Let’s cut straight to it: as of April 2025, the unemployment rate in the United States is holding steady at 4.2% according to the BLS. It’s been hovering in that 4.0 to 4.2% range for the past year, so not exactly a rollercoaster ride. But even in a seemingly “stable” labor market, a lot is happening under the surface.

If you’re a job seeker, business owner, or someone trying to understand where the economy stands, that headline number doesn’t tell the whole story.

And let’s be honest, employment stats can sometimes feel cold and technical. But behind every tick up or down in those percentages are millions of real people trying to make rent, pay off loans, or figure out their next career move.

So let’s unpack what’s going on in the labor market this year in a real-world, human way.

So, What Does 4.2% Mean?

NEWS: 🇺🇸 US unemployment rate remains at 4.2%.

— World of Statistics (@stats_feed) May 2, 2025

Let’s start with some context. A 4.2% unemployment rate isn’t bad.

In fact, in historical terms, it’s pretty solid. Economists often consider anything between 4 and 5% to be within the range of “full employment,” where the job market is tight, but not overheated.

But… “not bad” isn’t the same as “great.” And here’s why.

What’s Behind That 4.2%?

According to the latest release from the Bureau of Labor Statistics (BLS), here’s what’s happening under the hood:

- 7.2 million people are officially unemployed.

- The number of long-term unemployed (out of work for 27 weeks or more) jumped to 1.7 million in April. That’s 23.5% of all unemployed people, according to PYMNTS.

- Labor force participation rate? 62.6%, pretty much flat.

- Employment-population ratio? Also pretty static at 60.0%.

Let’s pause here for a second: if you’re wondering, “Why do those participation numbers matter?” it’s because they give a clue about how many people have checked out of the workforce entirely, not looking for jobs at all.

People are taking care of family, discouraged by job prospects, dealing with health issues, or just plain burned out. These numbers help tell that story.

Where Are the Jobs Being Added?

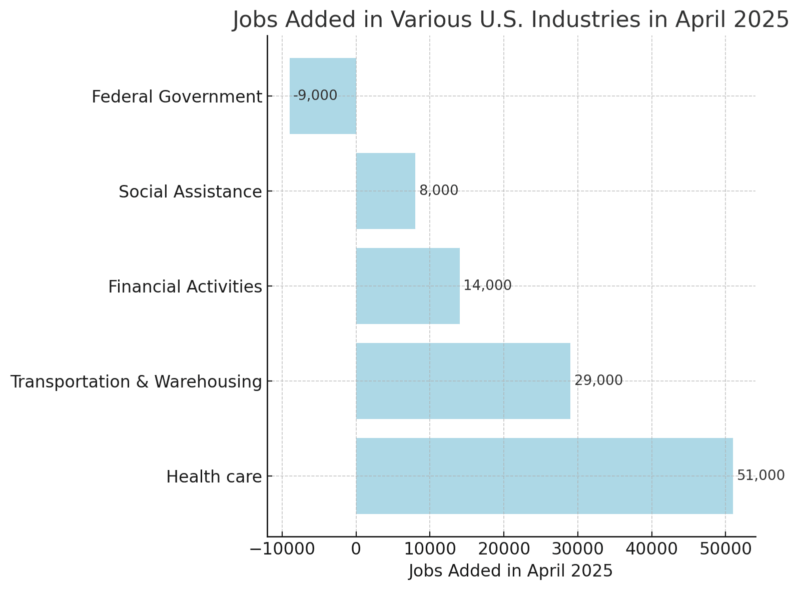

Okay, now the slightly brighter side: Nonfarm payrolls grew by 177,000 jobs in April, as noted by CNBC. Not fireworks, but decent.

That’s about in line with the 12-month average of 152,000 new jobs per month.

Here’s where employers are hiring:

So, we’re seeing growth in sectors that serve day-to-day needs—hospitals, banks, logistics—but a pullback in federal employment. That last one might have to do with post-COVID fiscal tightening, or just regular churn from retirements or expiring contracts.

Who’s Still Struggling?

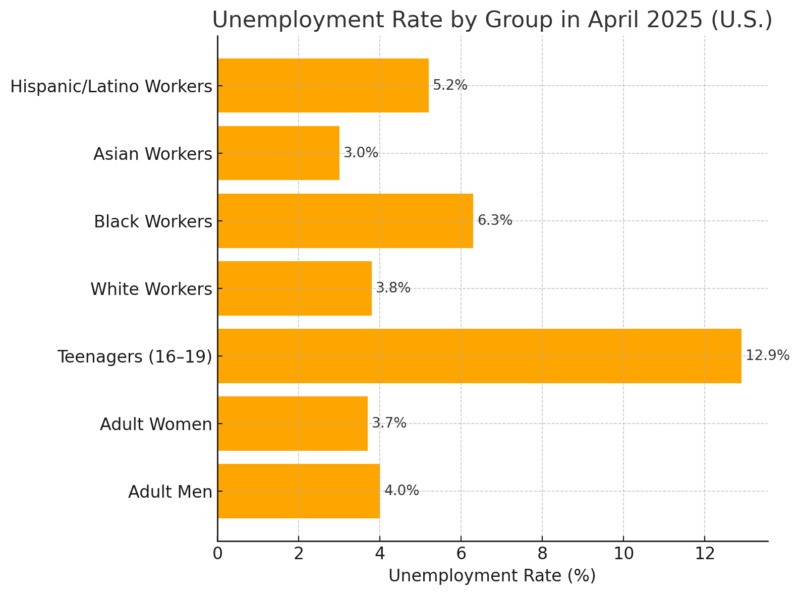

One of the more important angles on the job market isn’t just how many jobs are being created—it’s who is (or isn’t) getting them.

Here’s how unemployment is breaking down by demographic group:

That teenage rate is always higher, nothing new there, but the disparities by race are notable.

Black and Hispanic workers are still facing higher levels of joblessness.

That’s a reflection of deeper structural issues in the economy, access to education, transportation, networks, discrimination, and not just a blip in the data.

Long-Term Unemployment Is Creeping Up

Let’s talk about the long-term unemployed for a minute.

Anyone who’s been out of work for more than six months knows how demoralizing that stretch can be.

Employers start to wonder what’s “wrong” with you, confidence starts to erode, and savings dry up.

In April, 1.7 million people were in this group, up by 179,000 from March. That’s a red flag.

Even with job gains in some sectors, certain workers—especially older ones, or those in declining industries—are getting left behind. A tighter labor market should be pulling these folks back in. The fact that it’s not? That’s concerning.

Wages: Growing, But Not Exploding

Now for the paycheck part. In April:

Inflation has cooled off from the white-hot highs of 2022–2023, but it’s still not asleep.

So 3.8% wage growth helps, but it’s not a magic bullet. Rent, food, gas—they’re still climbing in most parts of the country.

Here’s a quick snapshot:

Metric

April 2025

YoY Change

Avg. Hourly Earnings

$36.06

+3.8%

Avg. for Nonsupervisory

$31.06

+4.0%

Avg. Weekly Hours Worked

34.3

No change

Nothing to panic over—but not exactly a wage boom either.

The Quiet Group: People Who Want Work but Aren’t “Unemployed”

One more group that often gets missed: those not technically in the labor force but who say they want a job. That includes people who aren’t actively looking, maybe because they’re discouraged or caring for someone, or just plain stuck.

- 5.7 million people fall into that camp.

- 1.6 million are considered “marginally attached”—meaning they’ve looked for work in the past year, but not recently.

- 414,000 are outright discouraged, saying no jobs are available to them.

That’s a big chunk of potential labor just… sidelined.

What’s Holding the Job Market Back?

Even with some job growth in April, the labor market isn’t exactly firing on all cylinders.

There are a few well-known pressure points slowing things down.

None of them are catastrophic on their own, but together, they add up to a kind of economic drag that keeps hiring cautious and wage growth modest.

1. Higher Interest Rates

The Federal Reserve hasn’t backed off the high interest rates it set to rein in inflation back in 2022 and 2023, as noted by PBS.

And while inflation has cooled a bit, borrowing costs remain elevated, and that has a ripple effect. Businesses considering expanding, launching new products, or opening new locations face steeper financing costs.

In simple terms, money is more expensive to borrow, so companies are more conservative.

Sector Impacted

Effect of Higher Rates

Real Estate

Fewer projects, stalled developments

Manufacturing

Capital investment delayed

Small Businesses

Tougher to secure loans for expansion

Tech Startups

Venture funding slowed, and layoffs triggered

2. Layoffs in Tech & Media

Tech and media continue their post-pandemic correction. A lot of firms ramped up hiring fast during the boom years of 2020–2022, and now they’re trimming back.

We’ve seen continued layoffs from major players, not always massive, but steady enough to spook investors and workers alike.

These aren’t just coding or marketing roles, either. Project managers, HR teams, and recruiters are all part of the restructuring.

Company Type

Current Trend

Big Tech (FAANG+)

Strategic layoffs, focus on AI hiring

Mid-sized Startups

Funding cuts, hiring freezes

Media Companies

Streamlining, merger-driven reductions

Many of these layoffs aren’t about weak demand, they’re about recalibrating priorities. That’s why some laid-off tech workers are jumping into health tech, clean energy, or fintech, where the hiring outlook is more solid.

3. Federal Government Job Cuts

J.P. Morgan notes that federal employment declined by 9,000 jobs in April and is down by 26,000 since January 2025.

That’s not insignificant. Budget debates in Congress and shifting priorities (think: more money going to AI and cybersecurity, less to administrative functions) are influencing hiring decisions.

It’s also worth noting: even workers on paid leave or severance packages are still technically counted as “employed” in the establishment survey, so the drop could be even deeper in practice.

Federal Job Area

Trend

Administrative Roles

Reductions underway

Public Health & Safety

Flat or slightly up

Tech & Cybersecurity

Targeted growth pockets

Government jobs, once seen as super-stable, are now facing more volatility, especially in non-essential departments.

4. Weakness in Manufacturing

Factories are facing real headwinds right now. Manufacturing employment overall was flat in April, and some pockets even shrank.

The standout stat? Motor vehicle employment fell by 4,700 jobs in April, a sharp drop that’s hard to ignore, as noted by Reuters.

Supply chains are still feeling whiplash from the past few years. Auto manufacturing is facing challenges tied to EV transitions, chip shortages, and shifting consumer demand.

| Manufacturing Subsector | April Jobs Change |

| Motor Vehicles & Parts | -4,700 |

| Durable Goods | +2,000 |

| Nondurable Goods | -3,000 |

While construction managed a modest gain (+11,000 jobs), manufacturing seems to be taking a breath — and not in a good way.

Where Are the Jobs?

So, where is the opportunity right now? It’s still out there. You just might have to adjust your aim.

In today’s labor market, job growth is concentrated in a handful of sectors that are either pandemic-proof, powered by demographic shifts, or boosted by technology and logistics needs. If you’re looking to switch industries or reenter the workforce, these areas are where the energy is strongest.

Current Hotspots for Job Growth

Sector

What’s Driving Growth

Health Care

Aging population, backlog of care from pandemic years

Transportation & Warehousing

Booming e-commerce, supply chain restructuring

Finance

Compliance, auditing, and risk roles

Social Assistance & Education

Long-term demand, especially in underserved communities

These fields aren’t just posting jobs — they’re posting steady jobs. And they tend to offer clear pathways to career progression, especially if you get in early and build experience over time.

Time to Pivot? Here’s How to Make It Work

For workers in industries that are slowing down — think manufacturing, oil and gas, or even some white-collar office jobs — a strategic career pivot might be the smartest play.

The good news? You don’t necessarily need a four-year degree to make a move.

Here are some areas where short-term training or certification can lead to real, well-paying work:

Career Track

What You’ll Need

Starting Salary Range

Medical Billing & Coding

Certificate (6–12 months)

$40K–$55K

Cybersecurity Analyst

CompTIA Security+, bootcamp, etc.

$55K–$ 75 K+

HVAC Technician

Trade school + apprenticeship

$45K–$65K

Supply Chain Coordinator

Online certification, logistics tools

$50K–$70K

Electrician

Apprenticeship or trade program

$50K–$80K

Many of these roles are “future-proof” — automation-resistant, regionally in demand, and backed by long-term trends like electrification, health care expansion, and digital security.

Where to Start if You’re Rebooting Your Career

If you’re starting from scratch or coming back after a break, here’s how to get traction:

- Check your local workforce board: They often offer free or subsidized training and have insight into who’s hiring now.

- Use job centers and career one-stops: Every state has them, and they connect you to real employers.

- Target certifications with fast ROI: Aim for programs you can finish in under a year and start working right away.

- Start networking in your target industry: Join a LinkedIn group, attend a free webinar, and message people doing what you want to do.

Wrapping Up

The job market in 2025 is holding a steady beat, but the tempo underneath is shifting. While 4.2% might sound calm, the story isn’t exactly quiet.

Job growth is real, but uneven. Wages are rising, but slowly. Some industries are thriving, while others are barely treading water.

If you’re trying to figure out your next move, don’t just look at the headline numbers. Dig into the details. That’s where the real map of opportunity lives.

And hey—if you’re in between gigs right now, hang in there. The path might not be easy, but the direction of the job market suggests it’s still moving forward. Slowly, yes. But forward.

References

- Bureau of Labor Statistics – The Employment Situation — April 2025

- CNBC – April jobs report shows U.S. adds 177,000 jobs, unemployment holds at 4.2%

- PYMNTS – Job Market Resilience May Not Bolster Consumer Spending

- Trading Economics – United States Average Hourly Earnings

- PBS NewsHour – Despite Trump’s pressure, Federal Reserve likely to keep rates unchanged this week

- J.P. Morgan – Jobs Report April 2025

- Reuters – U.S. Announced Job Cuts Decline in April, Recruitment Firm Challenger Says

Related Posts:

- 17 Crazy Things to Do in Las Vegas for Couples 2025

- Can You Really Become a Nurse in Just 12 Months? 5…

- SSA Targets 15 Million Field Office Visits in 2026,…

- Valencia Spain Crime Rate 2025 - Trends and Analysis

- US Inflation Rate in 2025 - What's Driving Prices…

- Key Statistics About the U.S. Birth Rate in 2025