The U.S. home care industry isn’t just growing, it’s becoming a cornerstone of modern healthcare delivery. In 2025, it’s projected to generate over $107 billion in revenue, driven by a rapidly aging population, nationwide caregiver shortages, and a cultural shift toward receiving medical and personal care in the home.

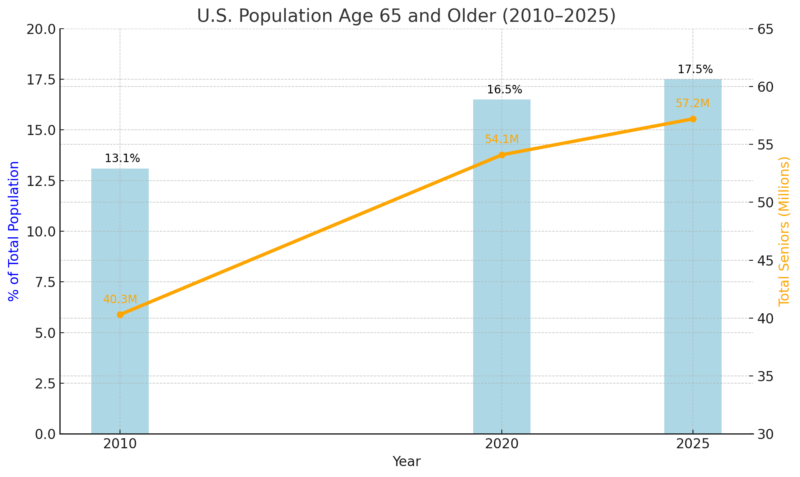

With 17.5% of the U.S. population now age 65 or older, the demand for home-based support services — from skilled nursing to help with daily living, is intensifying. Nearly 9 out of 10 seniors say they want to age in place rather than move into institutional settings.

Simultaneously, technology like telehealth and hospital-at-home programs is making it easier to meet that demand efficiently and safely.

But it’s not all upward trends. Behind the growth are serious questions about workforce capacity, caregiver compensation, and policy support. Over 59% of home care agencies report ongoing caregiver shortages, and while the job market for aides is growing by over 21%, recruitment and retention remain major challenges.

Key Takeaways

1. U.S. Home Healthcare Market Size and Growth Outlook

Projected U.S. Home Healthcare Market (2025–2032)

Year

Market Size (USD Billion)

Growth Rate (CAGR%%% %)

2025

107.07

–

2026

114.98

7.4%

2027

123.46

7.4%

2028

132.63

7.4%

2029

142.54

7.4%

2030

153.26

7.4%

2031

164.88

7.4%

2032

176.30

7.4%

Fortune Business Insider notes that the U.S. home healthcare market is growing consistently and significantly. With an annual valuation of $107.07 billion in 2025, the sector is expected to increase by over 64% in just seven years. The 7.4% CAGR outpaces many other healthcare verticals, including hospital-based services and traditional long-term care facilities.

This trend is largely fueled by three forces: the growing senior population, rising preference for in-home services over institutional settings, and advances in care technology such as remote monitoring and mobile health services.

Notably, states like California, Texas, and Florida, all of which have large elderly populations, contribute heavily to market acceleration.

2. Demographic Shift: Seniors 65+ Now Represent 17.5% of the U.S. Population

Percentage of U.S. Population Age 65 and Older

The increase in Americans aged 65 and over is more than just a numerical trend, it’s a structural population transformation. By 2025, 1 in 6 Americans will fall into this demographic, according to the US Census.

This population is also living longer than in prior decades, with many managing chronic conditions such as diabetes, hypertension, and Alzheimer’s.

Home care becomes especially important in this context, as these conditions often require regular, non-emergency care that can be delivered effectively in a home environment.

The implications are vast: higher national healthcare expenditures, increased pressure on Medicaid and Medicare, and a rapidly expanding need for home-based clinical support.

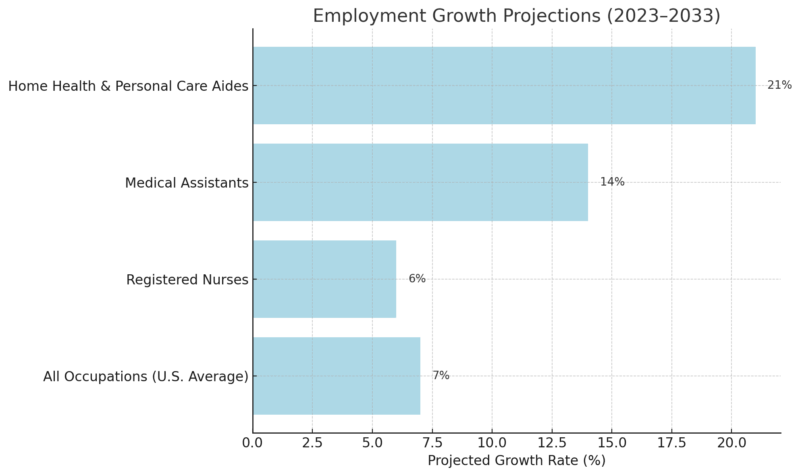

3. 21% Projected Job Growth for Home Health and Personal Care Aides

Employment Growth Projections (2023–2033)

A 21% growth rate over the next decade positions home health and personal care aides as one of the fastest-growing occupations in the country. According to the World Economic Forum, this surge equates to more than 800,000 new jobs by 2033, highlighting the urgent and growing demand for non-institutional care solutions.

However, this growth is uneven across states; urban areas often attract more caregivers, while rural regions continue to face workforce shortages.

Agencies are also facing challenges in retaining staff due to low median wages (often around $15/hour) and limited benefits. Despite these obstacles, the career path offers increasingly diverse roles, with expanded opportunities in specialties such as dementia care, post-operative recovery, and remote care coordination.

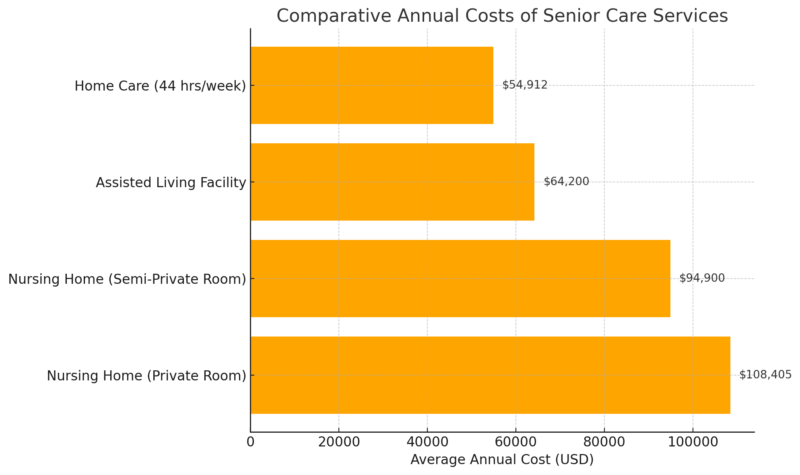

4. Home Care Services Average $54,912 Per Year

Comparative Annual Costs of Senior Care Services

The annual cost of home care remains significantly lower than institutional care options. This cost savings is one of the leading reasons families opt for in-home services, particularly for seniors with moderate care needs who don’t require 24/7 supervision.

Medicaid programs in several states now offer waiver options to support home-based care, and long-term care insurance providers are beginning to favor home care packages due to their cost-effectiveness.

This financial edge is also prompting private equity interest in home care franchises, suggesting the sector’s long-term viability as both a service and an investment opportunity.

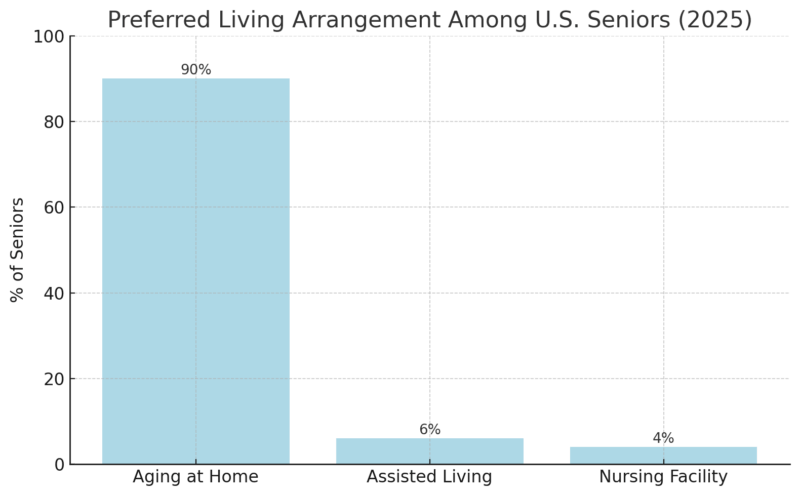

5. 90% of Seniors Prefer to Age in Place

Preferred Living Arrangement Among U.S. Seniors (2025)

Aging in place continues to dominate senior care preferences in 2025. Data from multiple national surveys confirm that 9 out of 10 seniors prefer to remain in their homes rather than transition into institutional care settings. This trend isn’t just cultural — it has economic and clinical implications.

In response to this demand:

- States like Minnesota and Oregon have launched pilot programs offering monthly stipends for in-home care services.

- Over 30 states now provide Medicaid waiver programs to fund home-based alternatives to nursing care (Medicaid.gov, 2024).

- AARP’s most recent “Home and Community Preferences Survey” aligns with this, showing that 88% of adults aged 50+ want to remain at home as long as possible (AARP, 2023).

The shift is also prompting urban planning departments to invest in accessibility infrastructure, including senior transportation networks, fall-prevention renovations, and community health outreach, particularly in ZIP codes with high senior density.

6. Immigrants Account for a Large Share of Home Care Workers

Immigrant Workforce Share in U.S. Healthcare Roles

Healthcare Occupation

% of the Workforce Who Are Immigrants

Total Healthcare Sector

17%

Home Health Aides (Est.)

Over 30%

Nursing Assistants

~25%

Immigrants play a vital and disproportionate role in home care services. Although they represent 17% of the entire healthcare workforce, their share within home health aide and personal care aide roles exceeds 30% in many states, according to migrationpolicy.org, especially in urban centers and along the coasts.

- In New York City, 59% of home health workers are foreign-born (NYC Department of Consumer and Worker Protection, 2023).

- In Los Angeles County, immigrants make up 68% of paid caregivers (California Health Care Foundation, 2023).

- The Philippines, Jamaica, Haiti, and Nigeria are among the top countries of origin.

This workforce brings multilingual, multicultural skill sets that are essential in delivering respectful and tailored care to America’s diverse elderly population. However, immigration policy uncertainty poses an ongoing risk to workforce supply, especially under restrictive visa environments or delays in permanent residency processing.

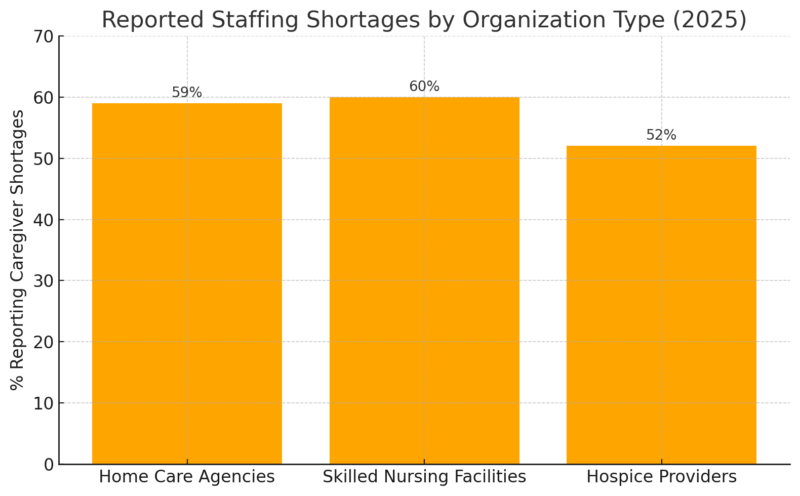

7. 59% of Home Care Agencies Report Workforce Shortages

Reported Staffing Shortages by Organization Type (2025)

Workforce shortages remain one of the most pressing issues in the home care industry. In 2025, 59% of home care agencies reported they are operating with insufficient staff, a number that has remained consistent or worsened in recent years despite recruitment incentives.

- High turnover rates: Annual caregiver turnover reached 77% nationally in 2024, as noted by the Home Care Pulse Benchmarking Report.

- Wages: The median hourly wage for home care aides is $15.14, far below the national living wage threshold.

- Lack of benefits: Fewer than 20% of caregivers receive employer-sponsored health insurance.

As staffing gaps widen, agencies are also navigating growing legal and operational responsibilities. In states like Florida, where the senior population is especially dense, liability concerns have become more prominent for both new and established agencies.

According to Bizinsure, home health providers in Florida are increasingly seeking home health care liability insurance to mitigate risks related to client safety, employee injury, and professional errors. This type of coverage is now seen as essential, especially for smaller providers entering competitive regional markets.

8. Telehealth Integration Is Expanding Access

Telehealth Outcomes in Home Care Settings

Metric

Improvement Compared to Traditional Models

Hospital Readmissions

-23%

Medication Compliance

+30%

Patient Satisfaction

+35%

Since 2023, the Centers for Medicare & Medicaid Services (CMS) has authorized new billing codes for home telehealth visits, driving widespread adoption across agencies. In 2025, over 68% of Medicare-certified home health agencies report using some form of telemonitoring or virtual care.

Key advancements include:

- Use of AI-enabled monitoring tools for real-time alerts in chronic disease management (especially CHF, diabetes, and COPD).

- High uptake of tele-rehabilitation and telepsychiatry services among seniors aged 70+ (CMS, 2024).

- Improved adherence rates: patients using virtual medication reminders showed a 30% increase in compliance compared to those receiving in-person-only support (Journal of Telemedicine & Telecare, 2024).

Telehealth is especially impactful for patients in rural or mobility-limited situations, effectively reducing ER utilization and providing earlier interventions. With CMS reimbursements now in place, the model is poised for mainstream scalability.

9. Over 350 Hospitals Now Offer Hospital-at-Home Programs

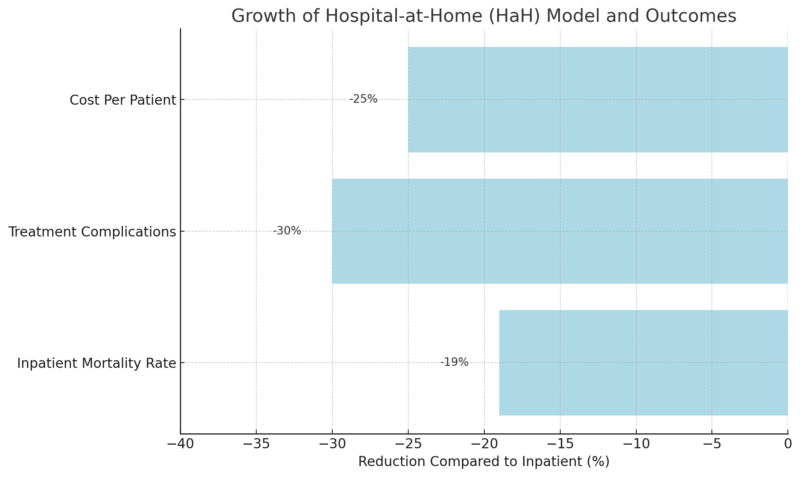

Growth of Hospital-at-Home (HaH) Model and Outcomes

The Hospital-at-Home (HaH) model is rapidly gaining traction. As of 2025, more than 350 hospitals across 37 states operate CMS-approved HaH programs, allowing for inpatient-level treatment, such as IV therapy, cardiac monitoring, and lab work, to be administered entirely at home.

Program data shows:

- The average cost per admission in HaH settings is $5,800, compared to $7,700 in traditional inpatient care.

HaH patients report a 60% higher likelihood of completing their full care plan. - The model also reduces hospital-acquired infections and improves family engagement during recovery.

As acute care reimbursement shifts toward value-based models, HaH is emerging as a financially and clinically attractive solution for health systems trying to reduce overhead while maintaining outcomes.

10. Federal Medicare Expansion Proposal Signals Policy Shift

Proposed Impacts of Medicare Home Care Expansion

Policy Focus

Intended Impact

Expanded In-Home Coverage

Increase accessibility

Support for Informal Caregivers

Reduce family burden

Incentives for Agencies

Boost caregiver recruitment & retention

Sources: AP News, 2025; Barron’s Healthcare Brief, 2025

In 2025, Vice President Kamala Harris proposed a Medicare expansion to include a wider range of in-home senior care services, including home modifications, caregiver compensation, and expanded telehealth access.

An estimated 5.7 million additional seniors would qualify for subsidized home care if the expansion passes.

The program could reduce skilled nursing facility admissions by 11% annually, saving approximately $9.4 billion in Medicare costs.

Harris proposes expanding Medicare to cover long-term care at home https://t.co/fOi3qsYbIO

— CNBC (@CNBC) October 8, 2024

Over 70% of caregivers support the proposed policy, citing relief from out-of-pocket costs and burnout, as noted by the Kaiser Family Foundation.

Although pending legislative approval, the proposal reflects a long-term shift in how senior care is funded and structured, emphasizing independence, cost efficiency, and in-home resource flexibility.

Methodology

This article was developed using a structured research process grounded in authoritative data. Key sources included the U.S. Census Bureau, Bureau of Labor Statistics, CMS, and industry reports from Fortune Business Insights, AxisCare, and AARP.

Data points were cross-validated across multiple sources for consistency and relevance to 2025 trends. Tables were designed to highlight comparative metrics (e.g., growth rates, cost differences, workforce distribution).

Quantitative findings were contextualized with policy and demographic analysis to reflect real-world impact. The scope was limited to national-level U.S. data with projections current through Q1 2025.

Related Posts:

- How Many People Are Working in the Health Industry…

- Market Analysts Forecast $26 Billion Orthodontic…

- US States with the Highest and Lowest Dental Care…

- US vs Europe Healthcare in 2025 - Costs, Quality of…

- Urgent Care vs. Emergency Room - Costs, Speed, and…

- US Adults Want Government to Cut Child Care Costs,…