After several years of price turmoil, inflation in early 2025 has largely eased back into the range near the Federal Reserve’s 2% target. According to the U.S. Bureau of Labor Statistics (BLS), consumer prices in March 2025 were 2.4% higher than a year earlier according to BLS.

And now in July is 3.0%.

This marks a dramatic improvement from mid-2022, when inflation peaked at 9.1% year-over-year, the highest rate since 1981.

Inflation has steadily fallen from 6.5% at the end of 2022 to around 3% by late 2024, according to usinflationcalculator.com, and now sits in the mid-2% range as of spring 2025. The latest data (released in April 2025) indicates that price growth is nearing its slowest pace in about two years.

In other words, after a period of painfully high inflation, the rate of price increases has come down to Earth.

Table of Contents

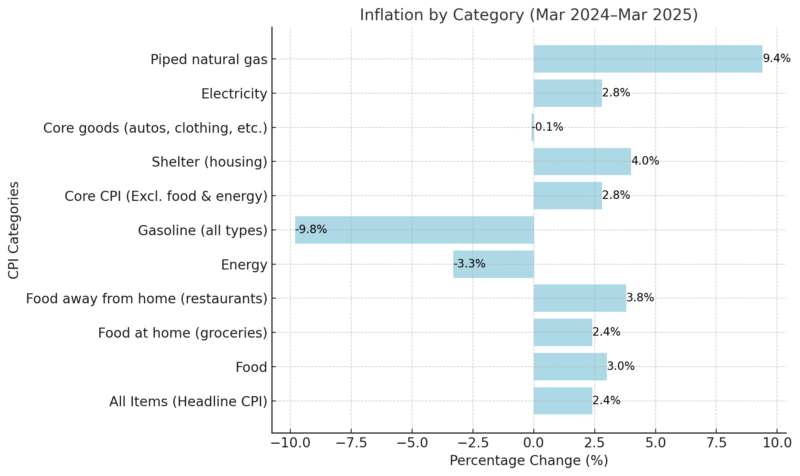

ToggleWhat’s Driving Inflation in 2025? A Closer Look at Prices by Category

As of March 2025, overall inflation in the U.S. has cooled to +2.4%, according to the Bureau of Labor Statistics. This is a big improvement from the highs of 2022, when prices were rising more than 9% a year.

Here’s what’s behind the current trend:

- Gasoline and energy prices have dropped, which helps slow down overall inflation. Gas prices are nearly 10% lower than a year ago (–9.8%), and total energy prices fell 3.3%. This is a major change from 2022, when energy costs were one of the biggest inflation drivers according to Morningstar.

- Food prices are still going up, especially when eating out. Grocery prices rose 2.4%, while restaurant prices went up 3.8%.

- Rent and housing costs remain a problem. Shelter costs are up 4.0%, making housing one of the biggest contributors to inflation in 2025.

- Goods prices have mostly stabilized. Used car prices are almost flat (+0.6%), and clothing (apparel) is barely up (+0.3%)

- Electricity and utility bills are still climbing. Electricity costs are up 2.8%, and natural gas bills are up a sharp 9.4% year-over-year.

Even though the headline inflation rate is falling, many everyday essentials are still getting more expensive. That’s why people still feel the pinch—because key expenses like rent, food, and utilities continue to rise faster than many paychecks.

In short:

How 2025 Compares to Recent Years: A Five-Year Inflation Recap

Year

Key Events / Drivers

2020

COVID-19 recession; lockdowns; weak demand; near-zero inflation

2021

Reopening surge; supply chain issues, stimulus-driven demand

2022

Peak inflation, global energy shocks, the Russia-Ukraine war, and shortages

2023

Gradual decline, falling gas prices, supply easing, and Fed rate hikes

2024

Return toward normal, stable energy, and cooling housing prices

2025

Near-target range; mild inflation mostly in services and housing

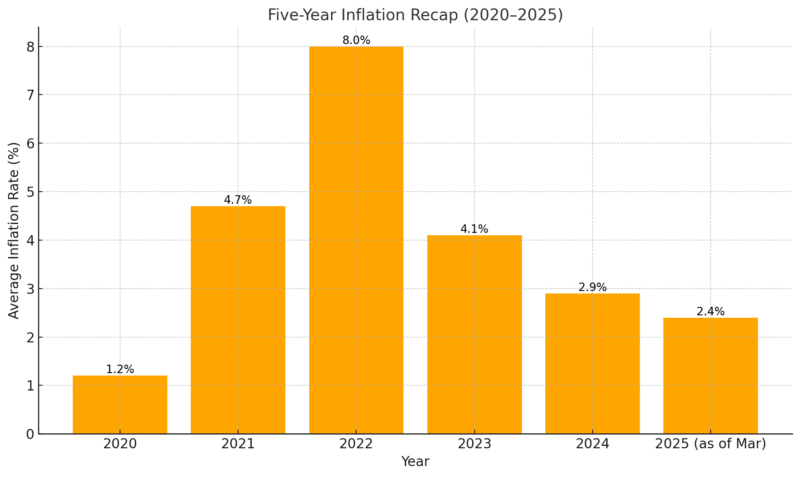

The path to today’s lower inflation has been anything but smooth. In 2020, consumer prices barely moved as the COVID-19 pandemic halted global activity. Inflation averaged just 1.2% that year, with some months hovering near zero as Americans stayed home and cut back on spending.

Things shifted rapidly in 2021. As the economy reopened and demand surged, inflation climbed past 4% by spring, ending the year at 7.0%, the highest since the early 1980s. Supply chain disruptions, shipping backlogs, and shortages of key items like semiconductors all drove prices higher.

Many Americans, still flush with stimulus funds, spent heavily on cars, electronics, and home goods, fueling the price surge.

The inflation peak came in June 2022, when year-over-year CPI hit 9.1%. For the full year, inflation averaged 8.0%, driven by rising energy prices, war-related disruptions in global markets, and sustained consumer spending, according to the Home Treasury.

Essentials like food, gas, and housing saw some of the steepest increases. Wages couldn’t keep up, leading to a drop in inflation-adjusted income for many families.

By late 2022 and into 2023, price pressures began to ease. Energy prices fell significantly, thanks in part to major releases from the U.S. Strategic Petroleum Reserve, which lowered gas prices by an estimated 17–42 cents per gallon. Supply chains untangled, with ports and factories catching up. Goods like used vehicles even saw price drops.

In response to earlier price spikes, the Federal Reserve raised interest rates aggressively, cooling demand in sectors like housing and autos. As a result, inflation ended 2023 at 3.4% year-over-year, with an annual average of 4.1%.

By 2024, inflation slowed further to around 2.9%, bringing it back within a range considered healthy by economists. That trend continued into 2025. In March 2025, CPI rose 2.4% compared to the year before, much closer to the Fed’s long-term goal of 2%.

Today, inflation is more manageable. Price increases are no longer broad-based, but rather focused on specific areas like services and housing. Gasoline and goods prices have stabilized or fallen, helping to ease pressure on household budgets.

The Main Causes of Inflation in 2025

Several factors explain both why inflation remains somewhat elevated in 2025 (around 2–3% instead of the Fed’s ideal 2%) and why it isn’t higher (i.e., why the earlier surge subsided).

In summary, the inflation landscape in 2025 reflects a mix of fading supply shocks, shifting demand patterns, and policy actions. Here are the key causes and influences:

1. Supply Shocks Have Faded

Factor

2022

2025

Supply chain delays

Severe (port backlogs, factory shutdowns)

Mostly resolved

Shipping costs

High

Back to pre-pandemic levels

Oil and grain prices

Spiked due to the Ukraine war

Stabilized

Core goods inflation

Rising

Slightly declining

During 2021 and 2022, supply chain chaos and global commodity shocks pushed up prices. COVID lockdowns disrupted manufacturing, and the war in Ukraine sent oil and grain prices soaring. These factors made goods more expensive across the board, according to the Federal Reserve.

By 2025, however, things have largely returned to normal. Global shipping costs are down, goods are moving efficiently again, and core goods inflation has flattened; some categories have even seen price drops. This easing of supply-side pressures is one of the biggest reasons inflation has cooled.

2. Consumer Demand Has Shifted

Driver

Pandemic Era (2020–2022)

2025

Fiscal stimulus

Trillions in aid

No new stimulus since 2022

Demand focus

Goods-heavy (home, electronics, cars)

Shifted back to services (travel, food)

Retail inventory

Shortages and delays

Overstocked in some sectors

The huge demand surge in 2021–2022, fueled by government stimulus and low interest rates, led to overheated markets as noted by Brookings. People bought more goods than ever while services remained limited.

By 2025, that dynamic has flipped: there’s less money from stimulus, interest rates are higher, and consumers are spending more on experiences (like dining and travel) instead of goods. As a result, retailers have scaled back prices, and the pressure from consumer demand has eased.

3. Wages and Services Still Driving Prices

Indicator

2023–2024

2025

Wage growth (nominal)

4–5% per year

Steady at 4–5%

Real wage growth

1–2% after inflation

Modest gains in 2025

Services inflation

~3.5%

Remains elevated

Shelter inflation (CPI)

6–8% in 2022

Still high at ~4.0%

Although inflation overall has slowed, certain sectors—especially services—are still seeing higher prices. One reason is continued wage growth. Unemployment has been low (~3.5%), so businesses are raising pay to attract workers, especially in hospitality, healthcare, and other service jobs, according to Actalents.

Those higher labor costs are passed on to consumers. Additionally, housing prices and rents remain elevated, and even though new rent growth has slowed, it takes time for that to show up in inflation data.

4. Energy and Food Prices: From Pressure to Relief

Category

2022

2025

Oil price

$100+/barrel

$70–$80/barrel

Gasoline

Record highs (> $5/gallon)

Down ~10% YoY

Electricity/natural gas

Volatile, supply issues

Still rising, but slower

Food prices

Double-digit gains

Up ~3%, more stable

Energy and food prices were major inflation drivers in 2022. Oil spiked after the Ukraine war, and food supply disruptions caused sharp increases. In 2025, oil prices are lower and more stable, helping to keep gas prices down.

Electricity and utility gas bills are still rising in some areas due to lingering supply issues, but not nearly at previous rates. Food inflation has also cooled, though certain items (like eggs) remain volatile due to supply issues like avian flu. These components no longer fuel inflation like before, but could rise again if new shocks occur.

5. Federal Reserve Interest Rate Policy

Monetary Policy Impact

2022–2023

2024–2025

Fed interest rate

Raised from 0.25% to 5.25%

Holding ~4.25–4.5%

Mortgage rates

From ~3% to 6.5–7%

Still elevated

Lending conditions

Looser (2021)

Tighter credit access

Effect on inflation

Delayed impact

Actively cooling demand

To control inflation, the Federal Reserve raised interest rates rapidly in 2022–2023, taking borrowing costs to the highest levels in decades. This made mortgages, car loans, and credit cards more expensive, slowing down big purchases.

In 2025, these high rates are still in effect, which helps keep demand in check and inflation from rising again. While monetary policy takes time to work, its impact is now fully visible. The Fed is expected to hold rates steady or cut slightly, depending on future data.

Who Feels It Most? How Inflation Impacts Consumers, Businesses, and the U.S. Economy

Inflation doesn’t hit everyone the same way, and even now, with U.S. inflation easing to around 2.4% in 2025, its effects are still rippling through households, companies, and the broader economy.

While price spikes have slowed, the higher cost of living and the policy responses to fight inflation continue to shape daily life and long-term plans.

Group

2022 (High Inflation Peak)

2025 (Moderating Inflation)

Consumers

Real wages fell; prices outpaced income; shrinkflation; cutbacks

Real wages improving (+1.4% YoY); high price levels linger; cautious spending

Household Costs

Groceries, gas, and rent surged; credit card rates climbed

Food & shelter still rising; gas cheaper; APRs >20% remain a burden

Social Support

COLA raised for Social Security (8.7% in 2023)

Benefits keep pace, but higher baseline prices remain

Business Profits

Some firms boosted profits; others couldn’t offset rising costs

Pricing power fading; focus shifts to efficiency, managing wage growth

Financing Costs

Borrowing was cheaper pre-hikes; expansion was easier

High interest rates (~6.5–7%); borrowing is more expensive

Workforce

Labor shortages, rising wages

Labor still tight; wages stable at 4–5%, real growth 1–2%

Housing Market

Home prices surged, then cooled sharply

Home sales slower; mortgage rates still high (~6.8%)

Markets & Investment

Volatile; S&P 500 fell ~20% in 2022

Stabilized but cautious; capital is more expensive

Economic Growth

Strong nominal growth; real growth pressured by inflation

Slower but steady (~1.8% GDP forecast for 2025 – IMF)

Policy Response

Fed rate hikes + SPR oil releases

Fed holding rates high; trade tariffs add new inflation pressure

National Debt

Inflation eroded the debt’s real value

Higher interest payments now add fiscal stress

Consumers Are Still Feeling the Squeeze

During the inflation spike of 2022, prices rose faster than wages, eroding household buying power. Families—especially lower-income ones—were forced to cut back, trade down, and dip into savings. Many faced “shrinkflation”, where the package size shrank but the price didn’t.

By 2025, relief is showing: real wages are finally rising (+1.4% from March 2024 to March 2025, according to Actalent). Big-ticket items like cars have stopped climbing as fast, and used car prices have even dropped.

But many essentials like rent, groceries, and electricity remain more expensive than pre-2020 levels, even if they’re rising more slowly. For those on fixed incomes, the adjustment is still tough.

Credit card interest rates remain high (often over 20%), and families are cautious. Surveys show inflation is still one of Americans’ top concerns in 2025, because the price level, not just the rate of increase, is what most people feel every day.

Businesses Are Rebalancing After the Profit Peaks

For many companies, 2022–2023 brought a mix of fortune and frustration. Some managed to raise prices faster than their costs, boosting margins. But others, especially small businesses, struggled with raw material costs, labor shortages, and unpredictable supply chains.

By 2025, the picture is mixed. With inflation stabilizing, companies no longer need to constantly raise prices, but they now face higher borrowing costs. Interest on business loans has jumped since 2022, and capital-intensive sectors like construction or tech feel the squeeze.

Firms that adapted by cutting costs, becoming more efficient, or holding pricing power are doing better. Others, especially those in highly competitive markets, must now focus on value and affordability again, as customers become more price-sensitive.

Businesses are also still grappling with wage inflation. With unemployment low, talent remains expensive. Many companies have shifted to automation or restructuring to keep margins stable.

The Economy: Stabilized but Slower

Inflation changed the entire economic landscape. The Fed’s response—raising interest rates from near-zero to over 5% by 2023—cooled down housing, investments, and consumer lending. Mortgage rates more than doubled, and home sales dropped sharply by 2023. Related industries like furniture, appliances, and real estate also felt the chill.

On the flip side, inflation increased government revenues in nominal terms—higher prices mean higher tax collections. But it also made government borrowing more expensive: net interest costs on U.S. debt are climbing rapidly.

According to the IMF, U.S. GDP growth will slow from 2.1% in 2024 to 1.8% in 2025, in part due to high rates and new trade tariffs, which add to business costs and dampen demand.

Fortunately, despite worries about recession, the economy has avoided a major downturn so far. Employment remains strong, and inflation expectations are still anchored—most Americans believe prices will stabilize in the long run, helping prevent runaway wage-price spirals.

Policy Responses to Inflation: How the Fed and Government Reacted

Inflation targeting has become the predominant monetary policy strategy and has been remarkably successful in anchoring inflation, reflecting its reaction process, which allows it to flexibly incorporate a wide range of factors. https://t.co/wmTmVBLBtN #FEDSPaper #EconTwitter

— FedResearch (@FedResearch) April 1, 2025

The sharp rise in inflation after 2020 forced both the Federal Reserve and the U.S. government to act decisively.

Their strategies, monetary policy from the Fed, and fiscal and regulatory tools from Congress and the White House have shaped inflation’s path over the past few years.

While these efforts helped cool inflation by 2025, they also introduced new economic dynamics and trade-offs.

Let’s take a closer look at what each did, how effective those actions were, and where policy now stands.

1. The Federal Reserve’s Interest Rate Hikes: Leading the Inflation Fight

Timeline

Federal Funds Rate Target

Key Policy Move

Early 2022

0.00% – 0.25%

Pandemic-era ultra-low rates maintained

March–Dec 2022

Raised to 4.25% – 4.50%

Aggressive hikes begin: 0.25% → 0.75% steps

Mid-2023

Peaked at 5.25% – 5.50%

Highest rate since 2001

Late 2024 – Early 2025

Lowered to 4.25% – 4.50%

First cuts in years, as inflation eased

Outlook for 2025

Possibly 3.5% – 4.0% (Fed estimate)

Future cuts are expected only if inflation continues to fall

To curb inflation, the Fed embarked on one of the most aggressive interest rate campaigns in over four decades. Starting in March 2022, it raised its benchmark rate from near zero to over 5% by mid-2023.

These hikes were designed to cool consumer demand, reduce borrowing, and send a strong signal that the central bank was committed to restoring price stability.

The hikes worked, but not without side effects:

- Mortgage rates soared from ~3% in early 2021 to over 7% by the end of 2022.

- As of April 2025, mortgage rates are still elevated at 6.5–7% according to Morgan Stanley.

- Credit card and auto loan rates also spiked, making consumer debt more expensive.

- Businesses now face higher costs for borrowing and expansion, causing some to delay investment or hiring.

The Fed also engaged in quantitative tightening, reducing its large balance sheet by letting bonds mature without reinvestment. This further removed liquidity from the financial system.

By 2024, as inflation began to decline, the Fed paused hikes and made small cuts, bringing the rate down to 4.25–4.50% by early 2025. However, policymakers remain cautious, signaling that any future rate cuts will be modest and data-driven.

The Fed’s new approach is “high-for-longer”—keeping rates higher than in the 2010s to avoid re-igniting inflation.

The Fed’s rate hikes successfully cooled demand and helped tame inflation, but they also raised the cost of living, borrowing, and doing business. The central bank now faces the challenge of balancing inflation control with economic stability.

2. Government Fiscal and Policy Measures: A Supporting Role

While the Fed did the heavy lifting, the federal government also took action, mostly aimed at targeting specific inflation drivers or providing short-term relief.

a. Energy Price Relief via SPR Releases

Policy

Outcome

Strategic Petroleum Reserve release (180M barrels, 2022)

Gas prices fell 17–42 cents/gal

State-level gas tax suspensions

Temporary price relief at the pump

SPR refilling resumed in late 2024

Reflects stabilizing oil prices, shift in focus

To address the surge in fuel prices in 2022, the Biden administration authorized massive releases from the Strategic Petroleum Reserve (SPR)—the largest in U.S. history.

According to the Treasury Department, this move helped lower gas prices by 17–42 cents per gallon. The visible drop in gas prices helped reduce headline inflation quickly in late 2022.

b. The Inflation Reduction Act (IRA) of 2022

IRA Provisions

Impact on Inflation

Medicare drug price negotiation

Slower long-term growth in drug prices

Health insurance subsidies extended

Lowered household premiums

Clean energy and domestic production investments

Long-run supply-side improvement

The IRA was marketed as an inflation-fighting bill, but is better seen as a long-term economic productivity package. It provides significant funding for clean energy, healthcare cost controls, and tax reforms.

Nonpartisan analysts, like the Penn Wharton Budget Model and the CBO, concluded that its short-term impact on inflation would be minimal, though it may reduce price pressure over time by improving domestic supply capacity.

c. Targeted Household Relief

Measure

Details

2023 Social Security COLA

8.7% increase—largest in 40 years

State “inflation relief” checks

CA issued $9.5B in direct rebates to residents

Other proposals (e.g., federal gas tax holiday)

Discussed but not passed

Several temporary steps helped consumers cope with high prices. Notably, Social Security recipients got a large cost-of-living adjustment (COLA) to match prior inflation.

Some states issued one-time payments. Economists warned that widespread rebates could increase inflation by boosting demand, but the small scale of these programs helped avoid that.

d. Trade Policy: A New Source of Inflation in 2025

Event

Effect on Prices

2025 tariffs on imported goods

Higher input costs for businesses

IMF forecast revision

U.S. inflation outlook raised by ~1% due to tariffs

Retaliation from trading partners

Potential price hikes on exports and retaliation effects

In early 2025, the U.S. imposed new tariffs on a wide range of imports, marking a return to protectionist trade policy, according to JP Morgan. While politically driven, the move raised costs for importers and manufacturers, which can lead to higher consumer prices.

The IMF adjusted its U.S. inflation forecast upward by about 1 percentage point, citing the new tariffs as a key factor.

This illustrates how fiscal or trade actions, even if well-intentioned, can conflict with inflation control goals.

3. The Fiscal Outlook: Less Stimulus, More Restraint

🆕Global Macro Views 👓 @MarcelloEstevao & @EconChart assess the U.S. fiscal outlook, as #debt and deficits climb, reporting that the U.S. federal budget remains imbalanced, with #expenditures outpacing #revenues 📊

Read More: https://t.co/ozFKB6yy93 pic.twitter.com/NwkuM6jUwJ

— IIF (@IIF) March 13, 2025

From 2020 through 2021, trillions in pandemic stimulus flooded the economy. But by 2022, much of that support wound down, helping remove inflationary pressure.

Year

Fiscal Stance

Inflation Impact

2020–2021

Massive stimulus spending

Boosted demand, inflationary

2022

Stimulus faded; deficit shrank

Eased pressure on prices

2023–2024

Deficits widened again (lower taxes, high rates)

Mild upward pressure

2025

Focus on targeted supply-side investments

Long-term anti-inflation potential

As of 2025, fiscal policy is more restrained, ned—not focused on demand-side stimulus, but on investing in domestic capacity (e.g., infrastructure, semiconductors, EVs).

This could help alleviate future inflation risks by expanding supply and productivity.

4. Where Policy Stands Now in 2025

- The Fed has paused major rate hikes, but is not cutting aggressively. Rates remain historically high to ensure inflation stays down.

- The government is focused on productivity and supply-side investments, not direct price controls or stimulus.

- Trade policy has re-emerged as a wild card, with tariffs pushing prices up, even as energy prices stabilize.

- Both monetary and fiscal policymakers are now walking a tightrope: cool inflation without stalling the economy.

The Fed led the charge against inflation through rate hikes and tighter credit, while the government played a supporting role through energy policy, healthcare legislation, and limited relief programs.

Heading into the second half of 2025, economic policy is in a wait-and-see mode—ready to respond if inflation re-emerges, but cautious not to overcorrect and stall recovery.

Outlook: Is the Inflation Dragon Finally Tamed?

As of April 2025, it seems the U.S. has emerged from the worst of the inflation crisis. After two turbulent years marked by rapid price increases, the economy is now in a phase of disinflation, where prices are still rising, but at a much slower pace.

Thanks to the Federal Reserve’s aggressive interest rate hikes and the gradual unwinding of pandemic-related disruptions, inflation has cooled to around 2–3%, far below the 9% peak of 2022.

The Forecast: Gradual Decline, with Some Bumps Ahead

Most experts believe inflation will continue to ease, albeit slowly. The Federal Reserve projects that core PCE inflation—its preferred measure—will trend toward 2% through 2025 and 2026. Similarly, long-term surveys show consumers and businesses expect relatively low inflation going forward, which supports this outlook.

However, not all projections are identical. The International Monetary Fund (IMF) expects CPI inflation to average about 3.0% in 2025, slightly higher than 2% in 024, largely due to new tariffs. It forecasts that inflation could fall closer to 2.5% in 2026 as the economy continues to stabilize.

In short, the consensus view is “slow and steady” progress. A return to 2021–2022 levels seems unlikely, but inflation may not hit exactly 2% for some time.

What Could Disrupt the Path? Key Risks to Watch

1. Economic Growth and the Labor Market

If the economy remains strong, particularly with unemployment still near 4%, wages could rise more quickly, pushing prices up again. On the other hand, if a recession hits, inflation could fall faster than expected.

Some analysts place the odds of a 2025 recession between 30% and 40%. Whether we get a “soft landing” or a harder economic downturn will shape how inflation behaves in the months ahead.

2. Commodity Price Shocks

Energy and food remain wildcards. Oil prices could spike due to geopolitical tensions, OPEC production cuts, or supply chain issues.

Similarly, extreme weather or supply disruptions could push food prices higher. While current trends are stable, these markets are notoriously volatile, and one major event could send inflation back up.

3. Wage Dynamics and Inflation Expectations

So far, long-term inflation expectations have stayed well-anchored, which is a good sign. Most Americans believe the Fed will restore price stability. But if inflation hovers above 3% for too long, that confidence could erode.

Workers may start demanding larger raises, and businesses could preemptively raise prices—a feedback loop the Fed wants to avoid. That’s why central bank officials continue to stress their commitment to a 2% inflation goal.

4. Policy Decisions: Trade, Rates, and Spending

New tariffs introduced in 2025 are already adding modest upward pressure to inflation. If protectionist trade policies expand, they could lift prices further.

On the flip side, if the Fed sees enough progress on inflation, it might lower interest rates sooner than expected, stimulating demand. Policymakers face a delicate balancing act: avoid a recession, but don’t reignite inflation.

5. Global Factors

Global inflation trends also matter. Prices are falling across many advanced economies, which helps U.S. inflation through lower import costs. A key player is China—its weaker domestic demand has cooled global goods inflation.

Meanwhile, a strong U.S. dollar, supported by high interest rates, makes imports cheaper, adding downward pressure on prices. But if that dynamic reverses, inflation could pick up again.

The Worst Is Likely Over, But Not Forgotten

@bloombergbusiness The national rate of #inflation has dropped significantly since its post-pandemic peak, but perception of inflation in different parts of the country is not created equal. Chicago #Fed President Austan Goolsbee speaks to Bloomberg on “Wall Street Week.” #economy #money ♬ original sound – Bloomberg Business

Inflation in the U.S. is dramatically lower than it was at its peak, and current trends point in the right direction. For consumers and businesses, that brings much-needed relief after years of sharp price increases.

But policymakers remain vigilant. Inflation has a history of being sticky, and once it embeds itself, it can be tough to dislodge without real economic pain, as seen in the 1980s.

Thankfully, today’s situation is far less extreme. With wage growth starting to outpace inflation again, purchasing power is slowly improving. And while interest rates remain high, they may begin to ease later this year, assuming inflation continues to fall.

Going forward, the challenge is to lock in the gains without tipping the economy into recession. The Fed will have to act with care, and fiscal policymakers must prioritize investment and supply-side reforms over short-term stimulus.

References

- U.S. Bureau of Labor Statistics – Consumer Prices Up 2.4 Percent from March 2024 to March 2025

- U.S. Bureau of Labor Statistics – CPI News Release, March 2025

- U.S. Department of Labor – Consumer Price Index Summary – July 2022

- U.S. Inflation Calculator – Current U.S. Inflation Rates (2020–2025)

- Morningstar – Inflation Slows, Gas Prices Lead Decline in March U.S. CPI

- CNBC – Inflation Rate Eases to 2.4% in March, Lower Than Expected

- U.S. Treasury Department – Statement on SPR Releases and Gas Price Impact

- Federal Reserve – Monetary Policy Report – February 2025

- Brookings Institution – What Caused the U.S. Pandemic-Era Inflation?

- Actalent – U.S. Labor Market and Economy Report – March 2025

- IMF (International Monetary Fund) – The Global Economy Enters a New Era – April 2025

- The Mortgage Reports – 30-Year Mortgage Rates Chart (2025)

- Morgan Stanley – Will Mortgage Rates Go Down in 2025–2026?

- J.P. Morgan – U.S. Tariffs and Their Economic Impacts – 2025 Update

- CBS News – Why the Inflation Reduction Act May Not Lower Inflation

- Reuters – IMF Cuts Growth Forecasts After U.S. Tariffs – April 2025

Related Posts:

- Is an Online DNP Program a Good Investment? Breaking…

- SSA Targets 15 Million Field Office Visits in 2026,…

- What Is the Lowest Currency in The World 2025?…

- Why Over 25 Million Americans Are Still Uninsured…

- Distracted Driving in Colorado 2026 - Penalties,…

- US Health Insurance System Is Driving Americans to the Brink