Healthcare in the United States can be complex, confusing, and—most notably—expensive. While most people expect to pay something out of pocket for medical services, what they don’t expect is to receive a surprise medical bill for services they didn’t realize weren’t covered.

These surprise bills can range from a few hundred dollars to tens of thousands, catching patients off guard and plunging many into financial distress.

According to a 2022 report by the Kaiser Family Foundation, nearly 1 in 5 emergency room visits results in at least one surprise bill.

Furthermore, the Consumer Financial Protection Bureau (CFPB) reports that medical debt affects 1 in 3 U.S. adults, totaling over $88 billion in collections on credit reports. These aren’t just numbers—they’re real people, real families, and real financial consequences.

Thankfully, new regulations like the No Surprises Act, effective January 1, 2022, offer some protection. But to truly safeguard yourself, you must be informed, proactive, and strategic in your healthcare choices.

Table of Contents

ToggleKey Takeaways:

- Know your insurance network and benefits.

- Don’t sign away your NSA rights without full understanding.

- Use tax-advantaged accounts to prepare for out-of-pocket expenses.

- Appeal questionable charges and file complaints when necessary.

- Shop smart for your health plan based on real needs and risks.

- Supplement your coverage if possible to reduce your out-of-pocket exposure.

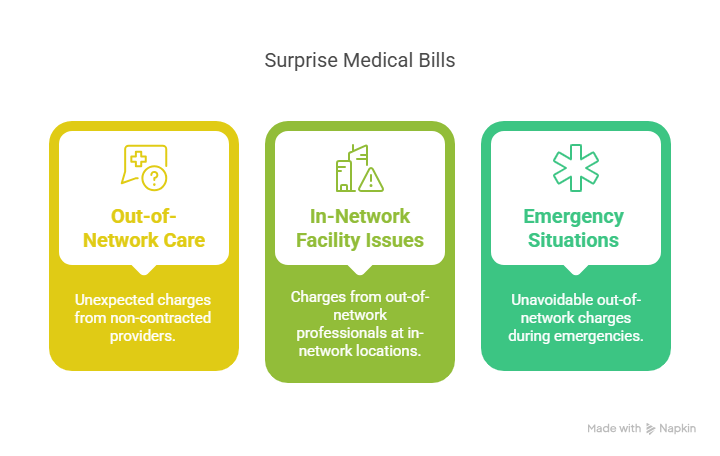

Surprise Medical Bills

These bills typically arise in the following scenarios:

- Care from Out-of-Network Providers Without Prior Knowledge: A patient may receive treatment from a provider who is not contracted with their health insurance plan. This can happen even when the patient believes they are receiving care at an in-network facility. For instance, while undergoing surgery at an in-network hospital, a non-network anesthesiologist or surgical assistant may be involved in the procedure without the patient being informed in advance.

- Services at In-Network Facilities by Out-of-Network Providers: Even if a hospital or clinic is in-network, some individual professionals working there may not be. These commonly include radiologists, anesthesiologists, pathologists, and emergency physicians. If these providers are not in-network, they can bill the patient directly for the amount not covered by insurance.

- Emergency Care Situations: During emergencies, patients often cannot choose their providers or verify network status. As a result, they may be treated at an out-of-network facility or by out-of-network emergency personnel, leading to out-of-network charges.

Example:

A patient visits the emergency room at a hospital listed as in-network under their insurance plan due to severe chest pain. The hospital itself is contracted with the insurance company, so the facility fees are covered.

However, the on-call cardiologist who evaluates the patient is not part of the insurance network. The patient receives treatment and is discharged. A few weeks later, they receive a separate bill for $2,500 from the out-of-network cardiologist.[/su_note]

This charge represents the portion of the provider’s fee not covered by the insurance plan. The patient had no opportunity to select the provider or approve the charges, but they are still financially responsible for the balance.

Such cases are common, particularly in hospital settings where multiple independent contractors deliver patient care, and many consumers remain unaware until the bill arrives.

How to Protect Yourself from Unexpected Medical Costs

Even with protective legislation like the No Surprises Act, one of the most effective ways to avoid being blindsided by medical expenses is to take a proactive, strategic approach to your healthcare planning.

Choosing the Right Health Insurance Plan

One of the most critical steps in protecting yourself financially is selecting a health plan that aligns with your health needs and budget. When choosing between plans, it’s important to understand the balance between monthly premiums, deductibles, and anticipated healthcare usage.

Plan Type

Premiums

Deductible

Best For

High Deductible Health Plan (HDHP)

Low

High

Generally healthy individuals who expect few medical visits per year.

Low Deductible Health Plan (LDHP)

High

Low

Individuals or families with ongoing or expected medical needs.

Pro Tip: If you opt for an HDHP, pair it with a Health Savings Account (HSA) to set aside tax-free funds for medical expenses.

Using Tax-Advantaged Medical Savings Accounts

Two primary types of accounts can help you manage healthcare costs more efficiently: Flexible Spending Accounts (FSAs) and Health Savings Accounts (HSAs). These accounts allow you to pay for eligible medical expenses with pre-tax dollars, reducing your overall taxable income.

Feature

FSA

HSA

Requires HDHP?

No

Yes

Rollover Allowed?

No (or limited to $640 in 2024, if allowed)

Yes, funds roll over year to year without limit

Investment Option?

No

Yes, you can invest your HSA funds for long-term growth

Employer Contributions?

Sometimes

Often available, with tax advantages for both employer and employee

Usage Deadline

End of calendar year (or short grace period)

None – you can use your balance at any time

HSAs, in particular, offer a triple tax benefit: contributions are tax-deductible, growth is tax-free, and withdrawals for medical expenses are tax-free, as it is noted according to Fidelity. This makes them not just a healthcare fund, but also a long-term savings vehicle.

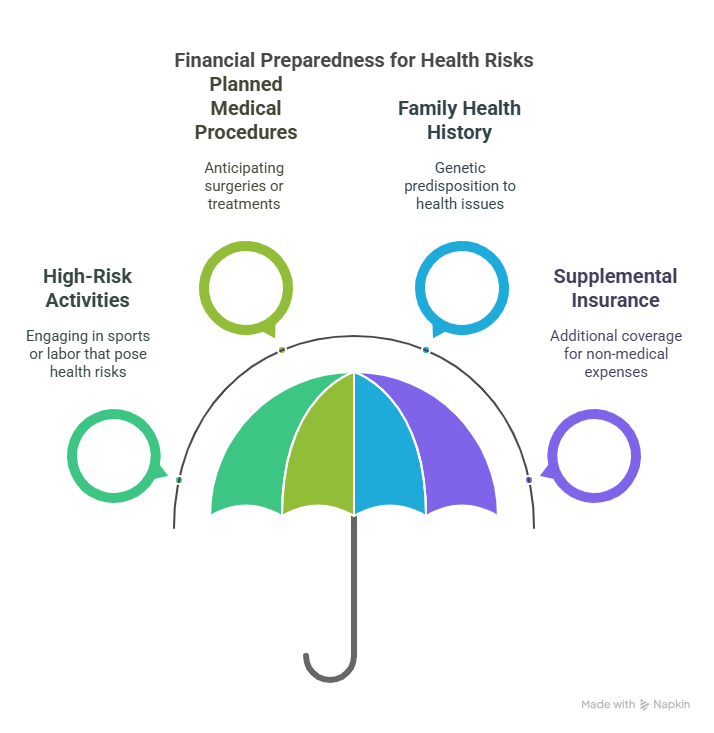

Planning for Known and Predictable Risks

Consider these factors:

- Do you or a family member engage in high-risk activities, such as contact sports or physical labor?

- Are you planning for pregnancy, surgery, or ongoing treatments shortly?

- Does your family history include chronic health issues that might lead to frequent doctor visits or testing?

If the answer to any of these questions is yes, choose a plan with lower out-of-pocket maximums or wider in-network provider access. Knowing these possibilities in advance allows you to avoid last-minute decisions that could result in costly out-of-network care.

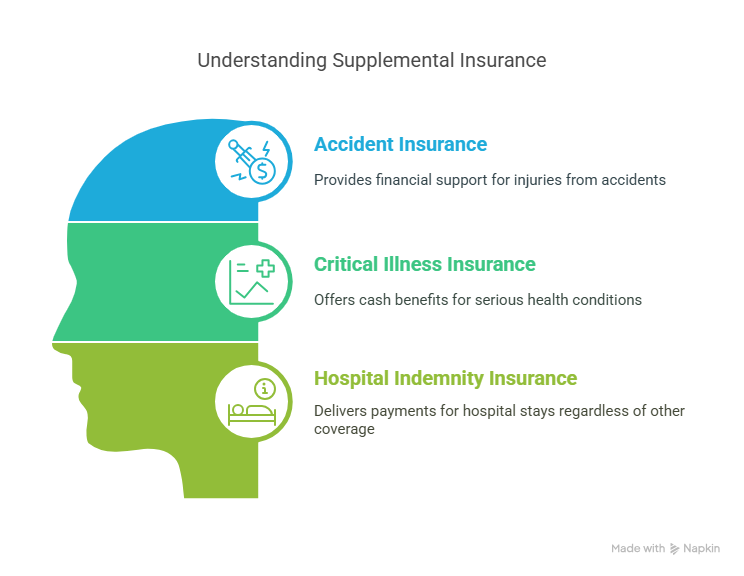

Supplemental Insurance: Added Protection for the Unexpected

Standard health insurance doesn’t always cover indirect or non-medical expenses associated with illness or injury, such as lost wages, travel for care, or daily living support. That’s where supplemental insurance comes in. These policies are designed to provide financial relief in specific situations and can be a smart investment, especially for families or individuals at higher risk.

Common Types of Supplemental Insurance:

- Accident Insurance: Pays a lump sum or reimbursement for injuries related to accidents.

- Critical Illness Insurance: Provides cash benefits if you’re diagnosed with a serious condition like cancer, stroke, or heart attack.

- Hospital Indemnity Insurance: Offers payments for hospital stays, regardless of other insurance coverage.

There are various resources available online that can help you compare supplemental coverage options and better understand what might suit your needs—platforms like Audelio.de can offer helpful insights when evaluating policies.

How the No Surprises Act Protects You

The No Surprises Act (NSA), effective January 1, 2022, was enacted to protect consumers from unexpected out-of-network medical bills in specific situations, according to CMS. It targets common scenarios where patients unknowingly receive care from out-of-network providers and are later billed for the difference.

Type of Medical Service

NSA Protections Apply?

Explanation

Emergency Services (ER Visits, Emergency Care)

Yes

You are protected even if the emergency facility or providers are out-of-network.

Non-Emergency Services at In-Network Facilities

Yes

Covers scenarios where you’re treated by out-of-network providers (e.g., anesthesiologists) at an in-network hospital.

Air Ambulance Services

Yes

NSA protections extend to out-of-network air ambulance transport.

Ground Ambulance Services

No

NSA protections do not apply; regulations vary by state.

Key Consumer Protections Under the NSA

- Limits Out-of-Pocket Costs:

Your costs for emergency services are capped at in-network rates, regardless of provider network status. - Bans Balance Billing:

Providers cannot bill you for the difference between what your insurer pays and their full charge in protected cases. - Cost Transparency for Uninsured Patients:

Requires Good Faith Estimates for those without insurance or those paying out-of-pocket. If the final bill exceeds the estimate by $400 or more, you have the right to dispute it as it is noted by CMS. - Informed Consent Requirement:

If you are scheduled to receive non-emergency care from an out-of-network provider at an in-network facility, you must be given a Notice and Consent Form in advance. This document must:- Inform you about your protections.

- Provide an estimated cost of care.

- Offer you the choice to decline out-of-network treatment.

What This Means for Patients

The NSA significantly shifts the burden away from patients by enforcing fair billing practices in emergency and certain non-emergency situations.

- Hidden provider network statuses,

- Lack of transparency in billing processes,

- And no patient consent regarding pricing.

The NSA now:

- Establishes boundaries on what providers can charge patients.

- Transfers responsibility to providers and insurers to settle payment disputes without involving the patient.

- Empowers consumers through clear disclosures, estimates, and structured complaint and dispute resolution processes.

However, the Act does not cover ground ambulance services, which remain a significant gap. According to a 2020 study by the Peterson-KFF Health System Tracker, about 51% of ground ambulance rides involved out-of-network charges. Consumers must be aware of their state laws, as some may offer protections where federal law does not.

For the uninsured or self-paying population, the NSA also introduces financial predictability by requiring advance cost estimates, promoting price transparency for the first time in federal law.

Overall, while not all-inclusive, the No Surprises Act is a major step toward billing fairness and is a vital tool in helping Americans avoid devastating medical debt due to undisclosed provider costs.

Medical Expenses and Your Taxes

According to IRS guidelines, you can deduct unreimbursed medical expenses that exceed 7.5% of your adjusted gross income (AGI) if you itemize deductions.

Eligible expenses include:

- Doctor visits

- Hospital stays

- Dental and vision care

- Prescription drugs

- Medical equipment

Conclusion

Surprise medical bills are more than just frustrating—they can be financially devastating. While the No Surprises Act offers important protections, the reality is that the healthcare system still demands vigilance from consumers.

The best way to avoid the sting of hidden healthcare costs is to prepare, plan, and protect yourself. In the unpredictable world of healthcare, knowledge truly is power—and peace of mind.

Related Posts:

- Researchers Tested Intermittent Fasting Without…

- This Unexpected Habit Could Make You Happier Overnight

- 5 States With the Highest and 5 Lowest Healthcare…

- US vs Europe Healthcare in 2025 - Costs, Quality of…

- Top 10 Everyday Products That May Contain Hidden Carcinogens

- When Birth Rates Crash, So Do House Sales - The Hidden Risk