According to World Population Review, Houston, located in Fort Bend County, Texas, has a current population of 2,319,119 as of 2025.

The city is experiencing a steady growth rate of 0.21% annually, reflecting an overall population increase of 0.86% since the 2020 census, which recorded a population of 2,299,269.

By 2025, the Houston metro area is projected to reach a population of 6,890,000 as it adds hundreds of thousands of new residents each year, cementing its status as a major hub in the region as noted by Macrotrends.

Table of Contents

ToggleKey Takeaways

- Houston’s population in 2025 is 2,319,119, with a metro area projection of 6.89 million.

- The city leads in STEM degrees, with 49.1% of graduates specializing in science and engineering.

- Harris County cut migration losses by half during the pandemic, losing 16,000 residents annually by 2022.

- Houston’s median home price rose 4.4% year-over-year to $339,370, remaining 17% below the U.S. average.

- Average household income in Houston grew 7.7%, reaching $97,458, while housing costs remain affordable at $1,240/month.

- Migration to suburbs like Fort Bend and Montgomery counties surged, driven by remote work and lifestyle changes.

Population Growth – A Historical and Projected Overview

Houston gained more than 1.3 million new residents in the past 10 years. Estimates say 118,000 more will move to the Houston area in 2025. Imagine the ride through 610 near The Galleria in 25 years! pic.twitter.com/591iB1ecCl

— houstoncitybeat (@houstoncitybeat) December 30, 2024

Houston has experienced remarkable population growth, solidifying its position as one of the fastest-growing regions in the United States. Between 2011 and 2012, the city gained over 34,000 residents, marking the second-largest numeric population increase among U.S. cities during that period.

By 2013, the Houston Chronicle reported that this growth trend showed no signs of slowing. Houston continues to attract new residents due to its abundant job opportunities, strong education system, and diverse housing options, alongside robust growth across many economic sectors.

Projections indicate that Houston’s population will rise significantly in the coming decades. By 2020, the population was expected to increase from 2.162 million to 2.52 million. By 2030, it is anticipated to reach 2.8 million, positioning Houston to surpass Brooklyn in population size.

Houston’s origins date back to 1836 when two real estate entrepreneurs from New York purchased land along Buffalo Bayou to establish a city. They named it after Sam Houston, the general who led the victory at the Battle of San Jacinto and became the Republic of Texas’s first president that year. The city was incorporated in 1837 and briefly served as the capital of the Republic of Texas.

In the decades following, Houston emerged as a major economic hub. By 1860, it was a critical center for exporting cotton, and its bayou system was expanded post-Civil War to accommodate increased commerce.

The discovery of oil nearby in 1901 spurred the growth of the Texas petroleum industry, and by 1910, Houston’s population had doubled within a decade to 78,000. In the 1950s, the city’s economy began shifting towards energy, attracting major companies to relocate to the area.

Since the 1990s recession, Houston has successfully diversified its economy, reducing its reliance on petroleum and fostering growth across various industries. Today, it stands as a thriving and dynamic city, continuing its trend of population expansion and economic development.

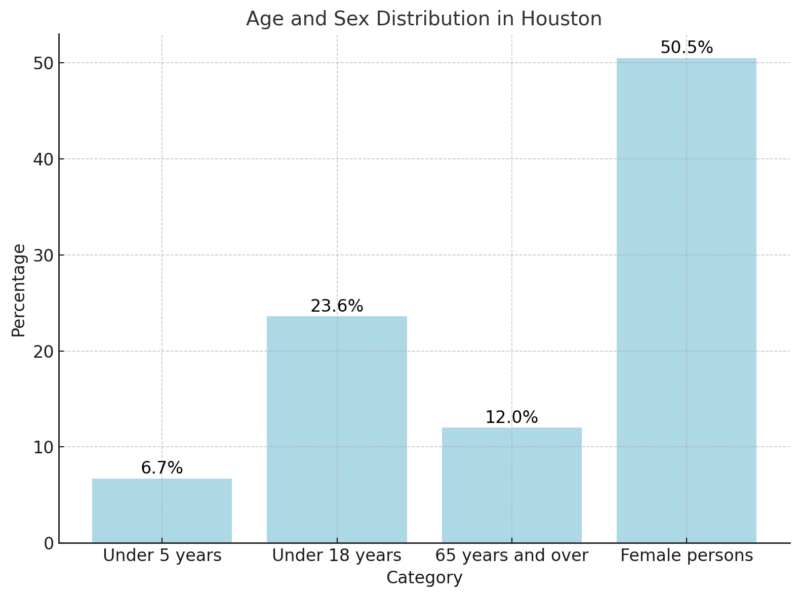

Age and Sex Distribution

- Age and sex distribution in Houston

Houston’s population demonstrates a balanced age structure, with nearly a quarter (23.6%) of residents under 18, indicating a youthful demographic that promises a robust future workforce.

The senior population, at 12%, reflects a growing need for senior services and healthcare.

Female residents slightly outnumber male residents, making up 50.5% of the population.

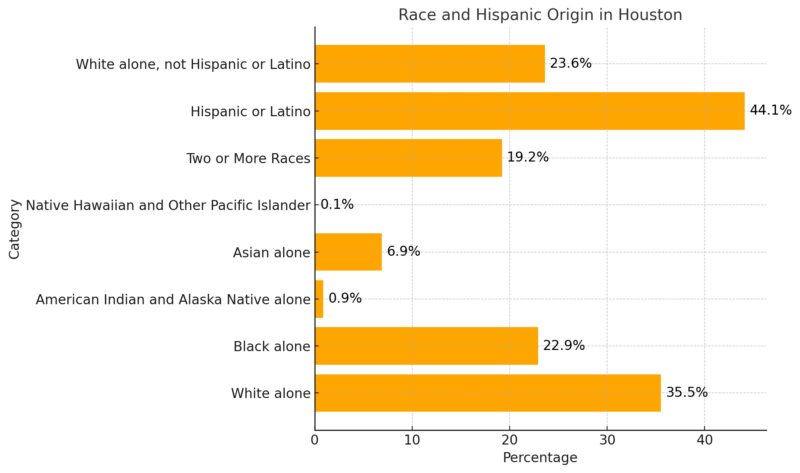

Race and Hispanic Origin

- Race and hispanic origin in Houston

Houston is one of the most diverse cities in the United States. Hispanic or Latino residents form the largest ethnic group at 44.1%, followed by White residents (35.5%) and Black residents (22.9%).

The city’s significant percentage of individuals identifying as Two or More Races (19.2%) highlights its growing multicultural identity according to the Census.

This rich diversity is a cornerstone of Houston’s cultural and economic vibrancy.

Population Characteristics

| Category | Value |

|---|---|

| Veterans (2019-2023) | 62,919 |

| Foreign-born persons | 28.8% |

Houston’s large veteran population of nearly 63,000 underscores its historical ties to military service and its commitment to supporting veterans.

Additionally, with 28.8% of residents being foreign-born, the city is a hub for immigration, fostering cultural exchange and contributing to its dynamic workforce.

Houston Neighborhoods by Population

| Rank | Neighborhood | Population |

|---|---|---|

| 1 | Alief | 102,240 |

| 2 | Sharpstown | 76,090 |

| 3 | Central Southwest | 60,860 |

| 4 | Kingwood | 59,470 |

| 5 | Northside-Northline | 58,830 |

| 6 | Greater Fondren Southwest | 58,700 |

| 7 | Clear Lake | 57,590 |

| 8 | Eldridge – West Oaks | 56,240 |

| 9 | South Belt – Ellington | 55,100 |

| 10 | Golfcrest – Bellfort Area | 49,760 |

| 11 | Greater Uptown | 49,280 |

| 12 | Woodlake – Briarmeadow | 47,960 |

| 13 | Memorial | 46,570 |

| 14 | Gulfton | 43,950 |

| 15 | Greater Greenspoint | 42,890 |

| 16 | Oak Forest – Garden Oaks | 41,560 |

| 17 | Greater Heights | 40,870 |

| 18 | Briarforest Area | 39,030 |

| 19 | Fort Bend – Houston | 34,970 |

| 20 | Greater Inwood | 33,920 |

| 21 | Spring Branch West | 30,080 |

| 22 | Westchase | 29,070 |

| 23 | Neartown – Montrose | 28,960 |

| 24 | Spring Branch Central | 28,080 |

| 25 | Eastex – Jensen Area | 28,020 |

| 26 | Northshore | 27,200 |

| 27 | Northside Village | 26,830 |

| 28 | Washington Avenue Coalition | 26,570 |

| 29 | Spring Branch East | 25,560 |

| 30 | Acres Home | 24,560 |

| 31 | Greater Hobby Area | 22,320 |

| 32 | OST – South Union | 20,150 |

| 33 | Braeburn | 19,340 |

| 34 | Denver Harbor – Port Houston | 17,160 |

| 35 | Downtown | 16,720 |

| 36 | Addicks Park Ten | 14,120 |

| 37 | Willow Meadows – Willowbend | 12,750 |

| 38 | Kashmere Gardens | 9,530 |

| 39 | Westbranch | 5,030 |

| 40 | Carverdale | 3,240 |

| 41 | El Dorado – Oates Prairie | 3,140 |

| 42 | Fondren Gardens | 2,900 |

| 43 | Hunterwood | 2,530 |

| 44 | Clinton Park Tri-Community | 2,500 |

| 45 | Medical Center Area | 1,340 |

Alief ranks as the most populous neighborhood with 102,240 residents, followed by Sharpstown (76,090) and Central Southwest (60,860) according to Statistical Atlas. These areas are likely hubs of cultural activity, diverse housing, and employment opportunities.

Neighborhoods such as Greater Uptown (49,280), Memorial (46,570), and Greater Heights (40,870) host significant populations, often associated with established communities and mixed residential and commercial developments.

Several neighborhoods, including the Medical Center Area (1,340), Clinton Park Tri-Community (2,500), and Hunterwood (2,530), have smaller populations. These areas may offer niche community experiences, quieter residential options, or specialized services.

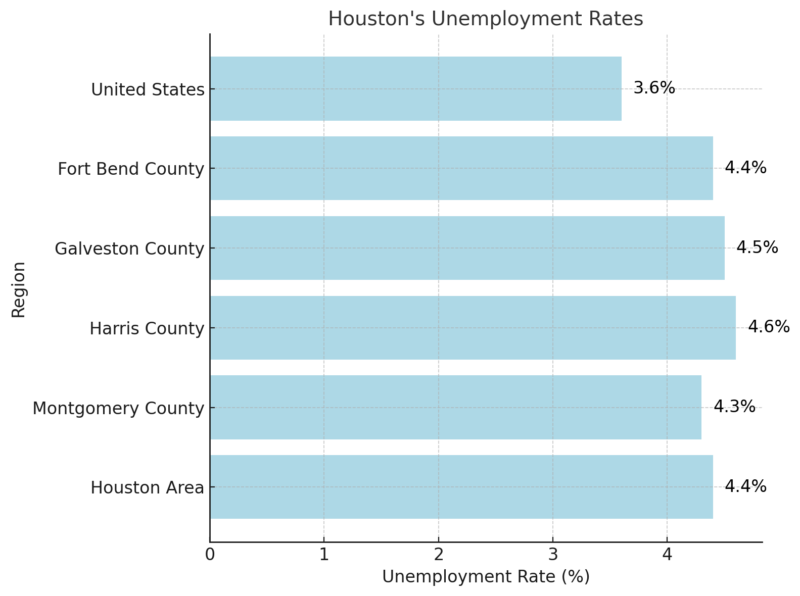

Employment and Unemployment Rates

- Houston’s unemployment rates

BLS report shows that Houston’s employment grew by 1.8% in the year ending November 2024, creating 62,500 jobs. The region’s unemployment rate averages 4.4%, slightly above the national average of 3.6%. Variations among counties highlight differing economic activity levels within the metropolitan area.

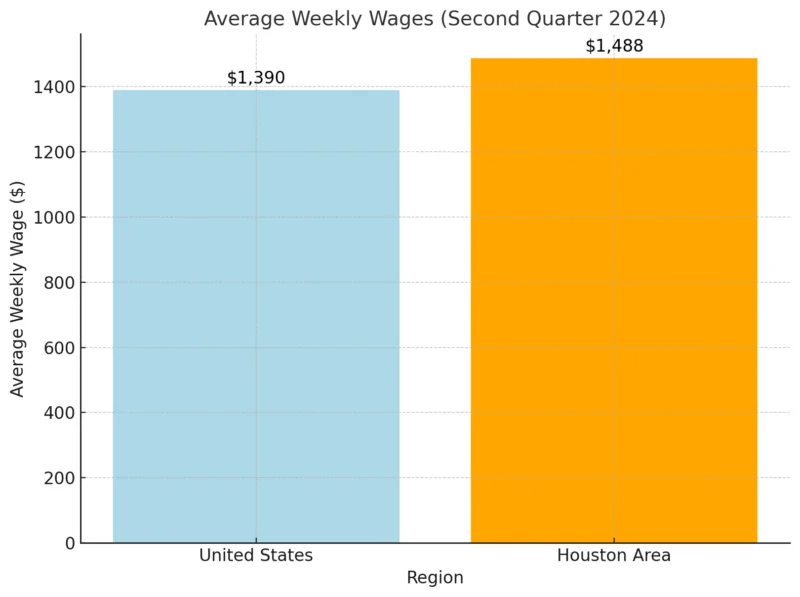

Average Weekly Wages (Second Quarter 2024)

- Average weekly wages – United States vs Houston

The Houston area surpasses the national average in weekly wages, reflecting its strong economy, particularly in high-paying industries like energy, manufacturing, and professional services.

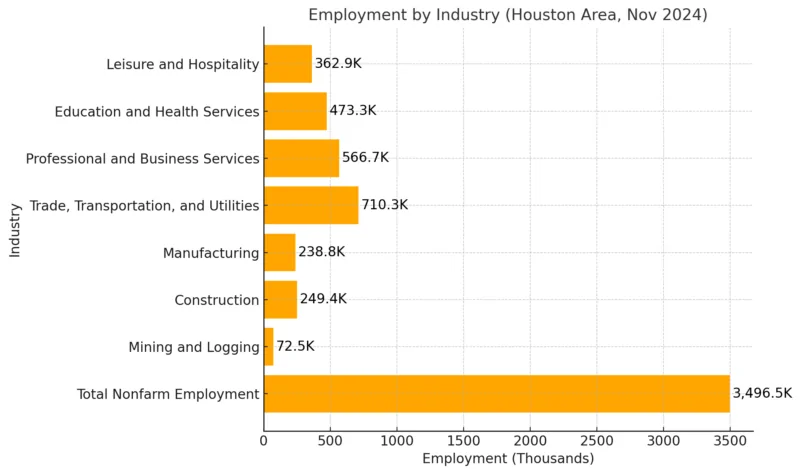

Employment by Industry (Houston Area, Nov 2024)

- Employment by industry

The construction industry experienced the largest growth (6.9%), highlighting a rebound in building activity. Education and health services also grew significantly (2.7%), reflecting demand for healthcare and educational resources in the region. However, professional and business services saw a slight decline (-0.2%).

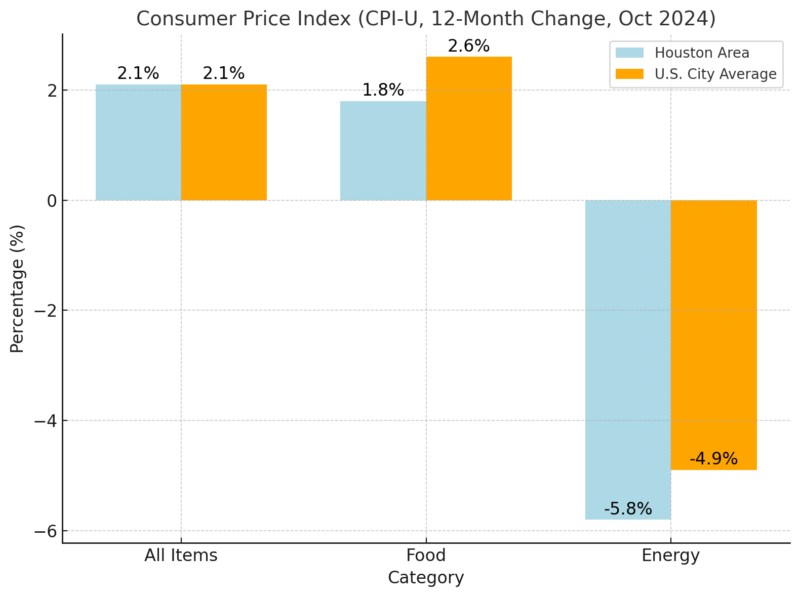

Consumer Price Index (CPI-U, 12-Month Change, Oct 2024)

- Consumer price index – Houston area vs US city average

Inflation in the Houston area aligns with the national average at 2.1%. Food prices have risen modestly (1.8%), while energy costs have declined significantly (-5.8%), contributing to an overall stabilization of living costs.

Average Annual Expenditures (2022-2023)

- Average annual expenditures – Houston area vs United States

Houston residents spend more annually than the national average, particularly on housing and transportation. These higher costs are offset by savings in food and healthcare, reflecting regional economic patterns and cost structures.

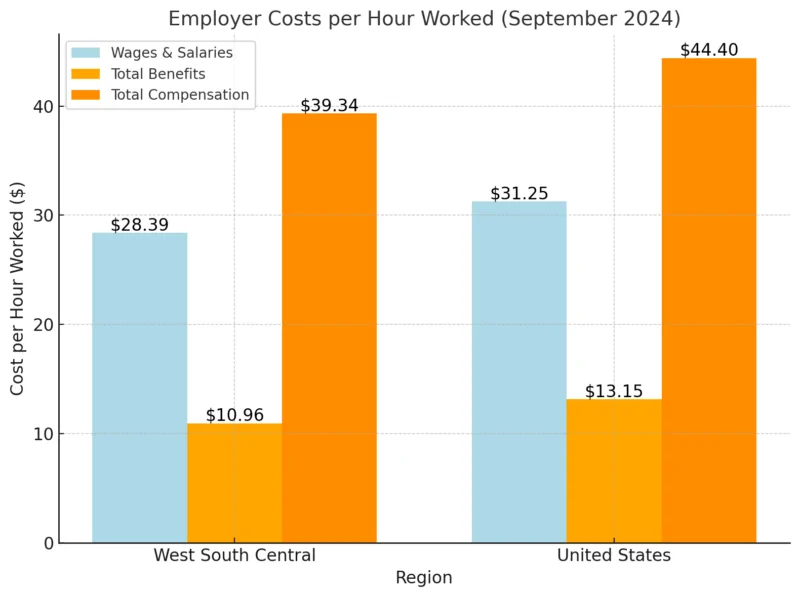

Employer Costs per Hour Worked (September 2024)

- Employer costs per hour worked – West South Central vs United States

While total compensation in the West South Central region (which includes Houston) is lower than the U.S. average, the balance between wages and benefits reflects the region’s competitive labor market and relatively lower living costs.

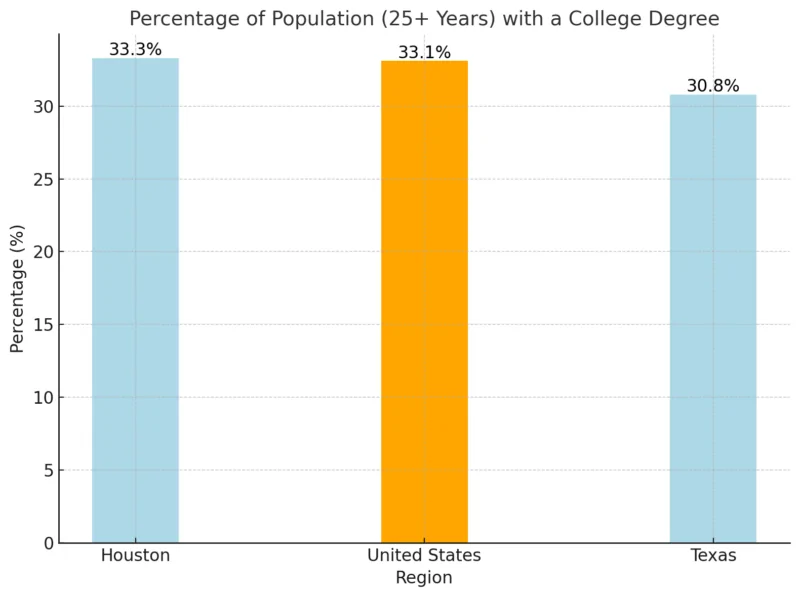

Educational Attainment

- Population with a college degree (Houston, US and Texas)

Houston.org says that the city exceeds both the national (33.1%) and state (30.8%) averages for the proportion of residents aged 25 and older with a college degree. This highlights the city’s strong educational attainment and its capacity to attract and retain educated talent.

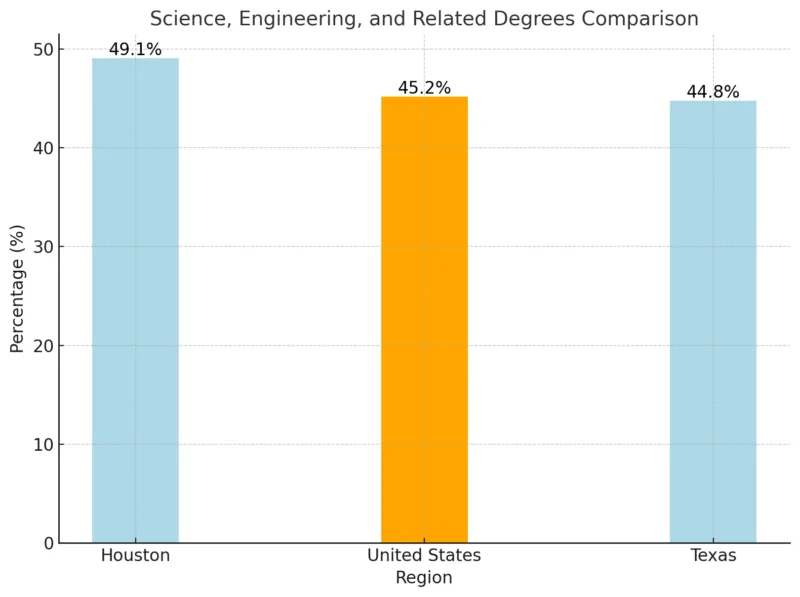

Science, Engineering, and Related Degrees Comparison

- Science, engineering, and related degrees comparison

Nearly half (49.1%) of Houston’s college graduates have degrees in science, engineering, or related fields, surpassing both the national average (45.2%) and the Texas average (44.8%).

This emphasizes Houston’s specialization in technical and STEM-related disciplines, aligning with the city’s strengths in industries such as energy, healthcare, and technology.

Houston Housing Market Overview (November 2024)

| Metric | Value | Year-over-Year Change |

|---|---|---|

| Median Sale Price | $339,370 | +4.4% |

| Number of Homes Sold | 1,428 | -3.6% |

| Median Days on Market | 42 | +10 days |

| Sale-to-List Price Ratio | 97.0% | -0.21 percentage points |

| Homes Sold Above List Price | 14.4% | -0.83 percentage points |

| Homes with Price Drops | 23.5% | -1.6 percentage points |

Houston’s median home price increased by 4.4% year-over-year to $339,370. While prices are rising, Houston remains more affordable than the national market, with home prices 17% lower than the U.S. average. This affordability makes Houston attractive to buyers seeking value according to Redfin.

Nearly one in four homes (23.5%) had price drops, a modest decline from the previous year. This trend indicates sellers are adjusting expectations to align with current market conditions.

Comparison to National Market

| Metric | Houston, TX | United States Average | Difference |

|---|---|---|---|

| Median Sale Price | $339,370 | 17% lower than the U.S. average | Houston is more affordable |

| Median Sale Price/Sq. Ft. | $183 | 6% lower than the U.S. average |

Homes are selling slower than last year, with the median days on the market rising to 42 days compared to 32 days last year. The slight cooling could reflect broader market stabilization or a decrease in buyer urgency.

Market Competitiveness

| Metric | Value |

|---|---|

| Competitiveness Score | 50 (Somewhat Competitive) |

| Average Sale-to-List Price Ratio | 97.0% |

| Average Days to Pending | 43 days |

| Highly Competitive Homes | Pending in ~13 days |

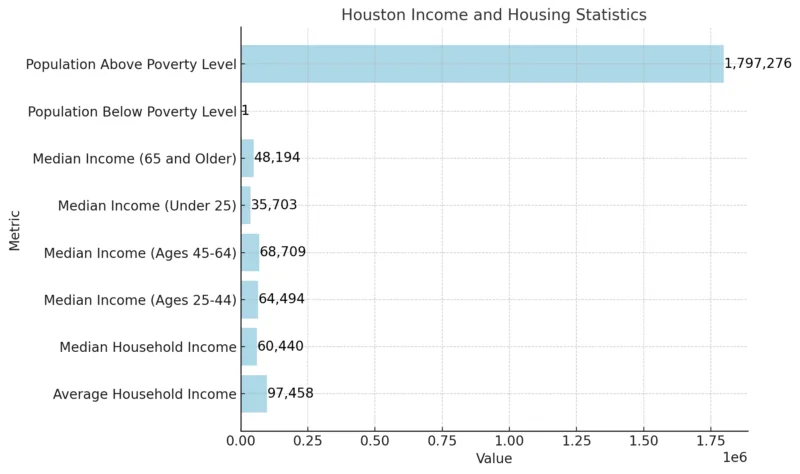

Houston Income and Housing Statistics

- Houston income and housing statistics

According to data from Point2Homes, the average annual household income in Houston is $97,458, while the median is $60,440. Both figures have shown significant year-over-year growth of 7.7% and 7.9%, respectively.

Income disparities across age groups are notable, with the highest median earnings seen in individuals aged 45-64 ($68,709), followed by those aged 25-44 ($64,494). Younger residents under 25 and seniors over 65 earn significantly less, with median incomes of $35,703 and $48,194, respectively, reflecting areas where targeted economic support may be beneficial.

Housing Statistics

| Metric | Value |

|---|---|

| Total Housing Units | 1,006,392 |

| Median Year Built | 1980 |

| Occupied Housing Units | 897,510 |

| Owner-Occupied Units | 41.96% |

| Renter-Occupied Units | 58.04% |

| Homes with Mortgages | 52.71% |

| Median Value of Mortgaged Homes | $281,100 |

| Median Monthly Housing Costs | $1,240 |

Houston’s housing market consists of 1,006,392 housing units, with a significant portion (897,510) occupied, as reported by Point2 Homes. Among these, 58.04% are renter-occupied, and 41.96% are owner-occupied, highlighting a predominance of rental housing.

@thriftyapartments HOUSTON TX APARTMENT STARTING AT ONLY $599! 😱 —— ▪️STUDIO • $599 ▪️2 BED 1 BATH • $899 ▪️2 BED 2 BATH • $975 📍Westchase —— #houston #thriftyapartment #apartments #houstontour #houstonapartments ♬ original sound – wisdm.mari

Over half of the owner-occupied homes (52.71%) are mortgaged, with a median value of $281,100. Monthly housing costs average $1,240, indicating relative affordability within the city compared to national averages. The median construction year of 1980 suggests a mix of older housing stock, which may influence maintenance and renovation trends.

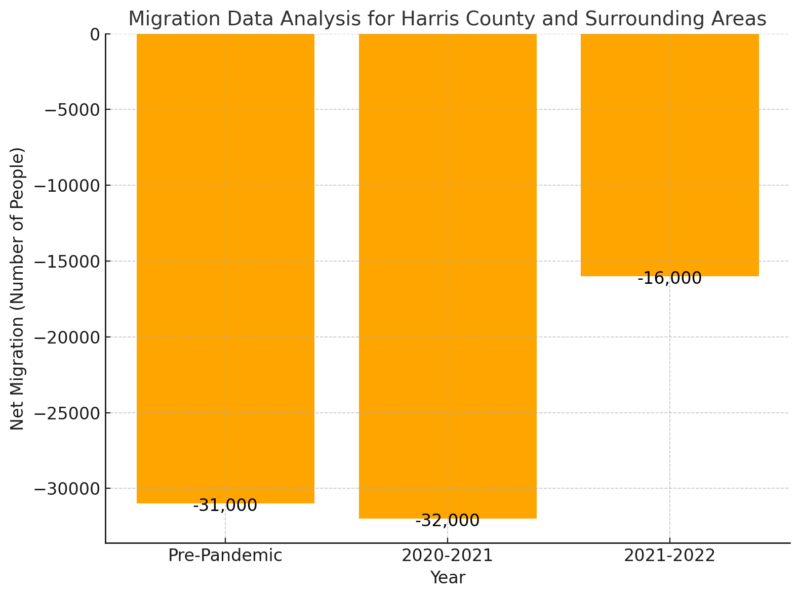

Migration Data Analysis for Harris County and Surrounding Areas

- Migration data analysis for Harris County and surrounding areas

Harris County experienced a net loss of residents to domestic migration before and during the pandemic, averaging 31,000 annually pre-pandemic. However, the loss decreased significantly to 16,000 between 2021 and 2022 as noted by Housten Chronicle.

This trend contrasts with many other urban areas, where losses during the pandemic were more pronounced. The stabilization highlights the county’s resilience and appeal during a time of widespread migration shifts.

Movement Between Harris County and Neighboring Counties (2020-2022)

| County | Residents Moving to Harris County | Residents Leaving Harris County |

|---|---|---|

| Fort Bend County | 41,000 | 67,000 |

| Montgomery County | – | 52,000 |

Fort Bend and Montgomery counties were the most common destinations for Harris County residents during the pandemic. Approximately 67,000 people moved to Fort Bend, and 52,000 to Montgomery, reflecting a significant suburbanization trend.

However, Fort Bend also sent 41,000 residents to Harris County, indicating strong two-way migration patterns likely driven by job opportunities and housing preferences.

Migration to Harris County from Other Texas Cities (2020-2022)

| City/County | New Residents Moving to Harris County |

|---|---|

| Bexar County (San Antonio) | 9,000 |

Counties housing major Texas cities, including San Antonio, Austin, and Dallas, contributed a combined total of 22,619 new residents to Harris County. This highlights continued intra-state migration despite the pandemic, driven by Harris County’s employment opportunities and its role as an economic hub.

Migration from and to Los Angeles County

| Direction | Number of Residents |

|---|---|

| Moved to Harris County from L.A. | Largest group outside Texas |

| Moved to L.A. from Harris County | Largest destination outside Texas |

Los Angeles County represented the largest source of out-of-state residents moving to Harris County. Conversely, it was also the top destination for former Harris County residents leaving Texas. This two-way migration reflects ongoing economic and cultural ties between Texas and California.

Methodology

- Data for this article was sourced from reputable entities, including the U.S. Census Bureau, IRS, BLS, Point2 Homes, and Macrotrends.

- We analyzed population trends, economic statistics, housing market data, and migration patterns from 2020-2025.

- Comparative analysis was performed between Houston and national or regional benchmarks for context.

- Insights were drawn from authoritative sources such as Houston Chronicle and government reports for accuracy.

- All information was synthesized into tables, charts, and concise summaries for clarity and usability.

References:

- World Population Review – Houston Population

- Macrotrends – Houston Population

- Houston Chronicle – Houston Growth Shows No Signs of Waning

- New York Times (Archive) – Don’t Look Back, Brooklyn: Houston is Gaining on You

- Census Bureau – QuickFacts: Houston City, Texas

- Statistical Atlas – Downtown Houston Population

- Bureau of Labor Statistics – Houston Economic Data (BLS Summary)

- Houston.org – Educational Attainment in Houston

- Redfin – Houston Housing Market

- Point2Homes – Houston Demographics

- Houston Chronicle – Houston Moving Trends Map Pandemic

Related Posts:

- Map of Houston, Texas – Geography, Attractions &…

- Oklahoma City Population 2025 - Growth Trends and…

- Jacksonville Population 2025 - Growth Trends and Projections

- Columbus Population 2025 - Growth Trends and Projections

- Portland, OR Population 2025 - Growth Trends and Projections

- Nashville Population 2025 - Growth and Future Projections