Required if you plan to prescribe controlled substances.

Typically takes 4-6 weeks.

Federal and Local Licenses

Local permits, zoning approvals, or federal regulations.

It can take several weeks to months, depending on the location.

You’ll need to register your practice as a business entity (LLC, S-Corp, etc.) with the state where you plan to operate. This provides you with the necessary legal recognition to conduct business.

Each state has its medical licensing process, which may require you to pass exams and meet specific continuing education standards. The medical board typically takes 6-8 weeks to process and approve licenses.

If your practice involves prescribing controlled substances, registration with the U.S. Drug Enforcement Administration (DEA) is required. The process can take 4-6 weeks, so plan.

Depending on your location, you may need local business licenses, occupancy permits, or zoning approvals to operate legally. These requirements vary by city and county.

5. Choose the Right Location for Your Practice

Selecting the right location is vital for attracting patients and ensuring the success of your practice.

The right location can increase patient volume and improve business sustainability, while a poor location may lead to wasted resources and missed opportunities.

Factors to Consider

Factor

Importance

Recommended Action

Proximity to Competitors

Understanding local competition can impact patient volume.

Analyze the number of competitors in the area.

Accessibility

A location that’s easy to access encourages more patients.

Ensure ample parking and access by public transport.

Size and Layout

Adequate space for current and future needs is essential.

Look for 2,000-3,000 square feet of space for most practices.

Key Considerations

- Proximity to Competitors: Conduct a thorough market analysis of your area. If your area is saturated with similar providers, you may face more competition. However, being in an underserved area can give you a competitive advantage.

- Accessibility: Ensure that your location is easy for patients to access, especially if they rely on public transport. Also, make sure there is sufficient parking for patients who drive. Locations near hospitals or clinics often attract more foot traffic.

- Size and Layout: The typical medical practice requires 2,000-3,000 square feet of space, though this can vary depending on your specialty. The space should allow for efficient patient flow, room for medical equipment, administrative areas, and potential expansion.

6. Purchase Equipment and Hire Staff

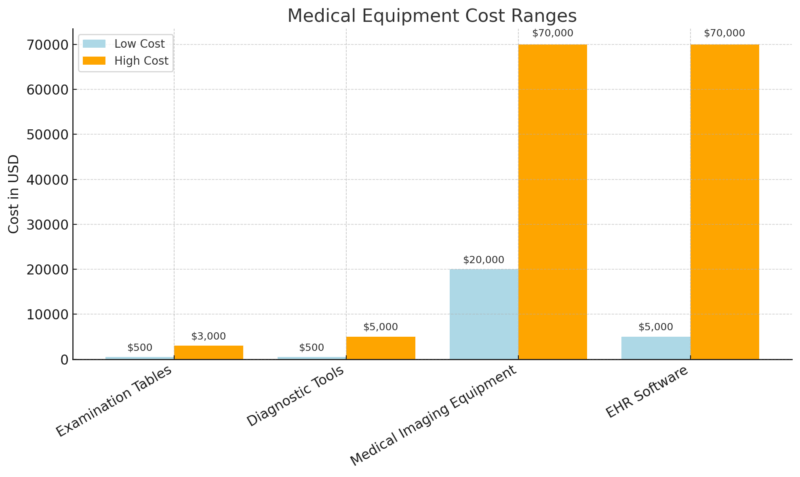

For a medical practice, purchasing the right medical and office equipment is crucial. Medical equipment typically includes examination tables, diagnostic tools like blood pressure monitors, otoscopes, and stethoscopes, along with imaging devices if required.

These items can range from a few hundred dollars to tens of thousands of dollars, depending on the specialty. For example, examination tables cost between $500 and $3,000, while imaging equipment, such as an ultrasound machine, can cost anywhere from $20,000 to $70,000.

Medical Software, particularly an Electronic Health Records (EHR) system like Epic or Cerner, is a significant investment. These systems streamline patient data management, billing, and scheduling.

EHR systems can cost between $5,000 and $70,00,0, depending on the scale of your practice and the features you need. While the initial setup can be costly, it’s an essential tool for improving efficiency and ensuring compliance with healthcare regulations like HIPAA.

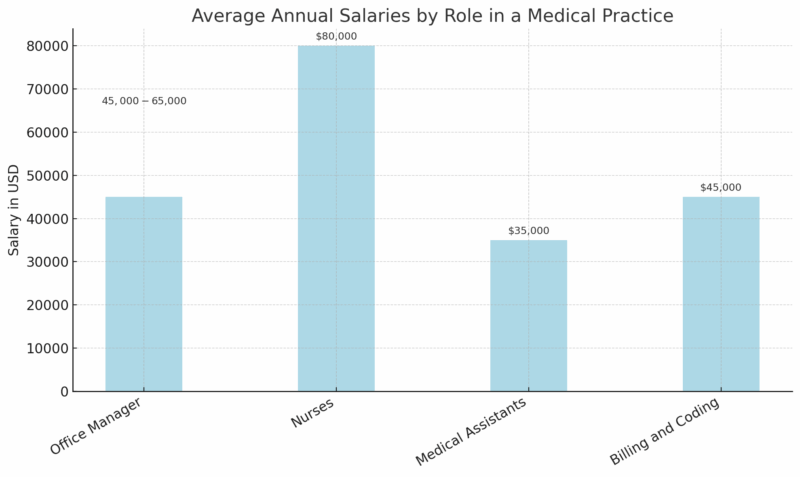

Staffing Needs

When building your team, consider key roles like an office manager, nurses or medical assistants, and billing and coding specialists. An office manager is crucial for handling the daily operations, from managing the front desk to ensuring the smooth running of patient flow. Office managers typically earn between $45,000 and $65,000 annually.

Nurses and medical assistants are key to providing direct patient care. Nurses earn around $80,000 annually on average, while medical assistants typically earn around $35,000 per year. These professionals help with patient examinations, taking vitals, and assisting with various medical procedures.

Billing and coding specialists ensure your claims are accurately processed and reimbursement from insurance companies is efficient. They are essential to your practice’s revenue cycle and typically earn about $45,000 annually. Their role is vital in minimizing billing errors and optimizing cash flow.

Hiring staff with experience in medical billing and coding can help ensure accuracy and timely payments from insurance providers, reducing financial stress in the early stages of your practice.

7. Secure Insurance Coverage

Malpractice insurance is a must for protecting against legal claims related to patient care. On average, the annual premium for a primary care physician is between $10,000 and $15,000, though this can vary based on the physician’s specialty and location. For instance, surgeons often face higher premiums due to the increased risk of lawsuits.

General liability insurance protects against accidents that happen on your premises, such as a slip-and-fall. A typical small medical practice pays between $500 and $2,000 annually for this type of coverage.

Workers’ compensation is required in most states to cover employee injuries. The cost can range from $0.75 to $2.74 per $100 of payroll, depending on the state and type of practice.

Type of Insurance

Average Annual Cost

Coverage

Malpractice Insurance

$10,000 – $15,000

Protects against legal claims from patients

General Liability

$500 – $2,000

Covers accidents on the practice’s premises

Workers’ Compensation

$0.75 – $2.74 per $100 payroll

Covers employee injuries in the workplace

8. Set Up Billing and Payment Systems

Some practices opt to manage billing internally. However, managing billing in-house requires expertise in coding, insurance claims, and patient billing procedures.

A practice with a dedicated billing department can expect to spend between $30,000 and $80,000 annually on salaries, depending on the number of staff and the complexity of the practice.

Alternatively, many practices outsource billing to third-party services to reduce overhead and increase efficiency. Outsourcing costs typically range from 4% to 8% of the practice’s collections, but it allows you to focus on patient care while experts handle the billing process.

Integrating an EHR system with your billing process is highly recommended. This integration streamlines data entry, reducing errors and improving the accuracy of claims, which directly affects revenue collection.

Billing Option

Average Cost

Advantages

In-House Billing

$30,000 – $80,000 per year

Full control over billing, familiar with patient data

Outsourced Billing

4% – 8% of collections

Reduced overhead, professional handling of claims

9. Market Your Practice

A professional website is essential for online presence, showcasing your services, staff, and contact information. A well-designed website can cost between $1,000 and $5,000, depending on the complexity and design features.

Additionally, Search Engine Optimization (SEO) for local searches is crucial, with the cost of SEO services typically ranging from $500 to $2,500 per month. Local SEO ensures that your practice ranks highly in search results when potential patients search for healthcare services in your area.

For a data-driven and healthcare-specific SEO strategy, consider working with a professional agency like SeoProfy.

A specialized partner can help your practice stand out in competitive local markets by optimizing your website structure, improving page load speeds, targeting high-intent keywords, and enhancing your presence on platforms like Google Maps.

At the same time, social media platforms like Facebook and Instagram are increasingly important for engaging with the community. Regular posts about services, health tips, and patient success stories can build trust and attract new patients.

Marketing Strategy

Average Cost

Benefits

Website

$1,000 – $5,000

Professional online presence, patient information

SEO

$500 – $2,500 per month

Improved search engine ranking, local visibility

Social Media

Free to manage, ads $200 – $2,000

Community engagement, brand awareness

10. Ensure Compliance with Healthcare Regulations

HIPAA Compliance is a must for every healthcare provider in the U.S. Violating HIPAA can result in severe penalties, ranging from $100 to $50,000 per violation. Ensuring that your practice follows HIPAA guidelines for patient privacy and data security is crucial.

OSHA Compliance requires healthcare providers to maintain a safe work environment for their employees. Failure to adhere to Occupational Safety and Health Administration (OSHA) standards can result in fines or legal action.

If you accept Medicare or Medicaid, understanding and following their specific billing requirements is essential to avoid fraud charges and ensure timely reimbursement. The Centers for Medicare & Medicaid Services (CMS) frequently updates its regulations, and staying current is essential to avoid costly mistakes.

Regulation

Potential Penalties

Requirements

HIPAA

$100 – $50,000 per violation

Ensure patient privacy, secure data management

OSHA

Fines up to $70,000 per violation

Maintain a safe work environment for employees

Medicare/Medicaid

Denial of claims, legal action

Follow updated billing and coding regulations

Bottom Line

@thecorporatelawyer 💉 Starting a medspa or medical practice in California? 🌟 Don’t make the mistake of choosing the wrong structure, like an LLC! 🚨 Medical services are governed by the Corporate Practice of Medicine, which requires a Professional Medical Corporation to stay compliant with the law. 🏢 📋 Key things to remember: ✔️ You must have proper agreements, like informed consents, to protect your business and patients. ✔️ A Medical Director is required to oversee the practice—RNs and NPs can’t practice medicine independently. ✔️ Choosing the wrong entity now could lead to costly startup fees later. ✨ Want to avoid these pitfalls? Book a FREE call today to learn how to set up your medspa or practice correctly! 📲 Click the link in bio to get started and ask all your questions. 🚀 #freedomthrubusiness #nursingcorporation #medicalcorporation #corporatepracticeofmedicine #medicaldirector #medspalawyer #medspalaw #californialawyer #registerednurse #nursepractitioner #businesslawyer ♬ original sound – Andrew Mahinay, Esq.

Starting a medical practice in the U.S. is a complex, multifaceted endeavor that requires careful planning and thoughtful decision-making.

From developing a clear business plan that defines your mission, market, and financial projections, to selecting the right location, acquiring the necessary equipment, and hiring a skilled team, every step plays a vital role in ensuring long-term success.

The costs of setting up a practice can range between $235,000 and $665,000, depending on factors like location, specialty, and staff size. Financing options, such as SBA-backed loans, are available to help secure the capital needed, but they require careful consideration of the potential risks and rewards.

The right legal structure, whether an LLC for flexibility or an S-Corp for tax advantages, can also have lasting impacts on taxes, liability, and business growth.

Compliance with regulations such as HIPAA and OSHA is non-negotiable, and securing the right insurance coverage is essential for mitigating risks. Whether through in-house or outsourced billing, setting up an efficient payment system ensures your practice maintains healthy cash flow.

Marketing efforts, especially through a professional website and local SEO, can be a key driver of patient acquisition and practice growth.

Related Posts:

- How Many Steps a Day Do You Really Need? New…

- FDA To Make Food Additive Safety More Open - What…

- Is It Possible to Increase Your IQ Through Practice?…

- Private vs. Public Health Insurance - Which Covers…

- Medical Malpractice Payouts By State Analysis (2025)

- 10 Latest Breakthroughs in Medical & Test Equipment…