According to data from the Federal Reserve’s Survey of Consumer Finances, the average American holds $62,410 in their accounts, checking accounts, money market accounts, call deposit accounts, and prepaid cards.

The same report shows that the typical American household holds about $8,000 in its main transaction accounts.

That number, though, should not be mistaken for the median since the true average skews higher due to a small share of households with very large balances.

The data also leave out long-term investments such as retirement funds, brokerage portfolios, and property equity.

Savings levels vary widely depending on age, education, household size, and whether someone owns or rents a home, all of which strongly shape financial stability across different demographic groups.

Table of Contents

ToggleKey Takeaways

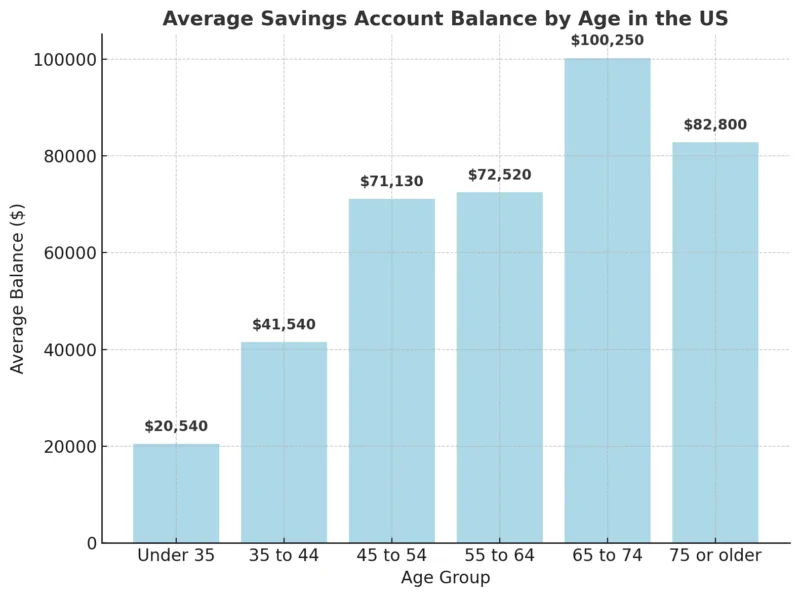

Average Savings Account Balance by Age

Savings account balances tend to increase with age, as older Americans generally have more accumulated wealth than younger individuals.

According to Federal Reserve data, individuals between 45 and 54 years old have, on average, $50,590 more in savings compared to those under 35.

However, balances tend to decline after age 70, as retirees begin to draw from their savings.

These trends highlight how savings grow over a lifetime, typically peaking between 65 and 74 before decreasing in later years as people spend during retirement.

According to the Bureau of Labor Statistics’ 2022 Consumer Expenditure Survey, individuals aged 45 to 54 have the highest annual expenses on average.

When it comes to financial preparedness, only 31% of Gen Z report having enough savings to cover a $1,000 unexpected expense, compared to 43% of Millennials, 36% of Gen Xers, and 59% of Baby Boomers.

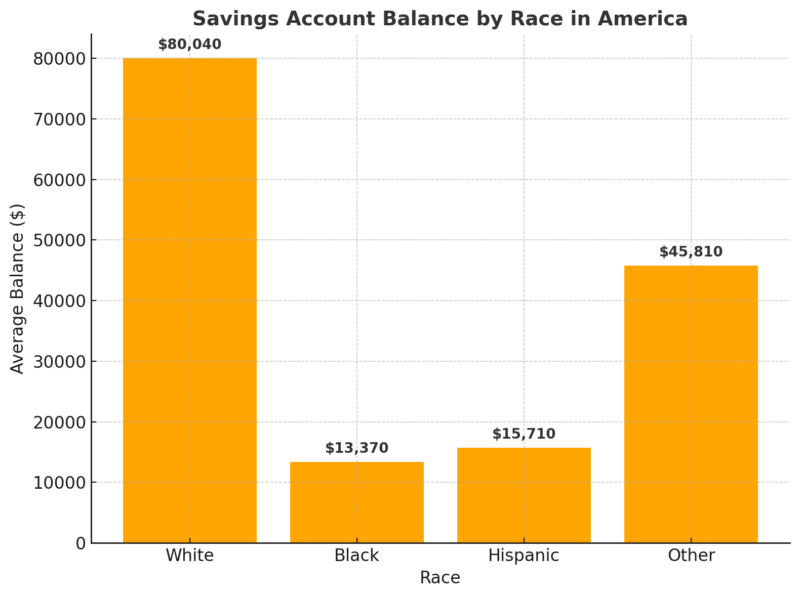

Savings Account Balance by Race

A significant racial wealth gap exists in America, extending beyond income and household wealth to include savings balances.

Data from Business Insider shows that White households have the highest average savings, while Black and Hispanic households have significantly lower balances.

On average, White individuals have $80,040 in savings, compared to $13,370 for Black individuals and $15,710 for Hispanic individuals. Other racial groups have an average savings balance of $45,810, which falls between these figures.

Black and Hispanic households generally have lower incomes than White or Asian households, which reduces their ability to save. U.S. Treasury data show that in 2020, median household income for Black families was about $46 000 and for Hispanic families about $55 500, compared with $75 000 for White families, according to home.treasury.gov. Lower wages leave less money to put into savings.

Access to affordable credit has been restricted by discriminatory practices. “Redlining” refers to the historic practice of banks and insurers refusing mortgages and other loans to residents of certain neighborhoods based on race. Federal Reserve history notes that redlining denied people credit simply because of where they lived, even if they were otherwise qualified.

Black students also carry heavier student debt burdens than their White peers. The Education Data Initiative reports that Black college graduates owe an average of $25 000 more than White graduates, and four years after graduation, Black borrowers owe roughly 188% more than White borrowers borrowed About 40% of Black graduates have graduate-school debt, compared with 22% of White graduates. Larger debts mean higher monthly payments, and delay savings and home ownership

Combined, lower wages, limited access to affordable credit, and heavier student debt make it harder for Black and Hispanic families to build savings, perpetuating wealth disparities across generations.

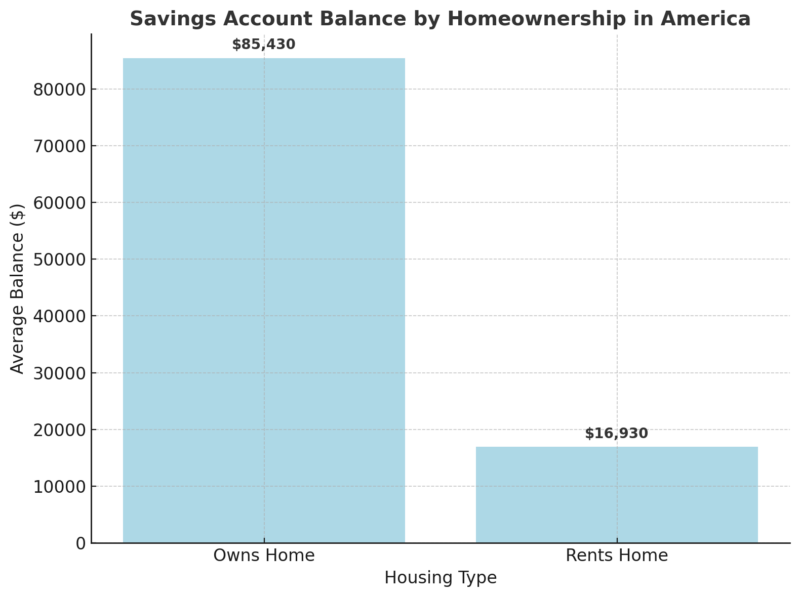

Savings Account Balance by Homeownership

Homeownership is a key indicator of financial stability, with homeowners generally having higher savings balances than renters.

According to Federal Reserve data, individuals who own their homes have an average savings balance of $85,430, significantly more than renters, who have an average of $16,930.

This disparity highlights the financial security and wealth-building advantages of homeownership, as homeowners often have higher incomes, greater financial resources, and more opportunities for long-term savings.

These figures reflect the broader wealth gap between homeowners and renters, reinforcing the importance of property ownership as a pathway to financial growth and economic security.

View this post on Instagram

A post shared by Mo Ade-Famoti | Investment | Financial Literacy (@moneystewards)

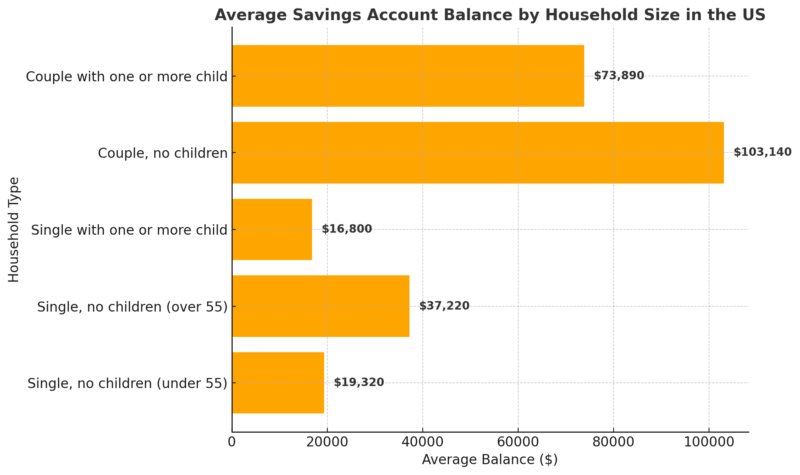

Average Savings Account Balance by Household Size

Household structure has a significant impact on savings balances, with couples without children tending to have the highest average savings, while single-parent households typically have the lowest balances.

Federal data shows that on average, single individuals under 55 have $19,320 in savings, while single parents with children have an even lower balance of $16,800.

In contrast, couples without children hold the most savings, averaging $103,140, likely due to higher dual-income potential and fewer financial dependents.

These figures highlight how life stages, financial responsibilities, and income structures impact household savings, but also one significant fact is that 30% of middle clas struggle with emergency savings

Couples without children tend to have the most financial flexibility, while single-parent households face greater financial constraints that limit their ability to save.

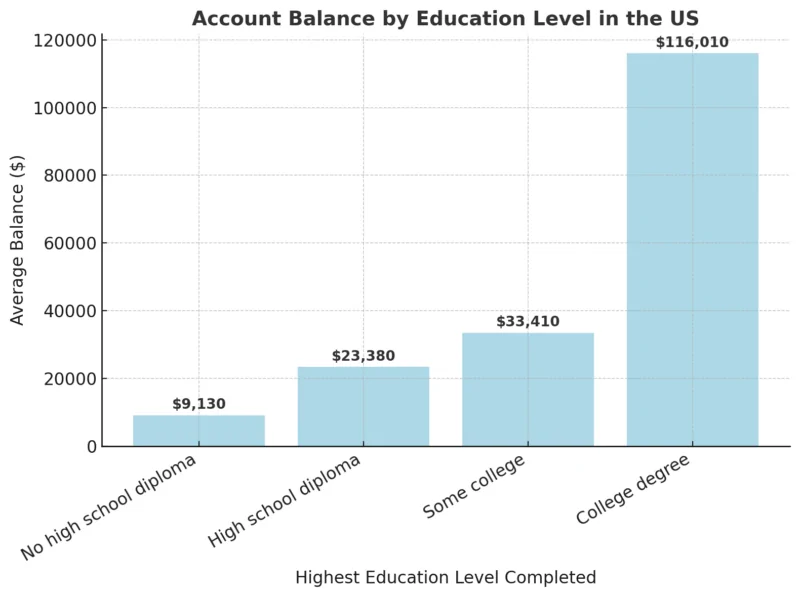

Account Balance by Education Level

Education plays a significant role in financial stability, with higher education levels strongly correlating with higher savings balances.

According to the 2022 Survey of Consumer Finances, individuals with a college degree have an average savings balance of $116,010, which is nearly five times that of someone with only a high school diploma ($23,380).

Similarly, individuals with some college experience have an average balance of $33,410, while those without a high school diploma hold the lowest savings, averaging $9,130.

These figures emphasize the financial benefits of higher education, as individuals with college degrees tend to earn higher incomes, leading to greater savings potential and long-term financial security.

Inflation Has Quietly Cut Into Your Savings

If you had $10 000 sitting in a savings account in 2019, it no longer buys what it once did. Inflation has eaten away roughly 27 % of your purchasing power, so you’d now need about $12 670 just to keep up with the same cost of groceries, rent, and everyday expenses. I’ve felt that squeeze too, watching prices climb while interest on savings crawled behind.

Meanwhile, debt is doing the opposite of saving. Credit-card balances in the U.S. crossed $1.13 trillion in 2025, with average balances around $7 000 per person and interest rates above 21 %. Add student loans , where the typical borrower still owes about $37 000, and it’s clear why so many people feel like they’re walking in place no matter how hard they budget.

If that sounds familiar, here’s what helps. Start by raising your savings goals by about 20–25 % to offset inflation. Move your emergency fund or short-term cash into a high-yield savings account (4–5 % APY) so your money works a little harder. When tackling debt, focus on the highest-interest balances first, even small wins build momentum. Automate payments, roll tax refunds or bonuses into debt reduction, and resist new revolving balances until you’ve made progress.

Across the Atlantic, people are saving more. In 2025, the average U.K. household saves around 10–11 % of income and Canadians roughly 11–12 %, compared with just 6.9 % in the U.S. The difference isn’t just math, it’s mindset. In Canada and Britain, stronger social programs and lower medical costs make it easier to plan long-term. Americans shoulder more day-to-day risk, so short-term spending often wins.

Still, the situation isn’t hopeless. Every extra dollar saved and every dollar of debt paid down now is protection against uncertainty later. Inflation might have chipped away at yesterday’s money, but today’s choices decide how much of tomorrow you’ll actually own.

Psychological Aspects of Saving

Studies from the American Psychological Association show that individuals who set specific goals — such as “save $200 a month” instead of “save more” — are far more likely to stay consistent. When people visualize their goals (like imagining a fully funded emergency account or a future trip), they build emotional motivation that pure numbers can’t create.

One of the simplest yet most powerful methods is the “pay yourself first” rule. Treat saving like a non-negotiable bill: as soon as your paycheck arrives, transfer a portion directly into savings before paying expenses. Even small, automatic contributions create momentum and signal commitment. This approach shifts saving from a chore to a default habit.

Small, consistent actions matter more than large, rare efforts. Whether it’s rounding up purchases to the nearest dollar or automatically moving $10 each week into a separate account, these micro-behaviors build financial discipline. Over time, they help retrain the brain to associate saving with progress rather than sacrifice. Behavioral economists call this “habit anchoring” — a mental link between tiny wins and long-term success.

Key Savings Statistics

- High-yield savings accounts offer better interest rates than traditional savings accounts, helping funds grow more efficiently.

- Only 25% of Americans consider themselves completely financially secure, down from 28% in 2023, according to Financial Freedom Survey.

- Nearly 59% of U.S. adults feel uncomfortable with their level of emergency savings,

- 27% of Americans have no emergency savings at all, leaving them financially vulnerable in case of unexpected expenses.

- 36% of adults had more credit card debt than emergency savings in both 2023 and 2024, highlighting financial strain.

- 57% of working Americans (full-time, part-time, or temporarily unemployed) fell behind on their retirement savings, according to the latest Retirement Savings Survey.

Methodology

Data for this analysis come from reliable, publicly available sources, including the Federal Reserve’s Survey of Consumer Finances (2022), Bureau of Labor Statistics CPI (2019–2025), Education Data Initiative (2025), and Experian/Investopedia reports (2025) for credit-card and loan data. International savings comparisons use information from World Population Review, ONS (UK), and Statistics Canada.

All figures are shown in 2025 U.S. dollars, adjusted for inflation using official CPI data. Median values are used where possible to avoid distortion from high-wealth outliers. Savings rates are expressed as a share of disposable income, following OECD standards.

The focus is on how inflation, debt, and demographics affect household savings. Data were cross-checked with multiple sources for consistency, but minor variations may occur as agencies update their 2025 datasets.

Conclusion

Savings data reveal deep gaps across age, race, education, and homeownership, but the takeaway is universal: financial control starts with awareness. Knowing that the median American holds about $8 000 in liquid savings — far below the average of $62 000 — reminds us why looking beyond averages matters. Wealth inequality, wage gaps, and access to credit shape those numbers, but personal action still makes a difference.

Now is the time to review your own financial picture. Ask yourself: Do I know my real monthly spending? Am I saving enough to keep pace with inflation? Could I redirect a small part of what I spend into a high-yield savings account or investment fund?

You don’t need a finance degree to start — you just need consistency. Begin with what you can, automate it, and increase the amount as your income grows. And if you feel unsure, speak with a certified financial planner or use free budgeting tools offered by your bank.

Saving is both a habit and an act of optimism. Every deposit, no matter how small, is a statement of trust in your future self — that you’ll be ready, capable, and in control when life throws the unexpected your way.

References

- Federal Reserve – Survey of Consumer Finances 2022

- Federal Reserve – Transaction Accounts by Age

- Bureau of Labor Statistics – 2022 Consumer Expenditure Survey

- Business Insider – Black History Month: Wealth Inequality in America

- Federal Reserve – Transaction Accounts by Homeownership

- Finance Monthly – Typical Savings Account Balance for Americans

- Bankrate – Financial Freedom Survey

- Bankrate – Retirement Savings Survey

Related Posts:

- How Much Money Is There in the World In 2025?…

- How Much Does a Wedding Cost in the United States in 2025?

- Scientists Find a Way to Help Aging Cells “Swap…

- Dermatologists Say Millions Over 65 Are Showering…

- How American Businesses Adjust to the U.S.-China…

- Scientists Analyzed 38 Million American Obituaries -…