By the time we hit 2030, medical billing won’t look much like what we know today. If you’ve already felt the pinch from rising premiums, surprise charges, or just the sheer confusion of your last doctor’s invoice — well, brace yourself. The next five years are shaping up to be a real turning point.

Why? Because the numbers don’t lie. In the U.S., healthcare spending is set to top $16 trillion by 2030, which would swallow up a jaw-dropping 32% of GDP. That’s nearly a third of the entire economy, just to keep the system running.

So what’s coming for medical billing? Let’s unpack what patients, providers, insurers, and everyone in between will likely be grappling with by the end of the decade.

Table of Contents

ToggleThe Main Drivers Behind the Shift

Let’s kick things off with why the system is shifting in the first place.

1. The Aging Population Is About to Tip the Scales

You can’t talk about future health costs without pointing to demographics. In the U.S., over 67 million people will be 65 or older by 2030.

In Canada? Around one in four. And older adults tend to need more care — more appointments, more prescriptions, more follow-ups, and longer hospital stays.

That means more billing, more paperwork, and a growing gap between what people need and what systems can afford.

2. Technology Isn’t Cheap, But It’s Non-Negotiable

From AI diagnostics to robotic surgery to remote patient monitoring, tech is revolutionizing medicine. But it’s also sending operating costs through the roof.

Every piece of smart equipment brings with it a new layer of billing codes, regulatory red tape, and vendor-specific contracts.

And don’t forget the software: electronic medical records (EMRs), billing platforms, patient portals — all of them need constant updates and cybersecurity protection.

3. Governments Are Stretched Thin

Back in 1990, Medicaid and Medicare (or their equivalents in Canada, like provincial health plans) made up a modest chunk of national spending. Now they’re expected to carry more than half the load.

In both countries, health budgets are climbing faster than GDP. For provincial governments in Canada, that means health care already eats up 40–50% of their total spending.

By 2030, unless something changes, governments will be forced to make hard calls: cut services, raise taxes, or pass more costs to patients. None of those options is exactly a crowd-pleaser.

So, What Will Medical Billing Look Like by 2030?

It’s not all doom and gloom, but the days of simple invoices and predictable coverage are on the way out. Here’s what the future might hold.

1. Real-Time, Dynamic Pricing

Imagine walking into a clinic and seeing a digital board showing today’s cost for a consultation, much like a menu at a fast-food joint. Sounds weird? Not for long.

As data systems become more sophisticated, pricing will become dynamic, changing based on availability, time of day, demand, or even your insurance status. Providers may adopt surge pricing models, like airlines or ride-hailing apps.

That’s partly to deal with capacity, but also to better reflect actual costs, something the current “flat-rate” system doesn’t do well.

What does it mean for you:

- Expect to see fluctuating charges based on real-time conditions.

- Insurance plans may start tiering coverage accordingly (e.g., “off-peak” discounts).

- Transparency will improve, but budgeting for care could get more unpredictable.

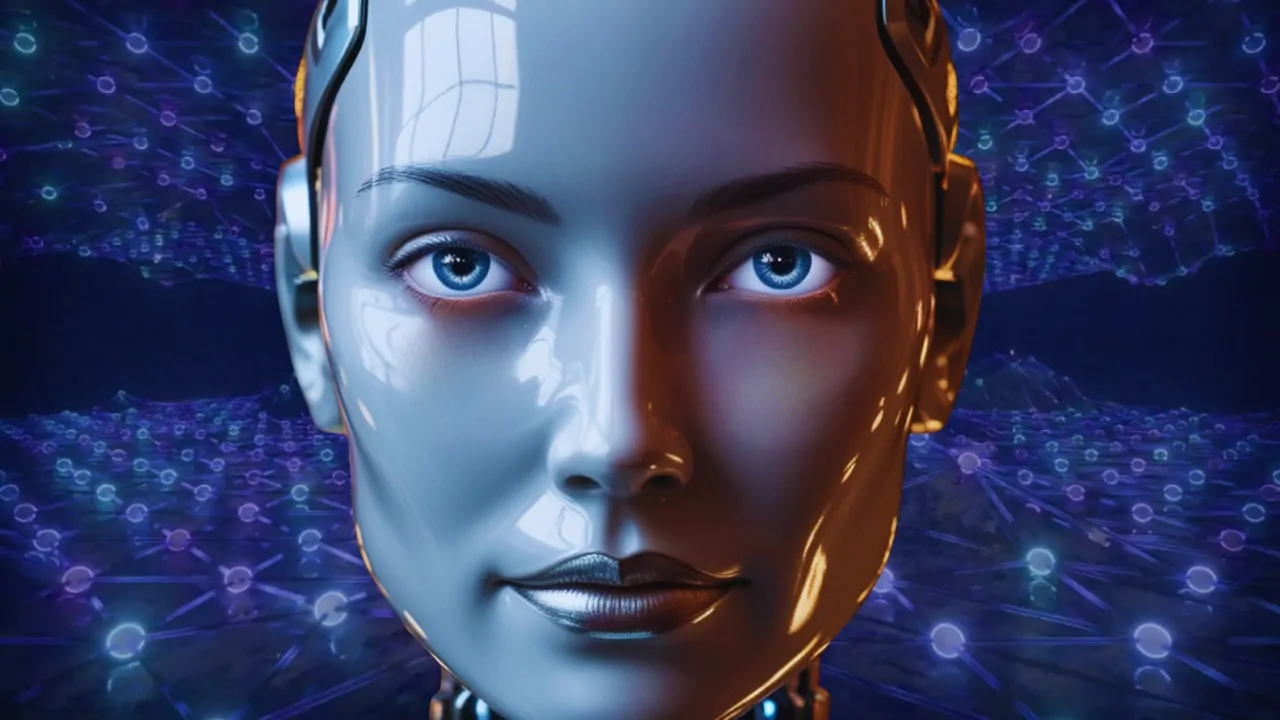

2. Automated Billing With AI Audits

Billing is about to get smarter and stricter. Expect hospitals and clinics to rely more heavily on AI to generate, cross-check, and send bills automatically.

That means:

- Fewer human billing errors.

- Faster claims processing.

- More pre-authorizations and denials based on algorithmic risk models.

On the flip side, those same AI tools will flag potential fraud, upcoding, or overbilling faster than ever. Providers who try to game the system could find themselves under audit in minutes.

Tip for clinics and patients alike: Keep clean records, review every charge, and ask for itemized bills — AI might be fast, but it’s not perfect.

3. Blockchain-Based Health Payments

Yes, blockchain. The same tech that powers cryptocurrency could be running your future hospital invoice.

By 2030, blockchain systems might become standard for:

- Verifying patient eligibility.

- Processing payments securely across multiple providers.

- Storing billing data in tamper-proof ledgers.

It’s not about Bitcoin, though. It’s about transparency, accountability, and real-time sharing of billing info across systems that don’t currently talk to each other.

For example, if you visit a walk-in clinic, a specialist, and a lab, all in one week, blockchain could tie those records together instantly and avoid double billing or gaps in coverage.

4. More “Consumerized” Healthcare Models

People are used to shopping around for phones and flights, and they’ll start doing the same for health care.

By 2030, expect:

- Online comparison tools for procedures.

- Subscription-based care for routine needs (think: $60/month for unlimited virtual visits).

- Expanded private-pay options, especially in Canada, where cracks in the public system are growing.

For the middle class, hybrid models will emerge: part covered by public plans, part covered by employer benefits, and part paid out-of-pocket.

The Big Picture: Health Spending Is Growing Like Crazy

We’re not just inching forward here. We’re on a bullet train toward higher costs. In 1990, national health spending in the U.S. sat at $666.2 billion. By 2030? Try $16 trillion. That’s nearly a 2,300% increase in just 40 years.

Take a look at how spending stacks up over time:

National Health Expenditures: 1980–2030

Year

Total Spending (Billion USD)

Private Spending

Public Spending

Per Capita (USD)

Health Spending as % of GDP

1980

$250.1

$145.0

$105.2

$1,064

9.2%

1990

$666.2

$383.6

$282.6

$2,566

12.1%

2000

$1,739.8

$859.9

$879.9

$6,148

18.1%

2010

$3,787.8

$1,819.2

$1,968.6

$12,522

22.0%

2020

$7,839.4

$3,776.1

$4,063.2

$24,478

26.5%

2030

$15,969.6

$7,753.0

$8,216.7

$47,891

32.0%

What jumps out:

- Health spending is growing faster than GDP, much faster. By 2030, it’ll eat up nearly a third of the U.S. economy.

- Per person, the annual spend will hit close to $48,000. That’s more than the median income in many provinces and states.

- Public programs (like Medicare and Medicaid in the U.S., or provincial health systems in Canada) are increasingly footing the bill, but that can’t go on forever.

Aging Population = Expensive Outcomes

As more people enter their 70s and 80s, the system’s financial weight grows heavier. People over 65 typically spend 4x as much on health care as those under 65.

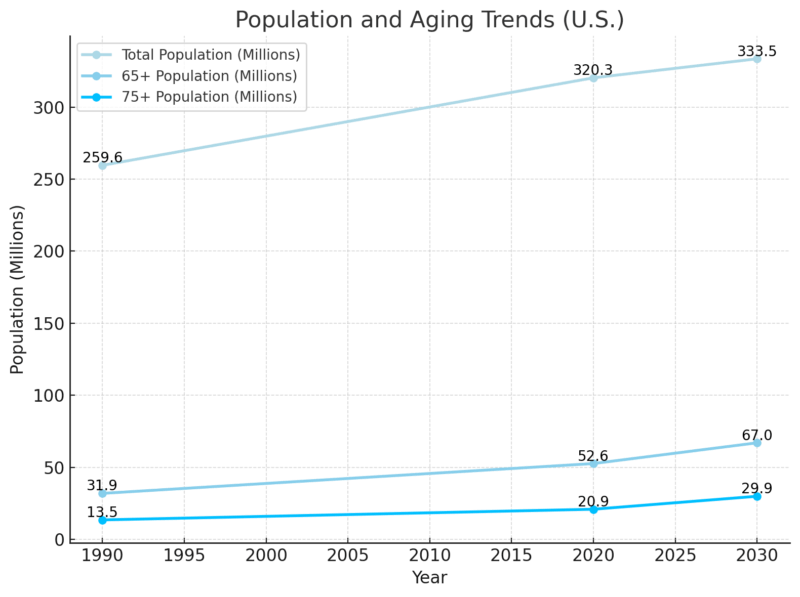

Let’s connect that with population data:

Population and Aging Trends (U.S)

By 2030, nearly 1 in 5 people in the U.S. will be 75 or older. Canada’s not far off: we’re heading for a quarter of the population over 65.

Aging leads to:

And guess what? All of that has to be billed.

What’s Driving Up the Costs?

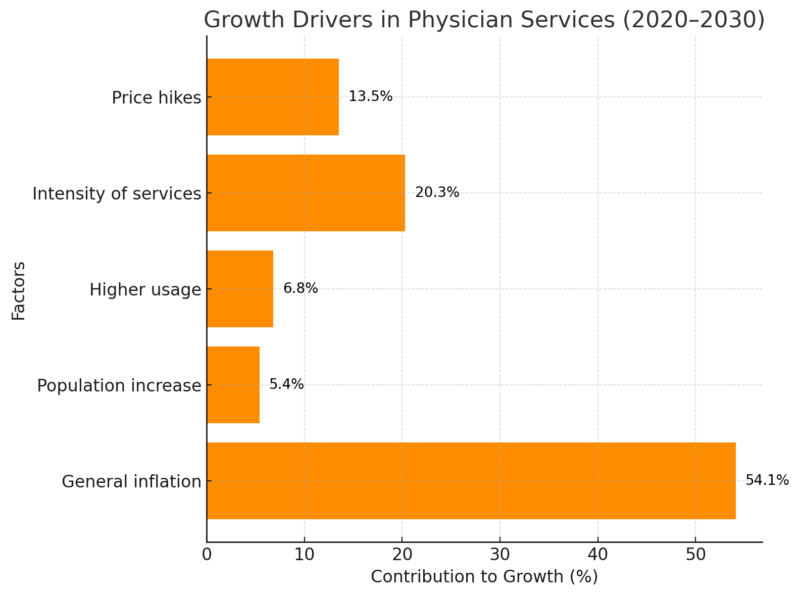

We’ve got detailed data breaking down why spending is increasing, and it’s not just inflation. Take a look at physician services as an example:

Growth Drivers in Physician Services: 2020–2030

So, only a small part of the rising costs comes from population growth. Most of it? We’re simply doing more tests, prescribing more treatments, and charging more per visit.

What Patients Should Expect (and Prepare For)

By 2030, the patient experience around billing could be completely different. Here’s what to anticipate — and how to stay ahead.

More Upfront Costs

Even in Canada, more services may fall outside public coverage. Think: mental health, dental, physio — all of which are already patchy in provincial plans.

Be ready to ask: “What does this cost me today?” before you sit down with the doctor.

A Digital-First System

Expect to manage billing through apps, not phone calls or paper statements. Your insurer, your GP, your pharmacy, even your therapist — all on one dashboard.

Many clinics are already streamlining their operations through platforms like Elation Health, which focus on integrating billing with electronic health records to make patient data and payments easier to manage on both sides.

Bundled Pricing

Some clinics will offer “care packages”: fixed fees for a surgery, a birth, or a year of chronic disease management. No line-item bills, just one price.

Great in theory, but watch for hidden exclusions. Always read the fine print.

Constant Plan Changes

Insurance plans will keep shifting their coverage terms based on cost pressure. Your 2025 plan might cover vision, but drop it in 2027. Employers may follow suit or pass on more costs to employees.

Keep copies of past coverage and check renewal letters closely. What was included last year may no longer be this year.

A Note on Equity

Let’s not sugarcoat it: rising costs and shifting systems often hit the most vulnerable first.

Over 85 million Americans are uninsured or underinsured, and more than 60,000 die each year because they can’t afford to see a doctor. Health care should be a human right—not a privilege. I’m proud to support Medicare for All. https://t.co/DGf4sbRZaj

— Ed Markey (@SenMarkey) April 30, 2025

In the U.S., where 30+ million people still live uninsured or underinsured, the billing changes of the next five years could either help, through automation and cost clarity, or make things worse, if AI-based denials and high deductibles become the norm.

Governments and health authorities will have tough decisions to make. And people working on the ground, physicians, administrators, tech developers — will need to advocate hard for inclusive systems that don’t leave anyone behind.

Final Thoughts

Medical billing in 2030 isn’t just a back-office issue. It’s becoming one of the main ways people interact with their health care system. It’ll affect where you go for care, how much you pay, and what kind of care you even have access to.

Yes, there’s hope: better tech, faster claims, fewer errors. But it’s not automatic.

We’ve got to stay alert, ask questions, review charges, and push for transparency. Because while the systems are changing fast, we still have time to make sure they’re changing in a way that works for people.