As of 2025, the United States has between 813 and 867 billionaires, depending on the tracking source (inequality and CNBC), making it the country with the largest billionaire population in the world.

Together, they hold over $6.2 trillion in combined wealth.

This reflects how the U.S. economy continues to mint new fortunes rapidly, especially in tech and finance, while deepening wealth concentration in fewer hands.

Table of Contents

ToggleBillionaire Growth in the United States: 1990–2025

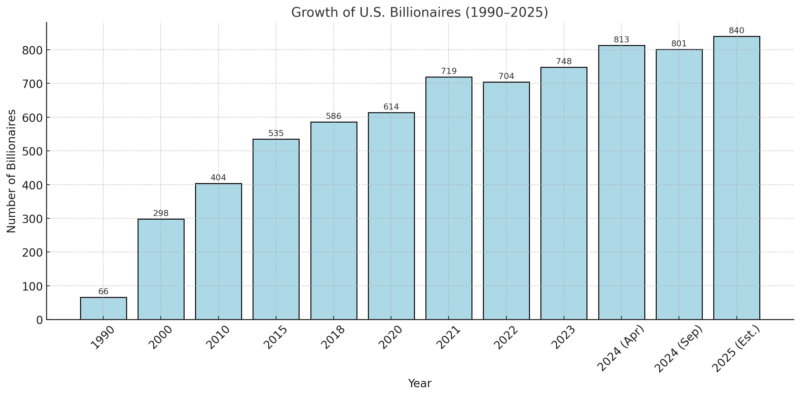

The data shows a staggering increase in the number of billionaires over the last three decades. In 1990, only 66 Americans qualified as billionaires, a figure that exploded to over 800 by 2024. This is not merely inflation or currency effects; it is the product of U.S. venture capital ecosystems, IPO surges, and tech sector domination.

Key drivers include:

This sustained billionaire growth also reflects how capital markets, stock-based compensation, and startup equity structures have funneled wealth into a small cohort, while middle-class wage growth stagnated by comparison.

Where Do Most U.S. Billionaires Live?

Rank

State

Approx. Number of Billionaires

1

California

~180

2

New York

~130

3

Texas

~80

4

Florida

~70

—

Alaska

0

—

Delaware

0

—

West Virginia

0

According to Madison Trust, the concentration of billionaires in California, New York, Texas, and Florida showcases the link between billionaire formation and economic clusters:

- California’s dominance comes from Silicon Valley’s startups, IPO pipelines, and a dense investor community that rewards equity holders. Major cities like San Francisco and Los Angeles serve as hubs for technology, media, and venture capital.

- New York retains its position as a financial capital, with billionaires in hedge funds, private equity, and media.

- Texas attracts oil, energy, and now tech billionaires, especially around Austin, leveraging its low-tax environment.

- Florida’s growth is driven by financial billionaires relocating for tax advantages, coupled with growing tech and crypto communities in Miami.

In contrast, states like Alaska, Delaware, and West Virginia have zero billionaires, indicating the critical role of venture capital ecosystems, major industry clusters, and urban financial networks in wealth creation. This data also underlines how billionaire wealth is geographically uneven, clustering where high-growth industries and tax incentives align.

Who Tops the Billionaire Rankings in America?

| Rank | Name | Company/Source | Net Worth (USD, early July 2025) |

| 1 | Elon Musk | Tesla, SpaceX, X, xAI | $388 billion |

| 2 | Larry Ellison | Oracle, tech investments | $262 billion |

| 3 | Mark Zuckerberg | Meta (Facebook, Instagram, VR) | $254.6 billion |

| 4 | Jeff Bezos | Amazon, Blue Origin, media | $233–241 billion (approx. $237 billion) |

| 5 | Steve Ballmer | Microsoft | $164 billion |

- Elon Musk ($388B) remains the richest person in the world, with his net worth driven primarily by his major stakes in Tesla and SpaceX

- Larry Ellison ($262B) surged past both Bezos and Zuckerberg due to a tech-stock rally tied to Oracle’s AI/cloud momentum.

- Mark Zuckerberg ($254.6B) maintains his position through continued dominance in social media and growing VR/AR ambitions via Meta

- Jeff Bezos ($233–241B) holds strong wealth thanks to his Amazon stake and diversified assets like Blue Origin and media holdings

- Steve Ballmer ($164B) remains in fifth place, owing much to his long-term Microsoft stock ownership and other private investments.

What Makes Someone a Billionaire?

A billionaire is defined by net worth exceeding $1 billion, calculated as total assets minus total liabilities. Assets typically include equity in companies, real estate holdings, art, and alternative investments.

The mechanics of billionaire wealth revolve around ownership stakes in appreciating assets. Most billionaires:

- Own large equity stakes in private or public companies.

- Use family offices to manage diverse asset classes.

- Leverage capital gains and market timing.

Importantly, net worth can fluctuate rapidly. For example, Musk’s wealth has varied by over $100 billion within a year, driven by Tesla’s share price. This volatility shows that billionaire status is not purely about cash but about asset valuation within market cycles.

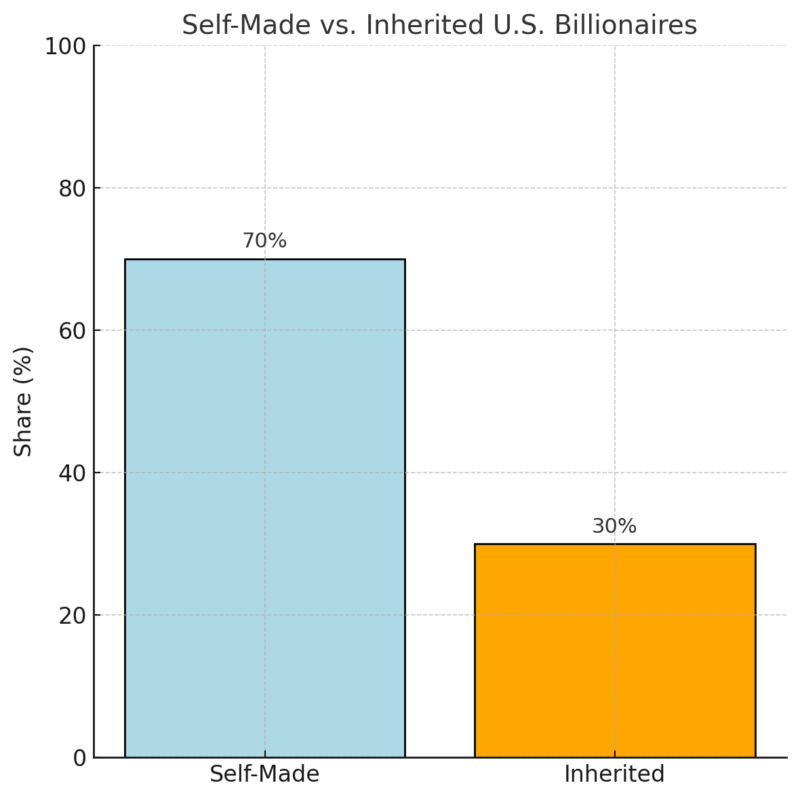

Self-Made vs. Inherited Billionaires

About 70% of American billionaires are self-made, emphasizing how the U.S. remains a fertile ground for entrepreneurial wealth creation. High-profile examples include:

- Tech founders (Musk, Zuckerberg, Gates).

- Media and entertainment figures (Oprah Winfrey).

- Finance and investment entrepreneurs (Ken Griffin).

The remaining 30% inherited their wealth, typically from:

- Retail dynasties (Walton family of Walmart).

- Industrial empires (Koch family).

- Asset-rich real estate families.

While self-made billionaires illustrate the American Dream narrative, inherited wealth showcases the persistence of intergenerational wealth and structural advantages in maintaining ultra-high-net-worth status. Both types coexist, shaping how wealth compounds within family structures and equity-based economies.

Billionaires by Gender and Age

Though men dominate the billionaire ranks, the number of female billionaires is rising, with over 300 women globally and a growing share in the U.S. Many are leaders in family businesses or founders in industries like fashion, cosmetics, and media.

Younger billionaires often emerge in:

- Tech startups.

- Crypto ventures.

- Creator economy platforms.

These shifts reflect how access to early-stage capital, networks, and high-growth sectors determines who enters the billionaire ranks, while structural barriers still influence gender and age distribution in ultra-wealth circles.

Wealth Inequality and Billionaire Wealth Growth

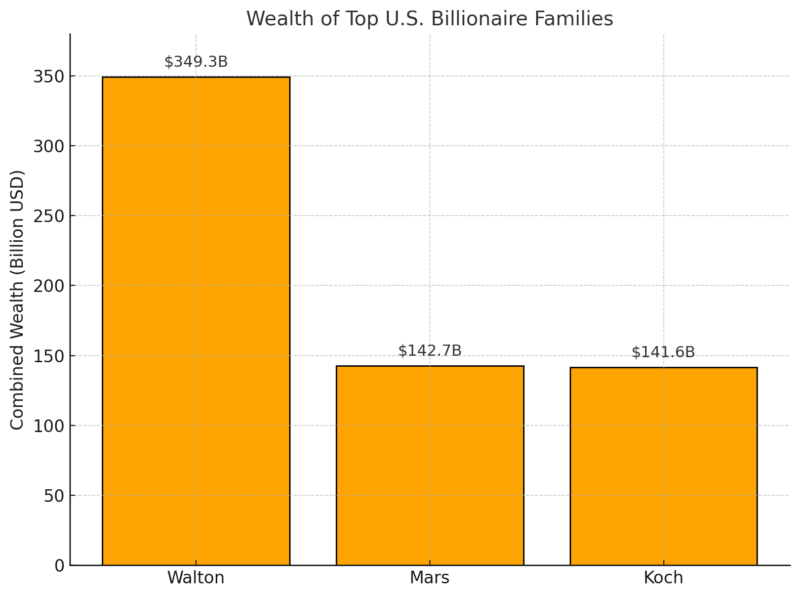

Family wealth data underscores the extraordinary concentration of wealth within a few families:

- The Walton family, heirs to Walmart, have a combined wealth surpassing the GDP of entire nations.

- The Mars family continues to expand its fortune through a mix of confectionery, pet care, and private investments.

- The Koch family maintains its wealth via Koch Industries’ diversified industrial operations.

These examples illustrate how intergenerational wealth management and control over private or family-owned conglomerates compound wealth over decades, reinforcing dynastic wealth structures in the U.S. economy.

Global Billionaire Context

Country

Approx. Number of Billionaires

USA

813–867

China

500+

India

190+

Germany

130+

Russia

110+

The U.S. holds about one-third of all global billionaires, emphasizing its dominance in tech, capital markets, and high-growth industries. China follows, but political and regulatory pressures have affected its billionaire landscape, while India’s surge reflects its tech and infrastructure boom.

The U.S. remains the most reliable environment for wealth creation and preservation, driven by:

- Advanced capital markets.

- A robust startup ecosystem.

- Intellectual property protections.

- Tax structures are favorable to capital gains.

This context is crucial for understanding how global wealth flows and billionaire creation are tied to each country’s economic, regulatory, and innovation environments.

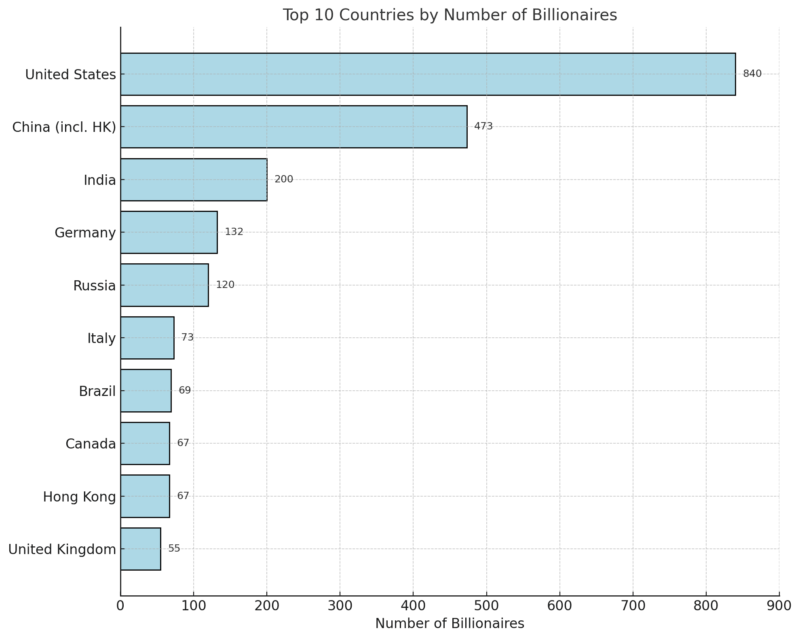

Top 10 Countries with the Highest Number of Billionaires

As of mid-2025, these 10 countries lead the world in billionaire count, illustrating how economic ecosystems, market access, and capital flows shape where wealth concentrates:

The United States remains the undisputed leader with 813 billionaires, reflecting its dominance in technology, finance, and venture capital markets. China (including Hong Kong) follows, with 473 billionaires despite increasing regulatory crackdowns and economic adjustments.

India’s 200 billionaires showcase its rapid growth in tech and infrastructure-driven wealth, while Germany and Russia remain top European and Eurasian hubs, respectively.

The presence of countries like Brazil and Canada illustrates how resource wealth, real estate, and local capital markets contribute to billionaire formation, while the UK’s position reflects its finance and property industries.

How Many Billionaires Are There in the World?

According to the latest global billionaire tracking:

- 2023: 2,640 billionaires globally, down by 28 from 2022.

- 2024: Billionaires’ total combined wealth was $12.4 trillion, slightly down from $12.7 trillion in 2022, reflecting market volatility and currency adjustments.

On a per capita basis, this equates to approximately 0.34 billionaires per million people globally, with the U.S. and China accounting for over half of all billionaires in the world.

Why Billionaire Numbers Fluctuate

Billionaire counts and their net worths fluctuate daily due to:

- Stock price movements (especially among tech and publicly traded companies)

- Currency fluctuations impacting wealth measured in USD

- Asset revaluations and divestments

- Tax, regulatory changes, and political instability

- Philanthropic giving (large-scale donations temporarily reducing net worth)

For example, Jeff Bezos’s net worth can rise or fall billions in a single trading day depending on Amazon’s share price, while Elon Musk has seen over $30 billion swings tied to Tesla’s volatility.

Is There a Trillionaire?

Currently, no individual is a trillionaire. However, speculation around who could be the first trillionaire often centers on:

- Elon Musk (due to his combined Tesla, SpaceX, and emerging AI ventures)

- Bernard Arnault (luxury market expansion)

- Jeff Bezos (continued Amazon growth, though less likely now given his lower relative net worth)

What About the Saudi Royal Family?

@viral.theoriess Joe Rogan – Saudi Arabia Royal Families Trillionaire Wealth #fyp #foryoupage❤️ #viralvideos #funnyt #fyp ♬ original sound – Viral Theories

While no individual member of the Saudi Royal Family is classified as a trillionaire, collectively, the House of Saud controls wealth estimated at over $1.4 trillion. This wealth is derived from:

- Vast oil reserves through Saudi Aramco

- Sovereign wealth funds like the Public Investment Fund (PIF) investing globally in tech, sports, and real estate

- Private holdings in domestic and international assets

Because their wealth is spread across thousands of family members and is not public in the same manner as Forbes billionaire lists, it is not attributed to a single “trillionaire” status, but it demonstrates how sovereign and royal family structures can exceed the net worth of any individual billionaire.

Conclusion

Tracking billionaire numbers is not just a curiosity. Billionaires wield enormous economic, cultural, and political influence, shaping philanthropy, investment trends, and public policy.

The U.S. is now home to nearly 800 billionaires https://t.co/4OkT7cPghi

— Oluyomi Ojo (@OluyomiOjo) July 2, 2020

The United States’ position as home to over 800 billionaires reflects its capacity for wealth generation but also underscores deepening wealth inequality. These billionaires benefit from an economic system that rewards capital ownership, entrepreneurship, and scalable technology, while systemic barriers continue to affect who can access these pathways.

As AI, clean energy, and digital transformations continue, the U.S. will likely produce even more billionaires. Whether this benefits society at large depends on how wealth is deployed toward innovation, public good, and economic mobility for all.

Related Posts:

- How Much Money Is There in the World In 2025?…

- How Many People Got Plastic Surgery in the United…

- How Many Children Are Adopted in the United States -…

- Number of Federal Employees of US in 2025 - How Many…

- How Many People Are Working in the Health Industry…

- How Many People Die Each Day in the US in 2025? And…