As of 2025, Florida’s population is estimated to have reached about 22,975,900, reflecting a decade of steady growth that aligns with recent projections according to World Population Review.

But according to some other sources it already surpassed 23 mil.

Since the 2020 census, which recorded a population of 21,538,187, Florida has continued to see a rise in residents, fueled by favorable migration patterns and abundant economic opportunities.

This growth not only reshapes the demographic map of Florida but also brings challenges and opportunities in urban development, infrastructure, and resource management

The state’s largest city, Jacksonville, and its capital, Tallahassee, are key focal points on the map as they adapt to accommodate this expanding population.

The increasing numbers highlight Florida’s appeal as a place to live, work, and thrive, even as the state strategizes to meet the demands of its rapidly evolving communities.

Table of ContentsKey Takeaways

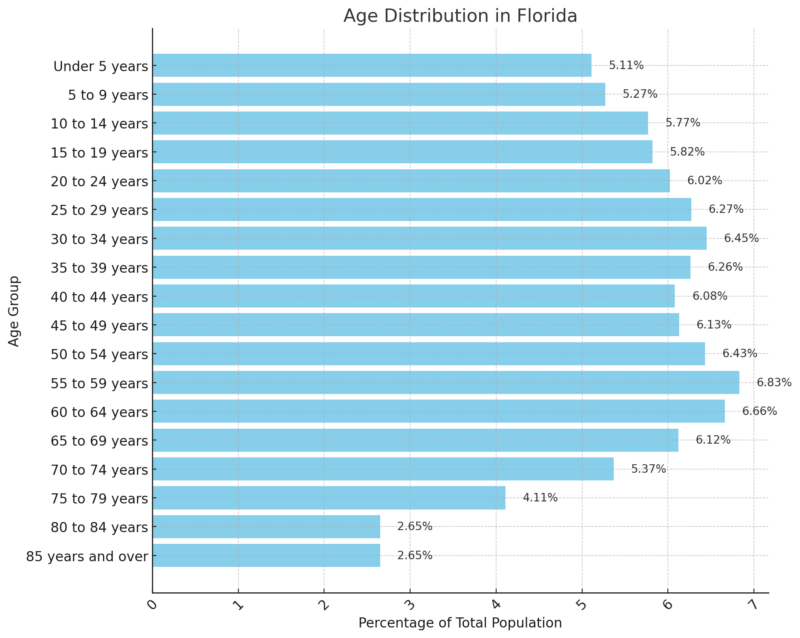

1. Age Distribution

The age distribution in Florida reveals a median age of 42.4 years, highlighting an older-than-average population compared to many other U.S. states according to Neilsberg.

Younger residents (under 15) make up 16.15% of the population, showing a smaller youth base.

The 15 to 29 age group accounts for 18.11%, while a large portion, 44.84%, falls within the 30 to 64 age range, indicating a strong representation in the workforce and middle-aged adults.

Notably, Florida’s population aged 65 and older is substantial, comprising 20.9% (18.25% for ages 65 to 84 and 2.65% for those 85 and older).

This demographic concentration aligns with Florida’s status as a popular retirement destination, underscoring the state’s appeal to older adults and retirees.

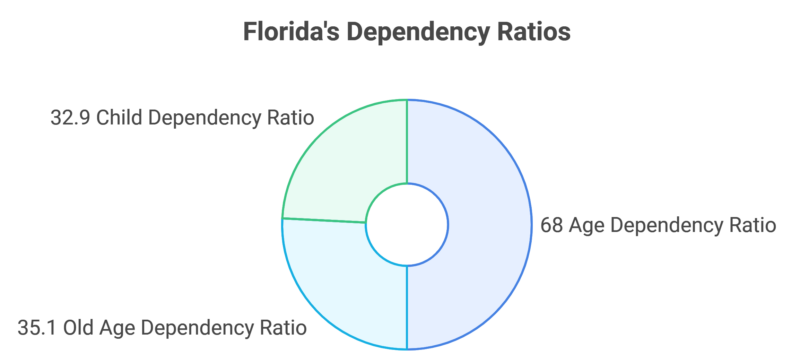

2. Dependency Ratios

The age dependency ratio of 68 highlights a high proportion of dependents relative to the working-age population, driven in part by an old-age dependency ratio of 35.1.

This means a substantial number of older adults depend on the working-age population, putting a strain on economic resources.

The child dependency ratio of 32.9 suggests a lower, but still notable, proportion of youth dependents.

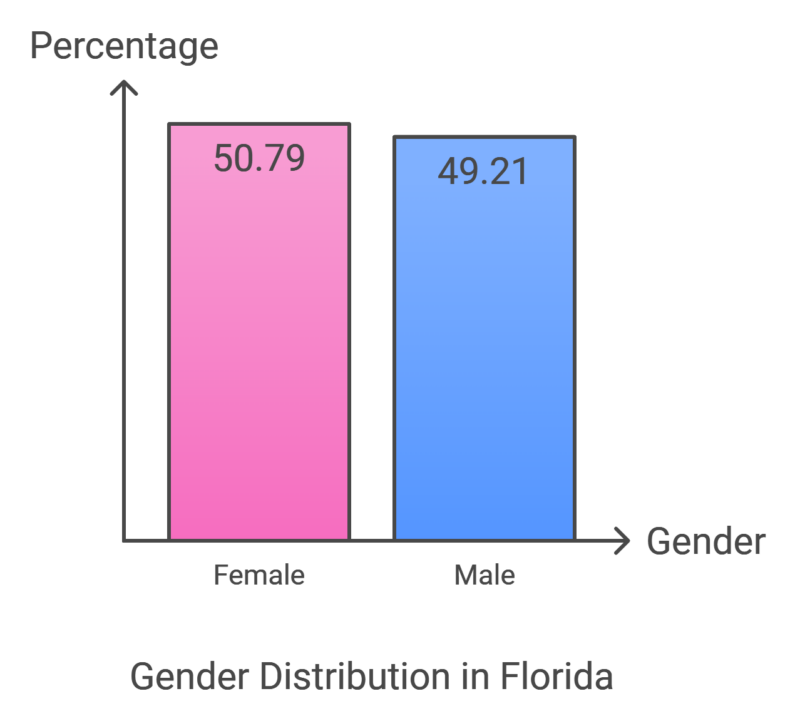

3. Gender Distribution

Florida’s population is almost evenly split by gender, with a slight majority of females (50.79%).

This minor gender imbalance is common in aging populations, as females tend to have a higher life expectancy, which likely contributes to the higher median age among females compared to males.

This distribution may influence healthcare and social services, given the unique needs of an aging female population.

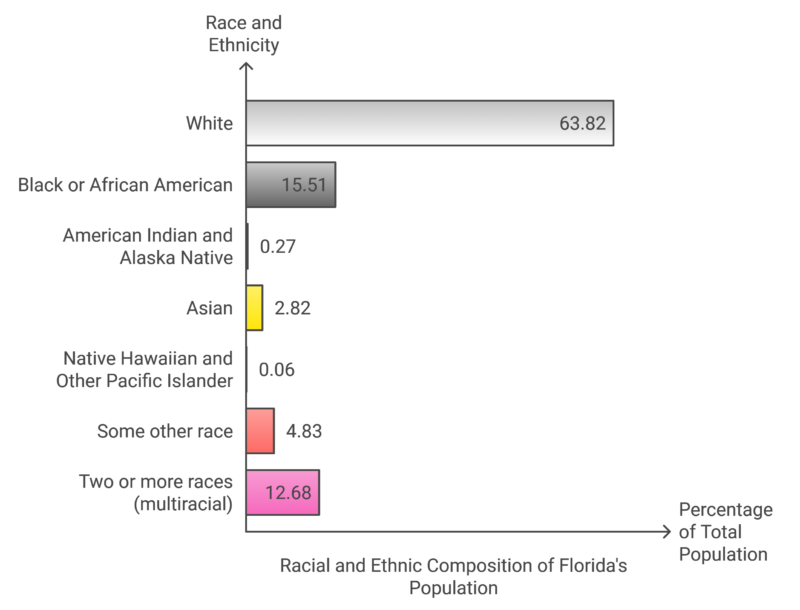

4. Ethnic and Racial Composition

This data illustrates Florida’s racial diversity, with the majority group being White at 63.82%, accounting for approximately 13.8 million residents.

Black or African American individuals make up the second-largest group at 15.51%, followed by multiracial individuals, who comprise 12.68% of the population.

This substantial multiracial population highlights Florida’s increasingly mixed demographic landscape.

While smaller in percentage, the Asian community makes up 2.82%, and “some other race” comprises 4.83%, reflecting additional diversity within the state. Native groups, including American Indian, Alaska Native, Native Hawaiian, and Pacific Islander, represent less than 1% combined, showing smaller populations in these categories.

5. Counties of Florida 2025

County

Population

Growth Rate

Area (sq mi)

Population Density (per sq mi)

Miami-Dade County

2,700,678

0.19%

733

1,421

Broward County

1,978,173

1.79%

464

1,644

Hillsborough County

1,557,655

6.23%

395

1,523

Palm Beach County

1,547,735

3.58%

758

788

Orange County

1,491,071

4.15%

349

1,651

Duval County

1,044,633

4.7%

295

1,369

Pinellas County

961,400

0.17%

106

3,509

Polk County

848,278

16.18%

694

472

Lee County

846,755

10.61%

301

1,084

Brevard County

657,251

7.96%

392

648

Pasco County

656,851

16.02%

288

879

Volusia County

601,049

8.15%

425

546

Seminole County

489,919

3.92%

119

1,585

Sarasota County

475,474

8.99%

215

855

Osceola County

453,025

15.82%

513

341

Manatee County

453,021

12.8%

287

610

Lake County

438,834

13.62%

367

461

Marion County

423,481

12.19%

613

267

Collier County

411,104

8.96%

771

206

St. Lucie County

388,286

17.15%

221

679

St. Johns County

333,148

20.23%

232

554

Escambia County

329,996

2.3%

254

502

Leon County

296,544

0.88%

258

444

Alachua County

287,947

2.93%

338

329

Clay County

238,244

8.81%

234

394

Okaloosa County

220,464

3.95%

359

237

Hernando County

218,679

11.79%

183

462

Charlotte County

209,686

11.54%

263

308

Santa Rosa County

208,125

10.11%

391

206

Bay County

196,328

12.49%

293

259

Indian River County

172,323

7.4%

194

343

Citrus County

170,884

10.56%

225

294

Martin County

164,643

3.76%

210

303

Sumter County

158,363

21.55%

215

284

Flagler County

136,120

17.32%

188

280

Highlands County

109,579

8.12%

393

108

Nassau County

105,176

15.54%

251

162

Walton County

89,304

17.6%

401

86

Monroe County

79,610

-3.91%

379

81

Putnam County

77,174

5.18%

281

106

Columbia County

74,256

6.48%

308

93

Jackson County

48,989

4.02%

354

53

Levy County

47,837

11.1%

432

43

Suwannee County

46,855

7.65%

266

68

Hendry County

45,275

13.98%

446

39

Gadsden County

44,273

1.99%

199

86

Okeechobee County

42,481

7.13%

297

55

Wakulla County

37,729

11.32%

234

62

DeSoto County

36,638

7.49%

246

58

Baker County

28,950

2.97%

226

49

Bradford County

28,420

0.7%

113

97

Hardee County

25,869

2.09%

246

41

Washington County

25,799

1.89%

226

44

Taylor County

21,851

0.5%

403

21

Holmes County

20,235

3.36%

185

42

Gilchrist County

20,172

12.81%

135

58

Madison County

18,808

5.25%

269

27

Dixie County

17,810

6.73%

272

25

Gulf County

16,087

12.82%

213

29

Jefferson County

15,831

9.95%

231

26

Union County

15,550

0.81%

94

64

Hamilton County

13,748

0.14%

198

27

Calhoun County

13,475

-1.69%

219

24

Glades County

13,109

8.54%

312

16

Franklin County

12,696

1.83%

210

23

Lafayette County

8,379

1.96%

210

15

Liberty County

7,799

-0.06%

323

9

6. Employment Rates

Job Openings and Labor Turnover for Florida (Seasonally Adjusted, in Thousands)

Estimate

July 2023

April 2024

May 2024

June 2024

July 2024 (p)

Change from June 2024 to July 2024 (p)

Job Openings

572

508

498

504

513

+9

Hires

399

404

372

369

354

-15

Total Separations

367

384

358

298

372

+74

Quits

271

290

206

205

268

+63

Layoffs & Discharges

80

74

134

80

94

+14

In July 2024, job openings in Florida rose by 9,000 from the previous month, indicating steady labor demand. However, hires decreased by 15,000, potentially reflecting hiring slowdowns or challenges in finding qualified candidates according to BLS.

In July 2024, Florida boasted the lowest statewide unemployment rate of the top 10 largest states in the nation. We added over 200,000 private sector jobs over-the-year in Florida, far outpacing the national rate of job creation. And, for the 45th month in a row, Florida’s… pic.twitter.com/IybET0FtQm

— Ron DeSantis (@GovRonDeSantis) August 16, 2024

Separations saw a significant increase (+74,000), driven primarily by an increase in quits (+63,000), which may suggest rising voluntary turnover as workers seek better opportunities or conditions. Layoffs and discharges also increased by 14,000, signaling potential instability in certain industries.

Job Openings and Labor Turnover Rates for Florida (Seasonally Adjusted, in Percent)

Estimate

July 2023

April 2024

May 2024

June 2024

July 2024 (p)

Change from June 2024 to July 2024 (p)

Job Openings Rate

5.5%

4.9%

4.8%

4.8%

4.9%

+0.1%

Hires Rate

4.1%

4.1%

3.7%

3.7%

3.5%

-0.2%

Total Separations Rate

3.8%

3.9%

3.6%

3.0%

3.7%

+0.7%

Quits Rate

2.8%

2.9%

2.1%

2.1%

2.7%

+0.6%

Layoffs & Discharges Rate

0.8%

0.7%

1.3%

0.8%

0.9%

+0.1%

The job openings rate in Florida slightly increased from 4.8% to 4.9% in July, indicating continued demand for workers.

The hires rate dropped by 0.2%, aligning with the observed decline in hires, while the total separations rate rose by 0.7%, with significant increases in both the quits and layoffs/discharges rates.

The rise in the quits rate to 2.7% suggests greater confidence among workers to voluntarily leave positions, while the increase in layoffs and discharges rate may signal restructuring or economic adjustments in some sectors.

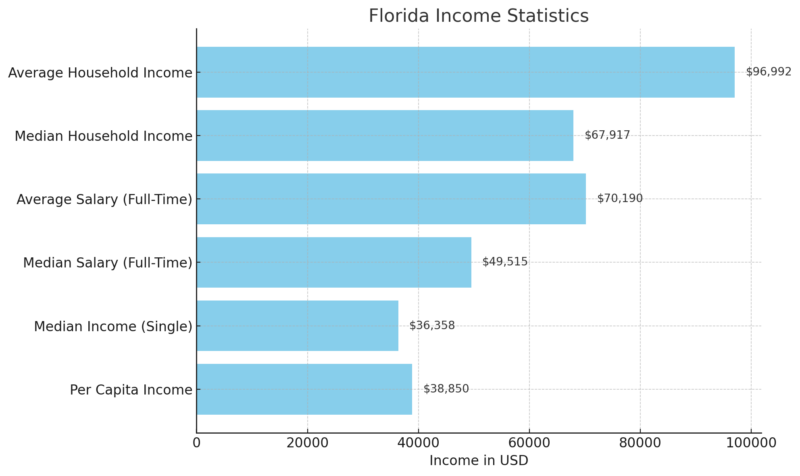

7. Florida Income Statistics (Households and Individuals)

Florida’s average household income and median household income are slightly lower than the national averages, reflecting economic conditions that may vary from other parts of the U.S.

While full-time workers in Florida have a relatively high average salary of $70,190, individual incomes for single households are generally lower, aligning with a slightly lower cost of living in some parts of the state according to incomebyzipcode.

Richest Zip Codes in Florida (2025)

Rank

Zip Code

Population

Mean Income

Median Household Income

1

33109

792

$900,203

$250,001

2

33480

10,853

$333,795

$163,929

3

33158

6,536

$284,824

$177,917

4

33149

14,639

$264,439

$169,792

5

32963

15,117

$248,440

$143,438

6

34102

10,767

$243,094

$111,742

7

33156

32,582

$231,573

$133,862

8

34228

7,479

$226,348

$141,250

9

33629

26,625

$223,527

$152,044

10

34103

11,214

$223,130

$99,615

The wealthiest zip codes in Florida, led by 33109, showcase significant income levels with mean incomes above $200,000 across the top ten.

This reflects concentrated wealth, often in coastal or high-demand urban areas, where luxury housing and exclusive communities contribute to high average and median incomes.

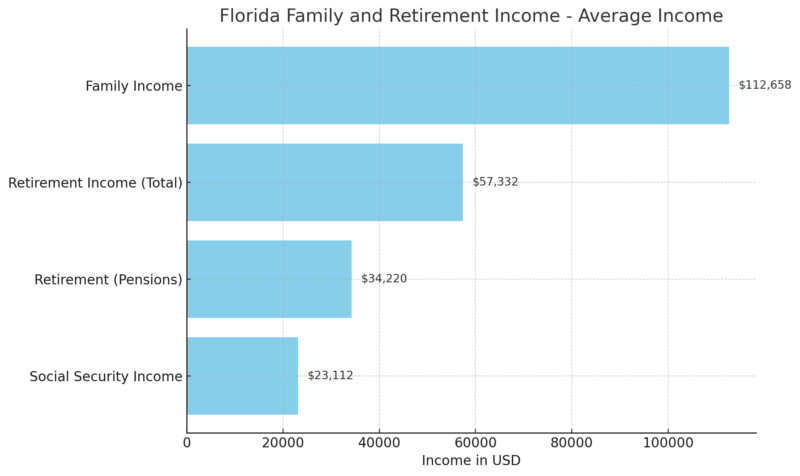

Florida Family and Retirement Income

Family incomes are generally higher than individual or single-person incomes, with family households averaging $112,658. Retirement income averages $57,332, showing reliance on both pensions and Social Security for retired individuals. This dual income is essential to meet cost-of-living demands in Florida, especially in areas with rising housing costs.

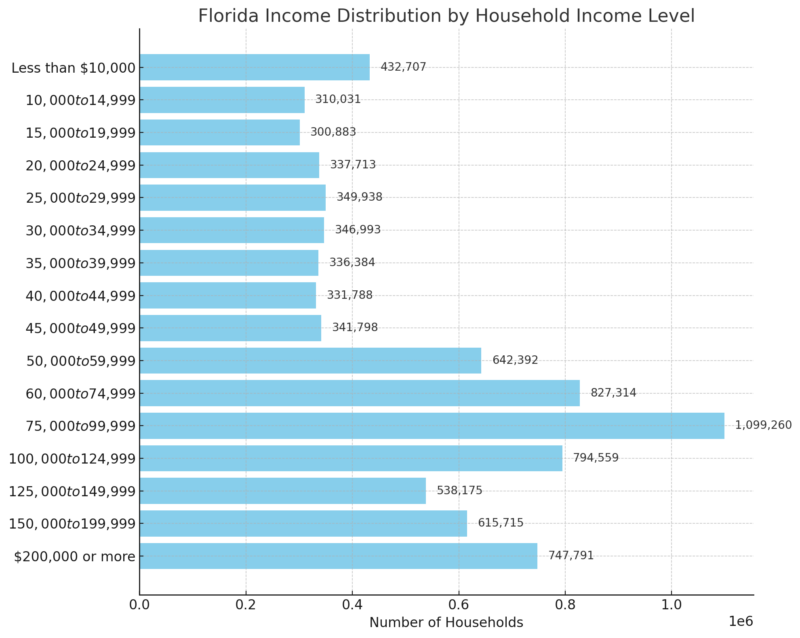

Florida Income Distribution (by Household Income Level)

Florida’s income distribution is relatively spread out, with the largest share (13%) of households earning between $75,000 and $99,999.

Higher income brackets (over $200,000) represent 9% of households, showing that a substantial portion of Floridians fall into middle-income ranges.

This distribution suggests economic diversity, with a mix of low-, middle-, and high-income households across the state.

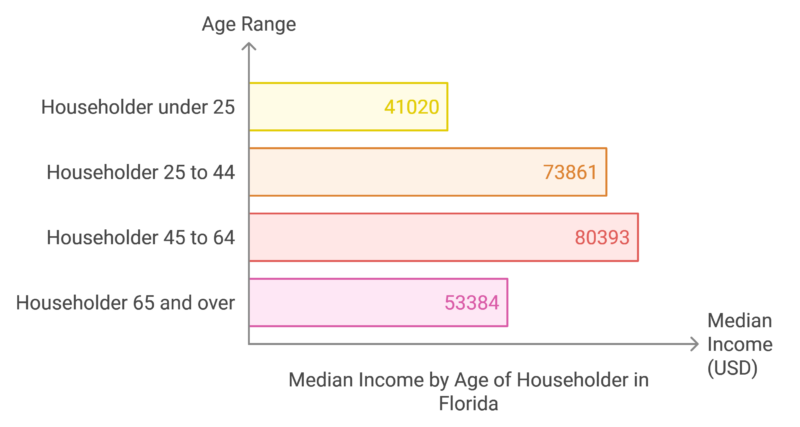

Median Income by Age of Householder in Florida

Median incomes in Florida vary significantly by age, with younger householders (under 25) earning less on average, likely due to entry-level jobs. Income peaks for householders aged 45 to 64, aligning with career advancement and higher earning potential.

For those aged 65 and over, the median income decreases to $53,384, reflecting retirement income and the shift away from active employment. This income trend by age is typical, as earnings tend to peak in mid-career and decline in retirement.

8. Education Levels

Metric

2023

2024

Change

Schools earning “A” or “B”

57% (1,961 schools)

64% (2,196 schools)

+7 percentage points

Schools earning “D” or “F”

6% (211 schools)

Less than 4% (113 schools)

-2 percentage points

Schools increasing grade or maintaining an “A”

N/A

1,761 schools (53%)

N/A

Elementary schools earning an “A”

N/A

Increased by 4%

+4 percentage points

Middle schools earning an “A”

N/A

Increased by 7%

+7 percentage points

High schools earning an “A”

N/A

Increased by 10%

+10 percentage points

Combination schools earning an “A”

N/A

Increased by 7%

+7 percentage points

Charter schools earning “A” or “B”

N/A

69% of 602 schools

N/A

FLDOE notes that The 2024 school grades reflect notable improvements across Florida schools, with a 7% increase in schools achieving top grades (“A” or “B”) and a reduction in schools with lower grades (“D” or “F”).

The performance improvements span elementary, middle, and high schools, with high schools showing the most substantial increase in “A” grades (+10 percentage points). Charter schools also saw strong performance, with 69% earning “A” or “B” grades. This trend suggests positive responses to the state’s educational policies and grading adjustments.

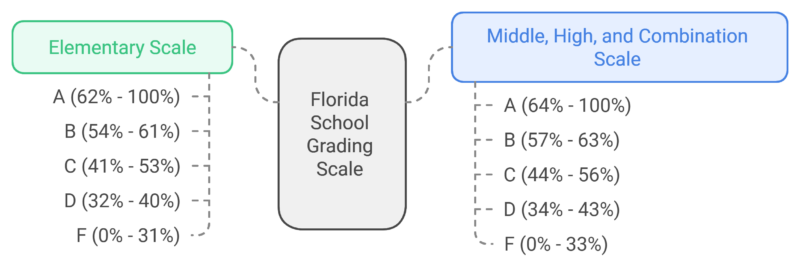

2024 School Grading Scale by School Type

The updated grading scale considers variations across school types, using a slightly higher threshold for middle, high, and combination schools to achieve each grade level.

This nuanced approach aims to provide a more accurate reflection of school performance based on the specific components assessed in different school types, ensuring that grade assignments are appropriate for the educational context of each school.

Education Metrics (2025)

Education Level

Metric

Value

National Rank

Higher Education

2-Year College Graduation Rate

62.90%

No. 2

4-Year College Graduation Rate

74.30%

No. 2

Educational Attainment

44.50%

No. 25

Debt at Graduation

$13,872

No. 26

Tuition and Fees

$4,613

No. 1

Pre-K-12

College Readiness

20.15%

No. 5

High School Graduation Rate

87.30%

No. 19

NAEP Math Scores

271.20

No. 32

NAEP Reading Scores

259.63

No. 21

Preschool Enrollment

49.30%

No. 12

US News states that Florida excels in higher education, ranking No. 1 for lowest tuition and fees and No. 2 for graduation rates at both two-year and four-year institutions, demonstrating strong affordability and completion. However, educational attainment and debt at graduation are mid-ranked, indicating moderate outcomes in higher-level credentials and student debt.

In K-12 education, Florida performs well in college readiness (No. 5) and preschool enrollment (No. 12), yet ranks lower for eighth-grade math (No. 32) and reading scores (No. 21). High school graduation is stable at No. 19, showing consistent secondary education outcomes but room for improvement in academic proficiency.

9. Health Statistics

Population, Income, and Health Coverage in Florida

Category

Florida Value

U.S. Average

Population (2023)

22,975,900

–

Below 200% FPL (2023)

29.5%

28.2%

Uninsured Population (2023)

2,357,500 (10.7%)

8.0%

Immigrant Share of Population

22.3%

14.5%

Noncitizen Immigrants

9.6%

6.9%

Adults with Medical Debt (2019-21)

1,500,000 (8.7%)

8.6%

Florida has a relatively high uninsured rate of 10.7%, surpassing the national average of 8.0%, which reflects coverage challenges for lower-income residents. Florida also has a significant immigrant population (22.3%), influencing healthcare accessibility and needs as per KFF.

Medical debt affects 8.7% of adults in Florida, mirroring national levels but highlighting ongoing financial strain related to healthcare expenses.

Tracking deaths and death rates is essential for understanding trends and identifying prevention strategies for those most at risk.

In 2022, Alachua County had an age-adjusted death rate from all causes of 767.4 per 100,000 people, slightly higher than the state average of 738.1 per 100,000 in Florida.

The data includes all ages, using an upper age limit of 999 to capture the oldest individuals.

The accompanying map uses quartiles to display county data visually, a method applied when there is data available for at least 51 counties.

Medicaid and CHIP in Florida

Metric

Florida

U.S. Average

Medicaid & CHIP Enrollment (Jun 2024)

3.8 million

–

Medicaid Spending (2022)

$34.6 billion

–

Federal Share of Medicaid Costs

65.2%

–

Medicaid & CHIP Eligibility Limits (% FPL)

– Parents (Family of 3)

27.0%

138.0%

– Other Adults

0.0%

138.0%

– Pregnant Women

N/A

214.0%

– Children

215.0%

255.0%

Florida’s Medicaid eligibility thresholds are significantly lower than national averages, especially for adults, with no coverage for non-disabled, non-elderly adults.

Despite having 3.8 million enrollees, these strict eligibility limits leave many low-income individuals without access to Medicaid, increasing uninsured rates.

The federal government’s contribution to Medicaid costs in Florida (65.2%) alleviates some state expenses, but the gap in coverage due to limited eligibility remains a concern.

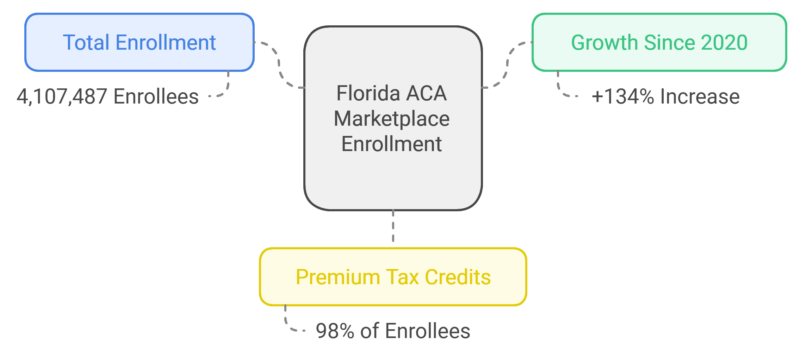

ACA Marketplace Coverage in Florida (2025)

The ACA Marketplace has become a vital source of coverage in Florida, with enrollment growing by 134% since 2020.

Nearly all enrollees benefit from premium tax credits, underscoring the importance of financial assistance for affordability.

This high level of enrollment demonstrates Florida’s reliance on the ACA Marketplace for bridging gaps in coverage, especially given the state’s lower Medicaid eligibility.

Employer-Sponsored Insurance in Florida

Metric

Florida

U.S. Average

Average Annual Premium (Family Coverage, 2023)

$23,597

–

Average Deductible (Family Coverage, 2023)

$3,751

$3,811

Employer-sponsored insurance is a significant source of coverage in Florida, yet the average premium for family coverage is high at $23,597, potentially straining household budgets. Florida’s average deductible of $3,751 is slightly below the national average but still substantial.

These costs highlight the financial burden of private insurance, especially for families who may face additional healthcare-related expenses.

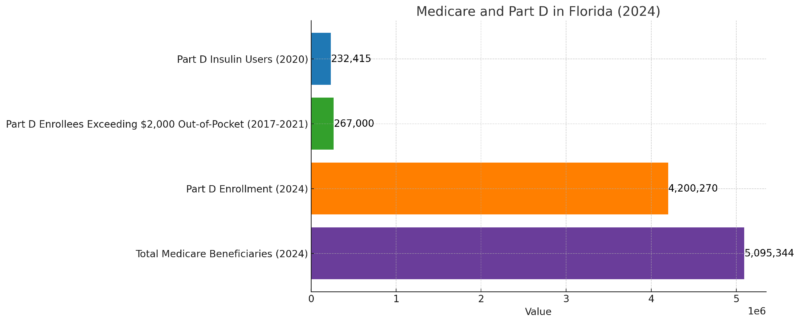

Medicare and Part D in Florida

Florida has one of the largest Medicare populations in the U.S., with over 5 million beneficiaries. Part D enrollment is high, with significant out-of-pocket expenses for prescription drugs, as seen in the 267,000 enrollees who exceeded $2,000 annually.

The $35 monthly cap on insulin under the Inflation Reduction Act provides important cost relief for the 232,415 insulin users in Florida, addressing one of the most common medication expenses for Medicare beneficiaries.

10. Migration Patterns

According to the Florida Chamber Foundation, the state expects an influx of 225,000 to 275,000 new residents in 2024. This is largely due to its desirable climate, no state income tax, and favorable job market.

Major metropolitan areas in Florida, including Lakeland-Winter Haven and Port St. Lucie, rank among the fastest-growing in the country. People relocating from other states seek a better quality of life and lower living costs, prompting urban expansion. This migration drives the demand for housing and infrastructure, presenting both opportunities and challenges for urban planning.

Methodology

This article was crafted by analyzing and synthesizing data from multiple reputable sources, including census reports, healthcare surveys, economic analyses, and demographic projections. Primary sources included the U.S. Census Bureau for population and demographic insights, the Kaiser Family Foundation (KFF) for health coverage and Medicaid data, and the Bureau of Labor Statistics (BLS) for employment rates. Education statistics and affordability metrics were referenced from U.S. News rankings and the Florida Department of Education.

We aimed to present Florida’s current population, health, economic, and social data in a balanced, fact-based manner. Data points were selected based on their relevance to recent trends and projections, focusing on population growth, healthcare coverage, employment, and income distribution.

Where available, the latest data from 2023-2025 was prioritized to provide a current perspective. The article is organized to offer insights by theme, with summaries and key takeaways to assist readers in navigating complex demographic and socioeconomic information.

References

- World Population Review – Florida Population 2024

- Census.gov – Florida

- Neilsberg – Median Age Florida, Population By Race

- BLS – Florida Job Openings

- Inomebyzipcode – Florida Income Statistics for 2024

- Fldoe.org – Florida Department of Education Announces 2024 School Grades Under New School Grading Scale

- US News – Yes, Florida Is No. 1 in the Country for Education. Here’s Why.

- KFF – Health Care in Florida

- Flchamber – Breaking Down Migration In and Out of Florida