The U.S. dental implants market alone was valued at $1,399.93 million in 2023, and projections show it growing to $1,522.37 million in 2024 and reaching $3,696.53 million by 2032, at a compound annual growth rate (CAGR) of 11.4% according to Polaris Market Research.

This growth is fueled by increasing awareness of oral health, the reliability of dental implants, and the aesthetic and functional advantages they offer over traditional dentures.

Table of Contents

ToggleKey Takeaways

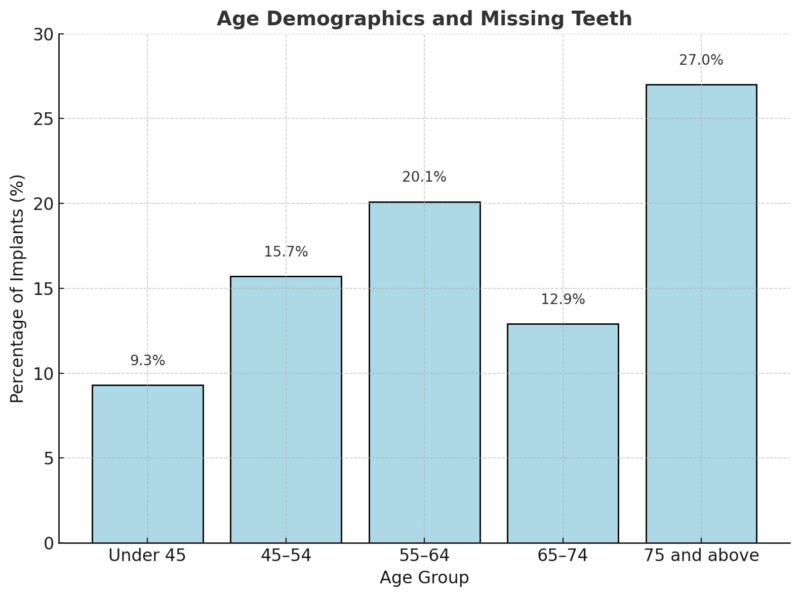

1. Age Demographics and Missing Teeth

The aging population is a primary driver of the dental implant market.

Statistics reveal that 12.9% of dental implants are for patients aged 65-74, emphasizing the critical role of these procedures in enhancing the quality of life for seniors.

This age group often seeks solutions for tooth loss caused by periodontal diseases, trauma, or decay.

Furthermore, the prevalence of missing teeth is staggering. Over 150 million Americans are estimated to have missing teeth, reflecting a vast unmet need for restorative dental care.

For many, dental implants are not just about aesthetics but also functionality, enabling them to chew and speak with confidence.

2. Dominance of Titanium

Material

Percentage Usage in the U.S.

Key Features

Titanium

93%

High biocompatibility, strong durability

Zirconia

5%

Metal-free, aesthetic, suitable for allergies

Other Materials

2%

Limited use due to lesser reliability

Titanium remains the material of choice for 93% of all U.S. dental implants, owing to its biocompatibility, durability, and osseointegration properties as noted by NCBI.

Innovations in titanium alloys further enhance its appeal, offering improved strength and reduced risk of rejection.

For patients, understanding the benefits of titanium implants is essential, as these are often seen as a lifetime solution to missing teeth.

Titanium and its alloys are indispensable in dental implantology, particularly for older patients.

With approximately 27% of individuals aged 75 and above being edentulous, titanium’s ability to integrate seamlessly with bone makes it a preferred choice.

Additionally, titanium implants are increasingly used in patients with dental injuries from accidents or sports.

Their strength and aesthetic appeal make them superior to traditional dentures, which often require frequent adjustments and lack the stability of implants.

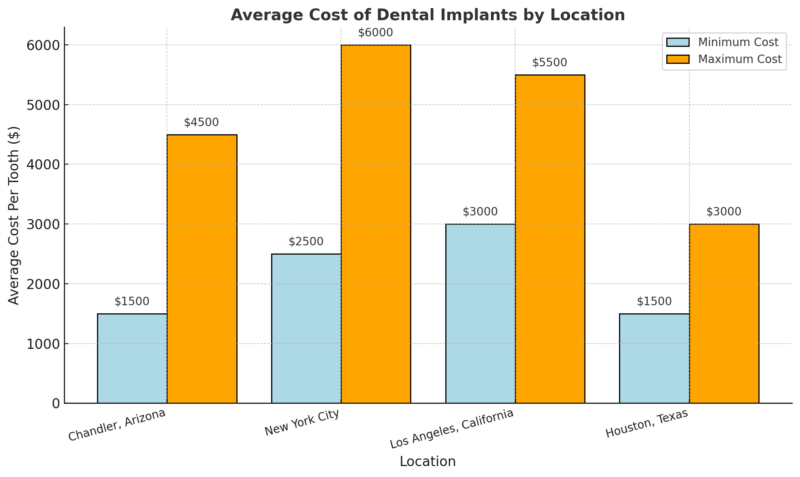

3. Costs and Procedure Expectations

The average cost of dental implants varies widely, but in Chandler, Arizona, for instance, the range is $1,500 to $4,500 per tooth according to Dental Depot Arizona.

These costs reflect not only the materials used but also the complexity of the procedure.

High-end crowns, such as those covered under the D2740 code, involve porcelain or ceramic materials that closely mimic the appearance of natural teeth.

But according to protetica.com prices in Eastern Europe for total prostheses are significantly less somewhere around 350$.

For many, dental implants are not just about aesthetics but also functionality, enabling them to chew and speak with confidence. You can visit this website to learn more about their benefits.

Patients are also increasingly opting for expedited procedures like “teeth in a day.”

While the term may imply completion within 24 hours, it actually refers to cumulative work done over a short period, streamlining the overall restoration process.

Additionally, for those requiring orthodontic solutions, the cost of retainers typically ranges between $150 and $500, depending on the material and customization involved.

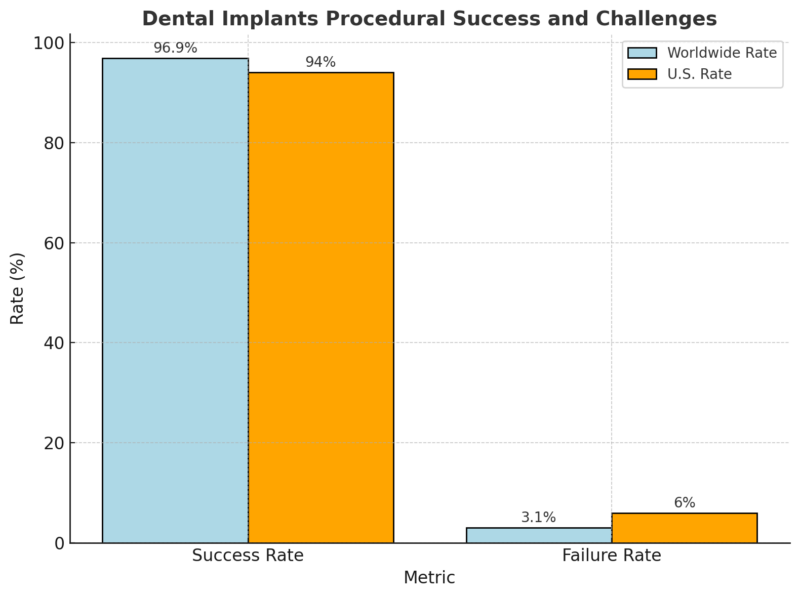

4. Procedural Success and Challenges

Dental implants have a high success rate, with a global failure dental implant rate of just 3.1%, although this rises slightly to 6% in the U.S. according to Research Gate.

The key to minimizing failures lies in advanced training, precision in implant placement, and careful patient assessment to rule out contraindications such as insufficient bone density or systemic health issues.

The success of procedures like All-On-4 implants, which boast a 98.8% prosthetic survival rate, highlights the reliability of modern techniques.

These procedures allow dentists to replace an entire arch of teeth with just four strategically placed implants, reducing costs and recovery time for patients.

5. Market Opportunities and Technological Advances

Year

Market Size (in USD)

Growth Rate

2023

1,399.93 million

–

2024 (projected)

1,522.37 million

8.7%

2032 (projected)

3,696.53 million

11.4% CAGR (2024–2032)

The U.S. market is projected to see approximately 3 million Americans with dental implants by the end of 2024. This growth is supported by a burgeoning global dental implant market, valued at $8 billion in 2024-2025.

US Dental Implants Market Poised to Reach US$ 3,696.53 Million by 2032, Expanding at a 11.4% CAGR from 2024 to 2032 https://t.co/pkgHye7AKn via @ein_news

— Polaris Market Research & Consulting (@polaris_mrc) November 11, 2024

Innovations such as 3D imaging, computer-guided surgery, and advanced materials like zirconia are transforming the industry, making procedures more predictable and efficient.

6. Service Diversification

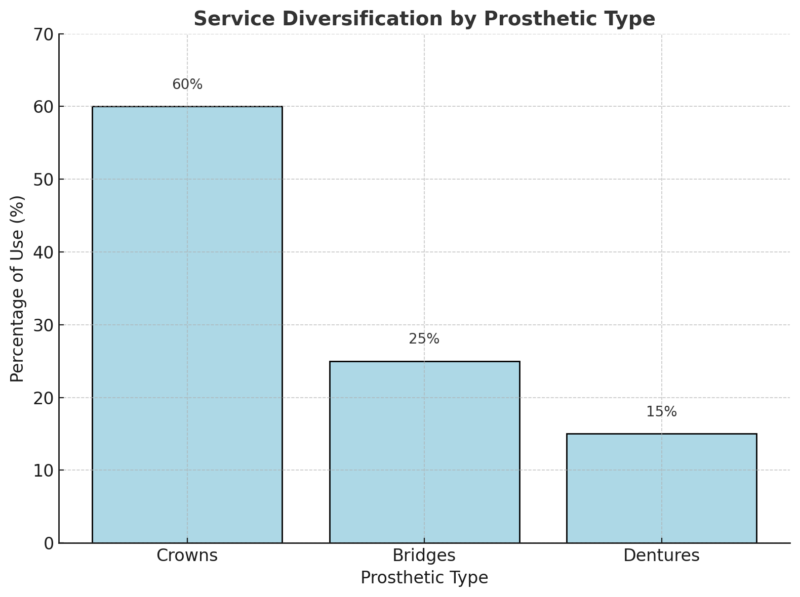

Crowns dominate prosthetic use at 60%, reflecting their versatility in restoring single teeth with a natural appearance and full functionality. Bridges, accounting for 25%, are preferred for replacing multiple adjacent missing teeth efficiently.

Dentures, at 15%, cater to patients needing full-arch replacements, offering stability and improved aesthetics when supported by implants. This distribution highlights the diverse needs of patients and the adaptability of implants in meeting varying restoration requirements.

Dental practices must adapt to meet the growing demand for implants. Offering a range of services—from single-tooth implants to full-arch restorations—can cater to diverse patient needs.

The increasing popularity of porcelain and ceramic crowns, coded under D2740, underscores the importance of providing high-end options that combine durability with aesthetics.

Transparency in cost discussions is critical, given the substantial investment required for implants. Practices should guide patients through insurance options and financing plans to make these procedures more accessible. With limited insurance reimbursements for implants, practices that offer flexible payment solutions may gain a competitive edge.

7. Increasing Demand for Prosthetics

Barrier

Description

Impact

High Costs

Limited insurance coverage and high out-of-pocket costs

Reduces accessibility

Complications

Risks such as implant failure and infections

This leads to patient hesitation

Awareness Gaps

Limited knowledge about options among patients

Delays adoption

Prosthetics such as crowns and bridges are major drivers of the implant market.

According to the American Academy of Implant Dentistry, over 15 million Americans receive bridges and crowns annually.

The limitations of removable dentures, including discomfort and a lack of natural appearance, are pushing patients and surgeons toward implant-supported prosthetics.

8. Market Growth Projections

Company Name

Specializations

Notable Innovations

DENTSPLY Sirona

General dental solutions

SureSmile Simulator (AI-driven aligner tool)

Straumann Group

Dental implants and prosthetics

Advanced zirconia implant systems

3M

Adhesive and restorative solutions

Filtek Matrix for composite restorations

Ivoclar Vivadent AG

Restorative and digital dentistry

VivaScan intraoral scanner

OSSTEM Implant Co.

Advanced implant systems

KS Implant System for durability and planning

The U.S. dental implants market is poised for significant growth, with the endosteal implant segment accounting for 88% of the market revenue in 2023.

This dominance is attributed to their high success rates and adaptability for most patients. Advancements in implant design and minimally invasive techniques are further driving this segment.

Major players in the market include DENTSPLY Sirona, Straumann Group, and 3M, among others.

Recent innovations, such as AI-driven simulation tools and compact intraoral scanners, are enhancing patient experiences and improving treatment outcomes.

For example, Ivoclar’s VivaScan, launched in 2022, streamlines the digital impression-taking process, offering greater accuracy and comfort.

Methodology

This article was crafted by synthesizing data from authoritative market research reports, industry statistics, and expert sources. Market growth projections were drawn from reliable economic analyses and CAGR trends.

Key demographic insights were integrated from implant usage statistics segmented by age and material preferences. Cost data was gathered from region-specific case studies and expert estimates.

Technological trends and success rates were derived from clinical studies and innovations by leading dental companies. Lastly, the structure combines in-depth analysis with accessible tables for clarity and reader engagement.

References

- Polaris Market Research – U.S. Dental Implants Market Analysis

- Precedence Research – Global Dental Implants Market

- Dental Depot Arizona. – How Much Do Dental Implants Cost

- National Library Of Medicine – Titanium Dental Implants

- Research Gate – Implant Failure Rate

Related Posts:

- Omaha Population 2025 - Stats You Should Know

- 12 Stats About Chicago’s Population in 2025 You Should Know

- Adult Inactivity Outside of Work - 10 Stats You Should Know

- How Much Do Retainers Cost? Price Ranges You Should Know

- Dental Care in the US: What the Numbers Reveal About…

- US States with the Highest and Lowest Dental Care…