Hims & Hers Health abruptly halted sales of its planned low-cost copycat version of Novo Nordisk’s blockbuster Wegovy weight loss pill only days after announcing it, following legal threats from the drugmaker and intervention from U.S. regulators.

The move highlights the escalating conflict between telehealth companies attempting to lower drug prices through compounded alternatives and pharmaceutical giants seeking to protect patented treatments, particularly in the rapidly expanding GLP 1 weight loss market.

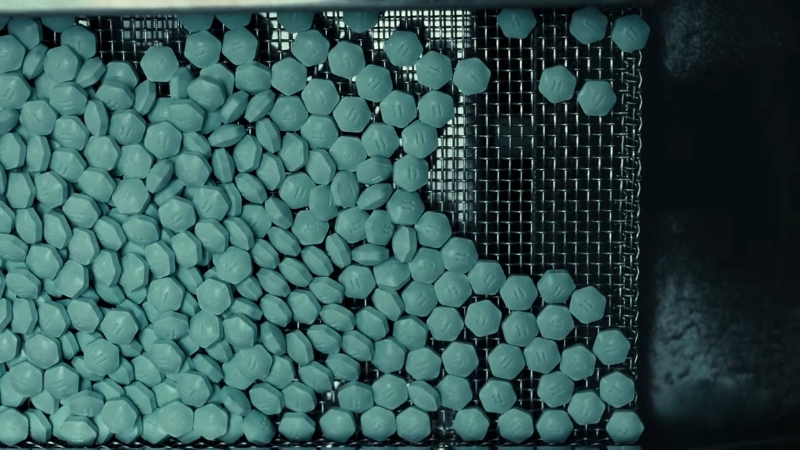

The telehealth provider had introduced the compounded semaglutide pill as a cheaper alternative to Novo Nordisk’s branded medication.

Early pricing indicated an entry cost of around 49 dollars for the first month, followed by a subscription model of roughly 99 dollars monthly. By comparison, the branded Wegovy pill typically costs about 100 dollars more per month in direct pay scenarios in the United States.

That price gap immediately drew consumer attention but also triggered regulatory and legal scrutiny.

Table of Contents

ToggleLegal Threats and Regulatory Intervention Forced the Withdrawal

Novo Nordisk responded quickly after the announcement, accusing Hims & Hers of illegal mass compounding. Pharmaceutical companies often argue that compounded versions of patented drugs undermine safety standards, intellectual property protections, and pricing stability.

Novo indicated it planned legal and regulatory action, a signal that intensified industry tensions already present in the GLP 1 drug space.

Soon after, the U.S. Food and Drug Administration entered the situation. The agency said it intended to take legal steps against the telehealth provider, including restricting access to drug ingredients and referring the matter to the Department of Justice for possible violations of federal law. This regulatory escalation appears to have been decisive.

Within days, Hims announced it would stop offering access to the treatment after what it described as constructive conversations with stakeholders across the industry.

The company emphasized that it remained committed to providing affordable healthcare options while maintaining compliance with applicable law. However, the speed of the reversal suggests significant pressure from both regulatory authorities and pharmaceutical competitors.

The Broader GLP 1 Drug Market Context

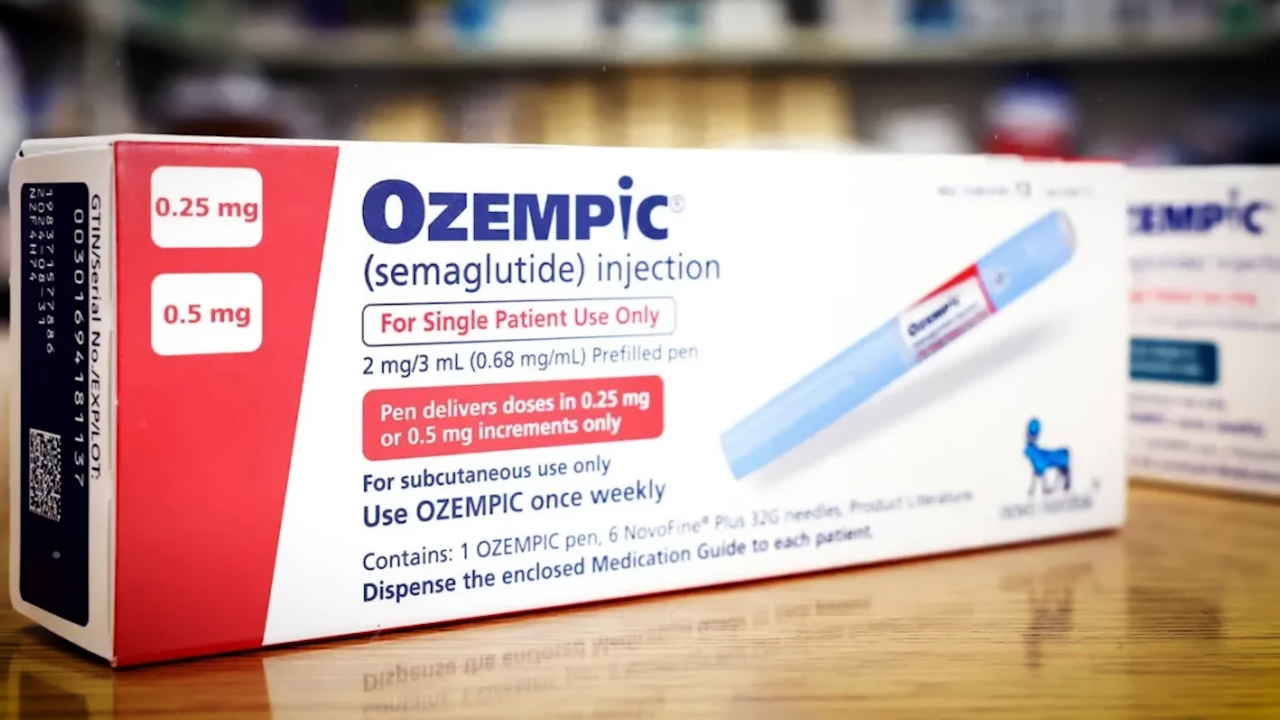

The controversy did not occur in isolation. Demand for GLP 1 medications, including semaglutide-based treatments such as Wegovy, Ozempic, and competing drugs from Eli Lilly, has surged globally.

These medications originally targeted type 2 diabetes but quickly gained widespread adoption for weight management after clinical trials demonstrated substantial weight loss effects.

This demand surge created a complex market dynamic. Drugmakers struggle to maintain supply while telehealth companies attempt to provide more affordable alternatives through compounding pharmacies.

Compounding became particularly common during previous supply shortages when regulators temporarily allowed pharmacists to produce versions of patented drugs to meet demand.

Even after shortages eased, some companies continued offering compounded alternatives, leading to ongoing disputes with pharmaceutical manufacturers.

Novo Nordisk and Eli Lilly have repeatedly argued that regulators have not acted aggressively enough against copycat products. The recent FDA action signals a shift toward tighter oversight, especially as the market expands and financial stakes increase.

Financial and Competitive Stakes Behind the Dispute

Weight loss medications have become one of the most lucrative pharmaceutical segments in recent years. Analysts widely described Novo Nordisk’s new Wegovy pill launch as a major commercial success and an important financial recovery point for the company.

Any cheaper alternative entering the market threatens pricing power, investor confidence, and long-term profitability.

The financial implications extend beyond drug manufacturers. Telehealth firms such as Hims & Hers built their business models partly on increasing access to medications through direct-to-consumer digital healthcare services.

Offering a significantly cheaper semaglutide pill positioned the company to attract cost-conscious patients, particularly those without comprehensive insurance coverage for weight loss drugs.

This clash, therefore,e reflects two competing healthcare approaches: traditional pharmaceutical innovation protected by patents and health-driven access models emphasizing affordability and convenience.

Advertising Strategy and Public Messaging

The timing of the withdrawal added another layer of visibility. Hims planned to air an advertisement during Super Bowl 60, focusing on what it calls America’s health gap.

The ad features rapper Common delivering a message about how economic inequality influences healthcare access.

Even without the copycat pill, the campaign positions the company as an advocate for affordable healthcare solutions. However, the legal dispute complicates that narrative, as pharmaceutical companies argue that unapproved compounded drugs may pose safety risks.

History of Tension Between Telehealth and Pharma Companies

The conflict between Hims & Hers and Novo Nordisk did not emerge suddenly. The companies previously attempted a partnership to sell discounted weight loss injections, but that collaboration ended months later.

One key issue reportedly involved continued compounding of semaglutide products despite agreements intended to limit the practice.

Statements from both sides illustrate the friction. Novo executives have repeatedly criticized mass compounding as deceptive or unsafe, while Hims leadership has argued that lowering drug costs is necessary to expand access.

At one point, the company’s chief executive publicly said he would not yield to pharmaceutical pressure over copycat weight loss treatments.

This ongoing tension suggests the recent withdrawal may not represent a permanent resolution but rather a tactical pause within a broader industry conflict.

Implications for Patients and Healthcare Access

For consumers, the immediate impact is straightforward: the lower-cost alternative pill will no longer be available through Hims & Hers. Patients seeking semaglutide-based weight loss treatment will likely need to rely on branded medications or other approved therapies.

Insurance coverage remains inconsistent for weight loss drugs, especially when prescribed primarily for obesity rather than diabetes. That coverage gap explains why cheaper compounded options gained popularity. Without them, affordability challenges may persist for many patients.

At the same time, regulators emphasize safety concerns. Compounded drugs may vary in formulation, purity, or dosing compared with FDA-approved versions. Regulatory scrutiny aims to ensure consistent standards but can also limit price competition.

What This Signals for The Future of Weight Loss Drug Competition

Hims & Hers abandons copycat weight-loss drug in face of FDA probe https://t.co/gNW0NTH88E

— Financial Times (@FT) February 7, 2026

This episode signals tighter regulatory oversight of compounded GLP 1 medications going forward. Pharmaceutical companies appear increasingly willing to use legal channels to protect their products, while regulators show readiness to intervene when intellectual property or safety issues arise.

Market demand for weight loss medications remains strong. Analysts expect continued innovation from pharmaceutical companies, including new formulations, delivery methods, and competing drugs.

Telehealth firms may shift strategies toward partnerships with drug manufacturers or focus on broader lifestyle and healthcare services rather than compounded alternatives.

Related Posts:

- Hims & Hers Rolls Out $49 Copy of Wegovy Pill in…

- Weight Loss Without Injections? Wegovy’s New Pill Is…

- One Weight Loss Strategy Is Far More Effective Than…

- Ozempic-Style Weight Loss Drugs for Cats Are Now…

- FDA To Make Food Additive Safety More Open - What…

- What’s the Legal Difference Between a Certificate of…