Every few years, a new crop of startups emerges that are not just “interesting but structurally positioned to become global corporations. In 2025, the landscape is dominated by artificial intelligence, defense autonomy, energy transition, robotics, and biotech.

These are not small consumer apps chasing vanity metrics; they are infrastructure, security, and science companies raising multi-billion-dollar rounds, signing long-term commercial contracts, and embedding themselves into government and enterprise systems.

The global venture funding environment, while tighter than the easy-money days of 2021, has not stopped outsized capital flow into companies building at the frontier. According to Crunchbase and PitchBook, global VC funding totaled around $250 billion in 2024, down from highs but stabilizing.

What stands out in 2025 is that the largest rounds are concentrated in AI, energy storage, defense, and robotics, indicating where investors and governments see the next corporate giants being born.

1. xAI (United States)

xAI, founded by Elon Musk in 2023, has become one of the most aggressively funded AI startups in history. In July 2025, the company raised $10 billion in a combination of debt and equity, with discussions ongoing for another $12 billion in debt financing to purchase high-performance GPUs.

Unlike many AI companies focused only on software, xAI is building massive GPU clusters (dubbed Colossus) to support its flagship model G,ro k.

This infrastructure-heavy approach positions xAI as both a model developer and a cloud-scale provider. Musk’s integration of Grok into X (Twitter) ensures distribution, but the company’s ambitions go further, to enterprise services, autonomous vehicles, and robotics.

Challenges and Risks

Metric

Data (2025)

Founded

2023

Headquarters

US

Funding raised

$10B closed (Jul 2025), talks for +$12B

Implied valuation

Not disclosed, analysts estimate $20B+

Key product

Grok (foundation model)

Infrastructure

Multi-hundred-thousand-GPU superclusters

Key challenge

Monetization beyond X; competition with OpenAI, Anthropic

2. Mistral AI (France)

Founded in 2023, Mistral AI has quickly become Europe’s flagship AI startup. With its commitment to open-source models, Mistral appeals to European governments and enterprises seeking independence from US and Chinese tech giants.

In mid-2024, the company raised €600 million, and by 2025, it is seeking another $1 billion at a $10 billion valuation. Reports suggest Mistral is already generating over $100 million in annual revenue run-rate through enterprise deals and licensing.

Why It Matters

Mistral’s positioning as a sovereign AI provider aligns with EU regulations and digital sovereignty goals. If it becomes the standard enterprise stack in Europe, expansion into Asia and Africa will follow.

Metric

Data (2025)

Founded

2023

Headquarters

Paris, France

Funding raised

€600M (2024), $1B round in progress

Valuation

Targeting $10B

Revenue (2025 est.)

$100M+ annual run rate

Key customers

EU ministries, large French enterprises

Strategic edge

Open-source + sovereign AI positioning

3. Perplexity AI (United States)

Perplexity AI, launched in 2022, is redefining search for the AI age. Its conversational search engine has attracted 30 million+ users and reached $150M ARR by mid-2025. In July 2025, the company hit an $18B valuation, with reports of fundraising at $20B in August.

Its biggest moves in 2025 include the launch of Comet, an AI-native web browser, and a high-profile (likely symbolic) bid to acquire Google Chrome. Whether or not that succeeds, it signals Perplexity’s ambition to control distribution, not just search results.

Strengths & Weaknesses

Metric

Data (2025)

Founded

2022

Headquarters

San Francisco, US

Valuation

$18B (Jul 2025), aiming $20B

Funding

~$1.5B total

ARR

$150M+

User base

30M+

Key product

AI-powered search + Comet browser

Risk

Distribution vs. incumbents; content licensing

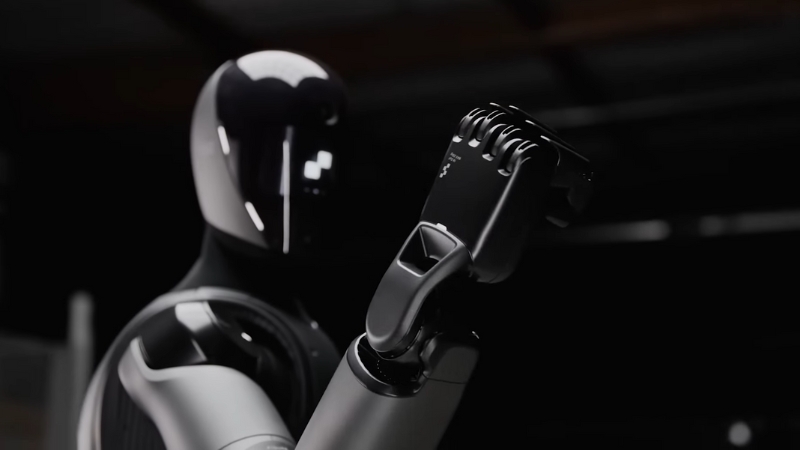

4. Figure AI (United States)

Figure AI is at the forefront of humanoid robotics. Founded in 2022, the company raised $675M at a $2.6B valuation in early 2024. By 2025, reports suggest it is seeking funding at valuations near $39B, signaling how much investor capital believes in robotics as the next frontier.

BMW’s Spartanburg factory has already deployed Figure’s humanoid robots for trial tasks. These robots are designed to replace repetitive labor in manufacturing, logistics, and eventually even home services.

Opportunities and Risks

Metric

Data (2025)

Founded

2022

Headquarters

Sunnyvale, US

Funding

$675M (Feb 2024)

Valuation

$39B rumored (2025)

Key customer

BMW Spartanburg factory

Use cases

Industrial automation, logistics, services

Challenge

Scaling production, ensuring reliability

5. Anduril Industries (United States)

@cnbcAnduril founder Palmer Luckey said Tuesday that the defense tech manufacturer is “definitely” going to become a publicly traded company.♬ original sound – cnbc

Anduril Industries is reshaping the defense industry. Founded in 2017, Anduril builds autonomous drones, undersea vehicles, and AI-driven defense platforms. By June 2025, the company was valued at $30.5B after raising $2.5B in Series G.

Its 2024 revenue exceeded $1B, putting it firmly in “prime contractor” territory. Anduril’s pitch is agility: software-first systems that can be updated quickly, unlike traditional military hardware cycles.

Metric

Data (2025)

Founded

2017

Headquarters

Costa Mesa, US

Valuation

$30.5B (2025)

Funding

$2.5B Series G (2025)

Revenue

~$1B (2024)

Products

Counter-drone, surveillance, a nd undersea vehicles

Customers

US DoD, Australia, UK

Growth driver

Rising global defense budgets

6. Betano / Kaizen Gaming (Greece)

Founded in 2013 in Greece as Stoiximan, later rebranded internationally as Betano under parent company Kaizen Gaming, this startup has become one of the fastest-growing online betting and casino operators in the world.

By 2025, Betano is present in more than 15 countries across Europe, South America, and Africa, with licenses in key regulated markets such as Germany, Brazil, and Portugal. In 2022, it became the first betting brand to sponsor the FIFA World Cup, marking its arrival as a global player.

The company’s rise reflects a broader trend in iGaming: startups evolving into diversified global corporations with proprietary technology, regulatory licenses, and social responsibility programs.

A good example of this transformation can also be seen in Soft2Bet, which started as a small B2C brand but now operates across regulated markets worldwide with over 16 licenses, its gamification engine (MEGA), and even a dedicated $50 million investment fund for high-growth gaming ventures.

Why It Matters

Metric

Data (2025)

Founded

2013 (as Stoiximan, later Betano)

Headquarters

Athens, Greece

Global presence

15+ countries (Europe, LatAm, Africa)

Employees

2,500+

Market size

Part of the $140B online gambling market by 2030

Key sponsorships

FIFA World Cup, UEFA, European football clubs

Strengths

Regulated licenses, rapid international growth, and brand visibility

Risks

Regulatory shifts, taxation in new markets

7. Commonwealth Fusion Systems (United States)

Historic news for CFS: We’ve signed a landmark agreement with @Google, a multifaceted partnership that dramatically advances our commercial fusion energy mission:

⚡️Google signed an offtake agreement for 200 megawatts of power from our first ARC power plant

⚡️Google is… pic.twitter.com/s6DlhTOOXr— Commonwealth Fusion Systems (@CFS_energy) June 30, 2025

Fusion energy could change the world, and CFS is closest to achieving it. Founded in 2018, the company has raised over $1.8B. In 2025, it signed a 500-MW power purchase agreement with Google and began siting its first ARC fusion reactor in Virginia.

CFS builds on the SPARC prototype, expected to reach first plasma mid-2020s. If successful, ARC plants could provide near-limitless clean power.

Metric

Data (2025)

Founded

2018

Headquarters

Cambridge, US

Funding

$1.8B+

Key project

SPARC prototype, ARC reactor in Virginia

Contract

500 MW PPA with Google

Market potential

Trillion-dollar global utility market

8. Form Energy (United States)

Form Energy is solving renewable intermittency with iron-air batteries that can store energy for 100 hours. This makes solar and wind reliable at the grid scale.

In late 2024, it raised $405M, bringing total funding above $1B. Its first large-scale project, 10 MW/1,000 MWh in Minnesota, is scheduled for late 2025.

Metric

Data (2025)

Founded

2017

Headquarters

Somerville, US

Funding

$1B+ total

Latest round

$405M (2024)

Pilot project

10MW/1,000MWh in Minnesota

Factory

West Virginia

Strategic role

Long-duration grid storage

9. Zipline (United States)

Zipline, founded in 2014, already operates across multiple continents. Its autonomous delivery drones have completed 1.4M+ deliveries and flown over 100M miles. In 2025, it expanded with Walmart to cover more US cities.

Valued at $4.2B in 2023 with $900M raised, Zipline is the clear leader in drone logistics, thanks to its precision tether-drop system.

Metric

Data (2025)

Founded

2014

Headquarters

San Francisco, US

Valuation

$4.2B (2023)

Funding

$900M total

Deliveries

1.4M+

Flight miles

100M+

Key partners

Walmart, African health ministries

Growth driver

Expansion into US retail + healthcare

10. Xaira Therapeutics (United States)

Launched in 2024, Xaira Therapeutics combines AI and biotech in a way few companies can. With $1B in launch capital, it has one of the largest war chests of any drug discovery startup.

Its mission: use AI foundation models to design novel drug candidates and move them into clinical trials faster than traditional pharma timelines allow. If even one succeeds, Xaira could leapfrog into the global biopharma elite.

Metric

Data (2025)

Founded

2024

Headquarters

US

Funding

$1B launch

Sector

AI + drug discovery

Potential

Disrupt $200B+ pharma R&D

Risk

Clinical trial failures

Final Thoughts

The 2025 startup cohort shows where the world is heading: AI platforms, defense autonomy, energy transition, robotics, and biotech.

These are not apps fighting for consumer attention; they are infrastructure companies being built with billions in capital and customers ranging from governments to global enterprises.

History tells us not all will succeed. But statistically, even if only three or four scale into the next Amazon- or NVIDIA-sized corporations, this list represents the companies most likely to dominate the 2030s economy.