In 2025, the global smart home safety market officially crossed the 34 billion-dollar mark, confirming what has been obvious for years: connected security systems are no longer a luxury but a baseline expectation for modern households.

Depending on the source, the total value ranges from 33.9 to 36.9 billion USD, with all projections pointing upward toward 70–100 billion USD by 2030.

This milestone reflects not just how much people are willing to invest in keeping their homes safe but also how deeply technology has reshaped the idea of home security itself.

Table of Contents

ToggleMarket Surged Past 34 Billion

The jump to over 34 billion USD in 2025 is a result of a perfect storm of consumer priorities and technological evolution.

Across every region, homeowners are buying into integrated, app-controlled safety systems, from video doorbells to AI-driven surveillance cameras, that fit seamlessly into broader home-automation setups.

Three core trends explain the momentum:

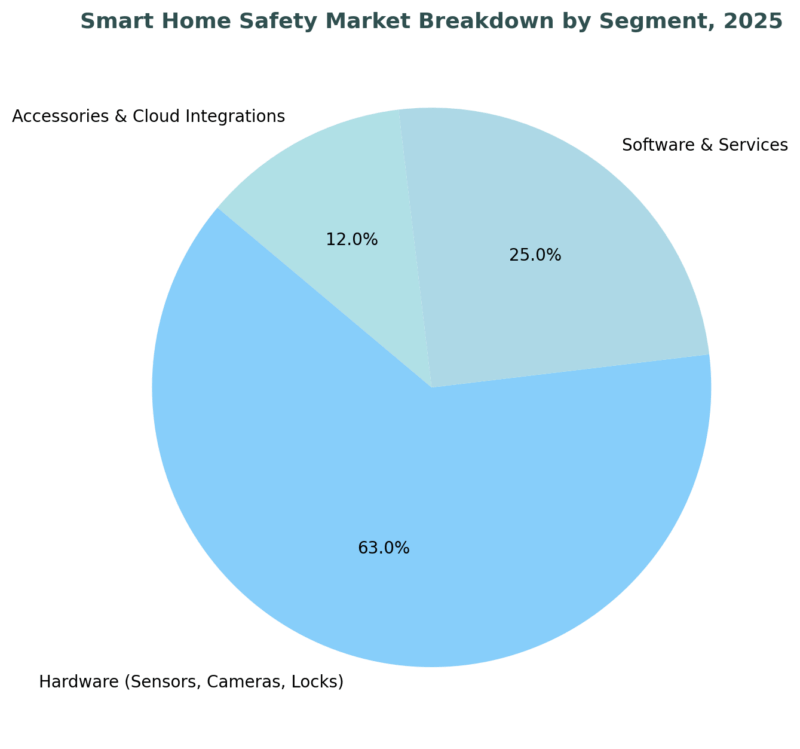

Market Breakdown by Segment

Hardware still leads, but services, particularly those offering real-time alerts, cloud footage, and AI-based motion recognition, are growing at the fastest rate. Consumers increasingly pay monthly for ongoing protection, not just for physical devices.

Regional Performance

Region

Market Share (2025)

Highlights

North America

37% approx.

Mature ecosystem, high adoption of smart locks and doorbell cameras.

Europe

28%

Growth supported by energy-efficient homes and integrated alarm standards.

Asia Pacific

24%

Fastest-growing region: Ch:na, Japan, and South Korea are driving expansion.

Rest of World

11%

Emerging middle-class adoption in Latin America and the Middle East.

The United States remains the single largest market, expected to reach around 21 billion USD by 2030.

Asia Pacific, however, leads in growth pace, with an estimated CAGR above 17% between 2025 and 2030, driven by urban apartment living and government-backed “smart city” initiatives.

What People Are Actually Buying

Segment

2025 Share

What It Means

Hardware (Cameras, Locks, Sensors)

≈ 63 %

Most spending still goes into tangible protection equipment.

Software & Services

≈ 25 %

Cloud monitoring and AI analysis drive steady subscription revenue.

Accessories & Add-ons

≈ 12 %

Includes hubs, battery backups, and integrated voice assistants.

Hardware leads, but digital services are climbing fast as consumers pay monthly for live monitoring, secure footage storage, and automated emergency alerts.

Devices Behind the Growth

When consumers buy smart safety products today, they focus on convenience, connectivity, and reliability rather than novelty.

The largest category by far is smart cameras, now integrated with AI that distinguishes pets, family members, or delivery staff from real threats. Video doorbells and smart locks follow close behind, giving homeowners full remote control of entry points.

Smoke, carbon-monoxide, and water sensors round out the top four, forming the backbone of the modern home-safety ecosystem.

In many newer devices, environmental safety is getting just as much attention as security. For example, gas-leak detection systems that once required professional installation are now simple plug-and-play units.

A leading example is a gas leak monitor from gasdog.com, a compact sensor that alerts homeowners via mobile app the moment it detects methane or propane buildup. Products like this illustrate how smart-safety technology is evolving beyond theft prevention into full-spectrum household protection.

Technology and Standards Shaping the Future

2025 marked the first full year of Matter implementation across most leading devices. This protocol eliminated many compatibility barriers that frustrated consumers.

Meanwhile, AI and edge computing transformed detection accuracy, reducing false alarms by analyzing movement patterns and sound in real time.

Cloud connectivity remains a core profit driver. Manufacturers are turning to recurring-revenue models, monthly fees for data storage or professional monitoring, which are expected to outpace hardware revenue growth by 2028.

Challenges Still Facing the Industry

Even with record revenue, the industry faces significant challenges:

The Numbers Behind the Headline

The major analytics firms align on one point: 2025 marks a record-breaking year.

Source

2024 Value

2025 Value

CAGR (2025-2030)

Grand View Research

33.94 bn USD

40.46 bn USD

~13%

Mordor Intelligence

,

36.94 bn USD

13.8%

Fortune Business Insights

29.04 bn USD

33.20 bn USD

14.2%

Regardless of the dataset, the pattern is identical: continuous double-digit annual growth. The smart home safety market is on track to double in less than five years.

What the Future Looks Like

Between 2025 and 2030, analysts expect major expansion in:

By 2030, the global market value could reach between 70 and 100 billion USD, depending on regional adoption rates and subscription penetration.

Bottom Line

Homes now behave like miniature data centers, with AI keeping watch as reliably as any security guard once did.

In states like Florida, Louisiana, and Texas – where homeowners’ insurance rates rank among the highest in the nation – the push for smarter, self-monitoring systems has grown even stronger.

As privacy standards tighten and hardware prices keep falling, smart-home safety is set to become one of the most stable growth engines in consumer technology for the rest of the decade.