New York is preparing to pass the Fair Pricing Act, which could make history by establishing the state’s first cap on hospital outpatient costs. This law is expected to directly affect patients who currently face some of the highest out-of-pocket medical bills in the country.

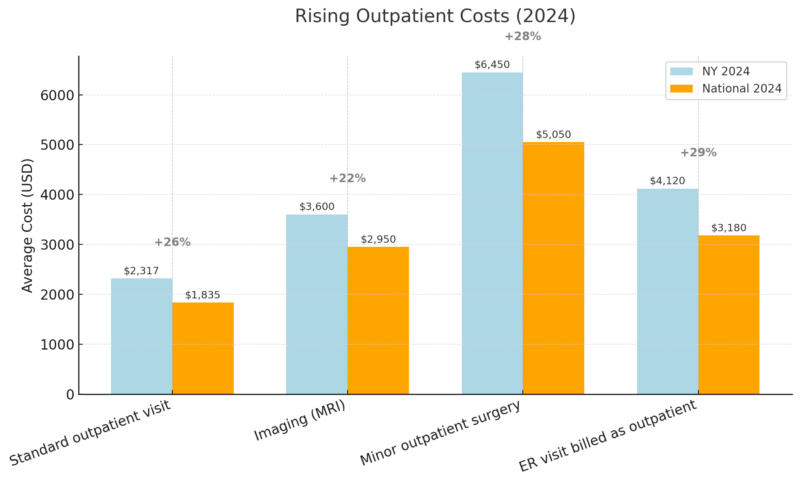

According to the New York State Department of Health, outpatient hospital charges have risen by more than 40% in the past decade, with average outpatient visits now costing over $2,300 before insurance. For uninsured patients or those with high-deductible plans, this often translates into overwhelming debt.

The Fair Pricing Act aims to limit how much hospitals can bill for outpatient care, especially for services that could otherwise be provided in less expensive settings such as clinics or urgent care centers.

If implemented, this cap could reduce the financial burden on millions of New Yorkers, particularly those with chronic illnesses or repeat hospital visits.

Rising Outpatient Costs: The Numbers Behind the Problem

To understand the significance of this legislation, it helps to look at the current financial reality for patients:

What the Fair Pricing Act Proposes

The Act introduces several key provisions:

Experts project this could save patients and insurers a combined $1.2 billion annually, based on current outpatient billing trends.

Impact on Households and Families

Medical debt continues to be one of the most common financial pressures for families across New York. A 2023 Urban Institute study reported that about 12% of residents have medical debt in collections, with an average balance of $1,890 per household.

For many, these balances do not come from major surgeries or long hospital stays but from repeated outpatient visits, bills that quickly add up when insurance companies deny claims or classify treatment as “non-emergency.”

The reality is that these costs often force people into impossible choices: delaying care, cutting back on basic household needs, or carrying balances on credit cards with high interest rates just to cover medical bills. The Fair Pricing Act would not erase medical debt overnight, but by putting a ceiling on outpatient charges, it could help families regain some control.

Parents could take a child to the hospital without the same fear of financial fallout, and older adults managing chronic conditions would have a better chance of keeping up with ongoing care. In short, the law could make routine and urgent care less destructive to household budgets, giving families room to focus on health rather than debt.

Connection to Accident-Related Medical Expenses

The Fair Pricing Act is designed to protect patients from routine hospital overcharges, but it will not apply in every situation. Medical bills that result from traffic accidents or personal injury cases fall under a different system.

In New York, those expenses are typically addressed through no-fault coverage or the liability insurance of the person found responsible for the accident. For example, someone injured in a crash in Queens would not see their bills capped under this law; instead, the costs would be pursued through the claims process.

These cases often involve questions about coverage limits, responsibility for ongoing treatment, or disputes between insurers. In such circumstances, working with a Queens car accident lawyer can be an important step to ensure that medical expenses are properly handled.

The Act may ease the pressure of everyday hospital bills, but accident-related costs remain tied to legal and insurance outcomes rather than the state’s new pricing rules.

Potential Pushback and Challenges

Hospitals, especially large health systems, are already voicing concerns that price caps could reduce their revenue. They argue this might limit their ability to fund staff salaries, advanced technology, or expansion projects.

The Greater New York Hospital Association (GNYHA) has warned that capping outpatient costs may push facilities to raise prices in other areas, such as inpatient care or elective surgeries.

Lawmakers counter this by pointing to other states, like Maryland, which already regulates hospital rates statewide, showing that hospitals can remain financially stable under capped systems.

Broader Economic Implications

If successful, the Fair Pricing Act could have ripple effects:

Conclusion

The Fair Pricing Act has the potential to transform the financial landscape of healthcare in New York by capping outpatient hospital charges, increasing billing transparency, and reducing medical debt.

With outpatient costs nearly 30% above the national average, this legislation is not just a financial adjustment; it’s a necessary step toward making healthcare accessible and sustainable.

However, patients must remember that the law will not affect all medical expenses equally. In cases like car accidents or personal injuries, liability and insurance will continue to dictate coverage, making legal representation a crucial factor.

If passed, the Act will provide relief for millions of patients, but it will not replace the need for accountability in accident-related claims.

Related Posts:

- US Software Jobs Are Set to Grow 15 Percent by 2034…

- WOPR Act 2025 - Illinois Blocks AI Therapy Tools…

- First Case of Type 1 Diabetes Reversal Achieved with…

- Breast Cancer Risk Starts with Your First Drink,…

- 3-Year-Old Boy Finds $4 Million Treasure Using His…

- State-by-State Breakdown - Average Cost of Hospital…