Elon Musk owns six companies in 2025: Tesla, SpaceX, X, Neuralink, The Boring Company, and xAI, collectively valued at over $1.6 trillion.

These companies touch nearly every frontier of modern tech, from electric vehicles to space travel, artificial intelligence, and brain–machine interfaces — highlighting Musk’s outsized role in shaping emerging industries

Backed by over $19 billion in federal contracts and billions in private capital, Musk’s ventures have helped him reclaim the title of the world’s richest man, with a net worth exceeding or around $717 billion as of late-2025.

From ramping Tesla’s robotaxi fleet to Starship launches for Mars, and from tunneling under cities to building “truth-seeking AI,” Musk’s portfolio shows the aggressive scaling and relentless reinvestment that made him the defining figure of modern tech entrepreneurship.

Everything Elon Musk Owns

Company

Purpose

Musk’s Title

Founded/Acquired

Estimated Value (2025)

Tesla

Electric vehicles, solar, and battery storage

CEO

2004 (invested)

~$1.1 trillion (mid‑July 2025) according to Bloomberg.com

SpaceX

Space transportation, satellite internet

CEO, CTO, Chairman

2002

~$400 billion (July 2025)

X (formerly Twitter)

Social media

CTO, Chairman

2022

~$45 billion combined under xAI

Neuralink

Brain–computer interfaces

Founder

2016

~$9 billion (May 2025 fundraising)

The Boring Company

Underground tunnel infrastructure

Founder

2016

~$5.7 billion (2022); likely similar now

xAI

Artificial intelligence research

Founder

2023

~$80 billion standalone; ~$45 b combined with X

Tesla

Elon Musk invested $6.5 million in Tesla in February 2004, becoming the largest shareholder and later the CEO. Tesla launched its first car, the Roadster, in 2008, but it was the Model S (2012) and Model 3 (2017) that turned Tesla into the global EV leader.

Tesla remains Musk’s most valuable company, with a 2025 market cap around $1.5 trillion. In 2024, Tesla generated approximately $100 billion in revenue, delivering just under 2 million vehicles globally, including the Model 3, Model Y, and the long-awaited Cybertruck making him one of the richest man in USA and World.

Their valuation in 2025 puts it ahead of Toyota, Ford, and GM combined, underscoring investor confidence in its lead on software-driven EVs.

Tesla has built Gigafactories in Nevada, Texas, Shanghai, Berlin, and Mexico, enabling aggressive scaling. In 2025, Tesla is ramping up its Optimus humanoid robots for factory automation and is in advanced testing of its robotaxi fleet, aiming to disrupt ride-sharing markets by 2026.

- Valuation: ~$1.5 trillion

- Annual Revenue (2024): ~$138 billion

- Net Income (2024): ~$14 billion

- Vehicles Delivered (2024): ~2.2 million

Musk once recalled sleeping on the factory floor during the Model 3 production crunch, saying, “I wanted my team to see that I was in it with them.” That gritty leadership style, often polarizing, helped pull Tesla through what he called “production hell.”

SpaceX

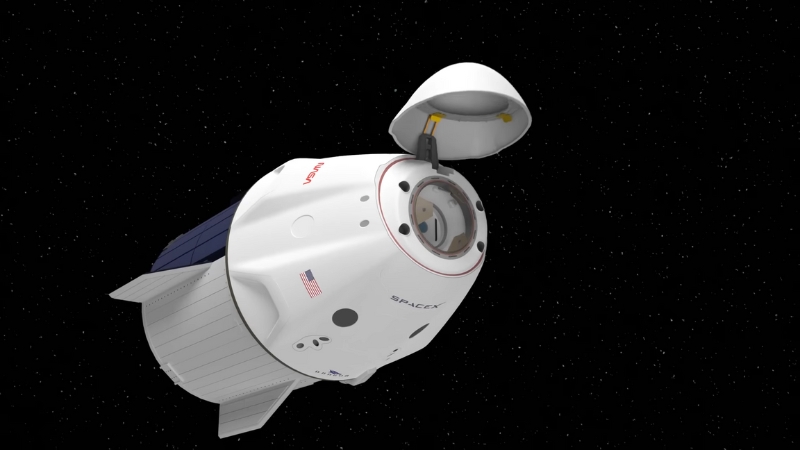

Founded in 2002 with $100 million from Musk’s PayPal exit, SpaceX has redefined the space industry, making reusable rockets standard.

SpaceX’s Falcon 9 rocket has launched over 400 successful missions, while Starship, its next-generation heavy-lift vehicle, is now flying orbital cargo and refueling missions as of early 2025. The Starlink satellite internet network, with over 6,000 operational satellites, serves over 3 million global users, generating ~$5 billion annually in subscription revenue.

The company is valued at ~$400 billion (July 2025), the highest among private aerospace firms, driven by contracts with NASA, the Department of Defense, and commercial satellite clients. SpaceX has secured over $10 billion in NASA and DoD contracts for lunar landing missions, space station resupply, and national security launches.

In 2024, SpaceX launched 131 missions — more than every other country’s space agency combined, cementing its role as the world’s dominant orbital launch provider.

Musk’s Mars vision remains core to SpaceX, with Starship missions to Mars targeted for cargo delivery by the early 2030s.

- Valuation: ~$1.5 trillion

In April 2023, Starship soared into the sky, only to explode minutes later, yet Musk called it a success, tweeting, “Learned a lot for next time.” By late 2025, during flight #11, spectators watched in awe as the giant booster attempted to land with chopstick-like arms, a moment that felt pulled from science fiction.

X (formerly Twitter)

Elon Musk acquired Twitter in October 2022 for $44 billion and rebranded it as “X” to create an “everything app” similar to WeChat in China.

In early 2025, Musk folded X into his AI company, xAI, in a deal that valued X at around $45 billion. While that figure reflects internal strategy rather than a public market valuation, it signals Musk’s belief that social media and AI are now inseparable

After the Twitter rebrand to X in 2023, the platform faced a rocky transition, from mass layoffs and advertiser exits to a push for subscriptions and new features. Yet under Musk’s hands-on leadership, X is actively repositioning itself as an AI-powered utility platform.

- Payments (X Payments) launched in late 2024, allowing peer-to-peer transactions.

- Integration with XAI’s Grok chatbot for conversational AI and customer support within X.

- Subscription-based revenue streams like X Premium reduce dependence on advertising.

Daily active users have climbed back to ~300 million as X incorporates livestreaming, AI-powered search, and microblogging, anchoring its push to become a primary digital utility.

- Valuation: ~$45 billion (with xAI)

- Daily Active Users: ~300 million

- X Payments Users: ~25 million

- Employees: ~2,000 (post-restructuring)

“Twitter was too constrained,” Musk said in mid-2023. “We need an everything app, and that’s X.” While some scoffed at the rebrand, Musk doubled down, embedding livestreams, AI chat, and payments, all while moderating posts with a community fact-check tool. Love it or hate it, X reflects its owner’s fingerprints.

Neuralink

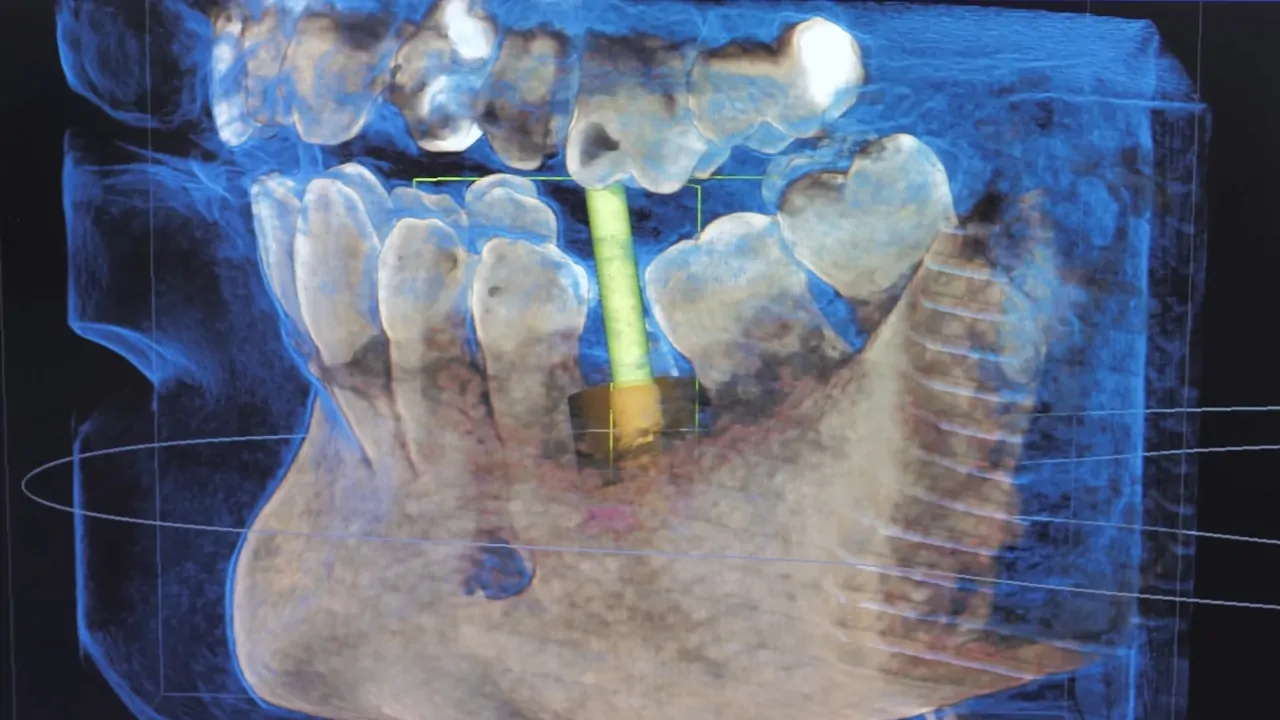

Founded in 2016, Neuralink aims to develop implantable brain-computer interfaces (BCIs) to help individuals with paralysis and neurological disorders regain functionality and to explore future human-AI symbiosis.

In 2025, Neuralink raised $600 million at a $9 billion valuation after completing its first successful human trial, where a patient used the N1 chip to move a computer cursor with thought alone.

Applications in the pipeline include:

- Restoring vision in cases of retinal damage.

- Treating depression through targeted neuromodulation.

- Enhancing human memory storage and retrieval capabilities.

Neuralink is operating with an FDA Breakthrough Device Designation, fast-tracking approvals for specific clinical applications.

- Valuation: ~$9 billion

- Employees: ~450

- Active Human Trials: ~25 patients

Musk has said, “The first person to receive the Neuralink implant was able to move a mouse cursor with their mind, and later posted on social media using only thought.” It’s the kind of moment that sounds like sci-fi but actually happened in early 2024, signaling a shift in what’s medically possible.

The Boring Company

The @boringcompany could do it for 1000X less money https://t.co/IXJY63xUCo

— Elon Musk (@elonmusk) December 10, 2024

Launched in 2016, The Boring Company (TBC) tackles traffic congestion with underground tunnel networks for high-speed transport.

Key projects include:

- Las Vegas Convention Center Loop, expanded to 29 miles with 60+ stations in 2025, moving over 15,000 passengers daily.

- Feasibility studies and tunneling projects in Austin, Miami, and Fort Lauderdale.

- Development of Prufrock, its next-gen tunnel boring machine capable of digging 1 mile per week.

Valued at ~$5.7 billion, TBC remains a lean but innovative company, using proprietary tunneling technologies to cut costs below traditional methods, enabling scalable urban transit solutions.

- Valuation: ~$5.7 billion

- Miles Tunneled: ~35 miles across projects

- Employees: ~250

Musk once quipped, “We can tunnel 1,000 times cheaper than traditional methods.” That bold claim was part joke, part mission, and The Boring Company reflects it, from its flamethrower merch drops to building tunnels beneath Vegas casinos.

xAI

@chronicrealityofficial X.AI Is The Beginning Of Elon Musk’s Monopoly #xai ♬ original sound – Chronic Reality

Founded in July 2023, xAI emerged as Musk’s counter to OpenAI, aiming to build “truth-seeking” AI that aligns with Musk’s philosophies of safe, open, and transparent artificial intelligence.

xAI launched Grok, an AI chatbot accessible within X, achieving ~80 million active users by mid-2025. The company has developed large language models (LLMs) optimized for lower latency on local devices and is working on AI research for scientific discovery and robotics.

xAI’s valuation, now estimated at ~$80 billion standalone, reflects its rapid growth in user adoption and licensing agreements with enterprise partners.

- Valuation: $80 billion standalone ($45 billion combined with X)

- Grok Users: ~80 million

- Employees: ~900

Conclusion

Musk’s plate is undeniably full. Whether it’s launching humans to Mars, embedding chips in the brain, or building an AI chatbot with attitude, he continues to test the boundaries of innovation.

Will his empire expand even further in 2026? If history is any guide, the answer is yes