As of 2025, there is no federal requirement to have health insurance in the United States. However, five states and the District of Columbia legally require residents to maintain health insurance coverage or face a state-level tax penalty.

Those jurisdictions are California, New Jersey, Rhode Island, Massachusetts, and Washington, D.C. Vermont has an individual mandate on paper but does not impose a financial penalty.

In every other state, health insurance is optional under the law, even though it may still be strongly encouraged.

This distinction matters because state mandates are enforced through state tax systems, not the IRS. If you live in one of these jurisdictions and go without qualifying coverage, the financial consequences can be substantial and recurring.

The Individual Mandate Explained, Briefly But Precisely

The individual mandate originated under the Affordable Care Act as a mechanism to stabilize insurance markets. By requiring both healthy and sick individuals to enroll, insurers could spread risk more evenly, keeping premiums lower overall.

From 2014 through 2018, Americans without qualifying health insurance faced a federal tax penalty.

That federal penalty was set at the higher of $695 per uninsured adult or 2.5 percent of household income, capped at the national average cost of a bronze-level plan.

In late 2017, Congress eliminated the penalty effective in 2019, according to NCBI. The legal requirement technically remains in the ACA, but without a penalty, it has no enforcement mechanism.

States, however, were free to create their own mandates. Several did, largely to protect their insurance markets and fund reinsurance programs that help keep premiums stable.

States That Still Require Health Insurance in 2025

California

California has enforced its own individual mandate since January 1, 2020. All residents, including dependents, must maintain minimum essential coverage for the full calendar year unless they qualify for an exemption according to the FTB.

For the 2023 tax year, which determines penalties assessed in 2024 and informs enforcement patterns in 2025, California’s penalty structure mirrors the former federal model. The penalty is the higher of $900 per uninsured adult and $450 per dependent child, or 2.5 percent of household income above the state filing threshold.

The Franchise Tax Board calculates the amount automatically when residents file their state return.

Exemptions exist for short coverage gaps, unaffordable coverage, certain hardships, members of health care sharing ministries, and individuals with very low income. Coverage purchased through Covered California, employer-sponsored plans, Medicare, Medicaid, and most student health plans all satisfy the requirement.

California uses penalty revenue to help fund state subsidies that reduce marketplace premiums, particularly for middle-income households that do not qualify for federal assistance.

New Jersey

New Jersey enacted the Health Insurance Market Preservation Act in 2018, with enforcement beginning in 2019. The law applies only to residents who are required to file a New Jersey income tax return.

Residents must maintain qualifying coverage for themselves and their dependents or pay a shared responsibility payment when filing state taxes. The penalty is based on income and household size and is capped at the average cost of a bronze-level plan in New Jersey.

The state allows exemptions for brief coverage gaps, unaffordable plans, income below the filing threshold, incarceration, certain religious affiliations, hardship circumstances, and time spent living abroad.

Unlike some states, New Jersey explicitly limits penalties to months in which coverage was absent, rather than imposing an annual flat assessment.

New Jersey directs penalty revenue into a reinsurance program that has consistently lowered individual-market premiums compared to pre-mandate levels.

Rhode Island

Rhode Island’s individual mandate took effect in January 2020 and applies to all residents who can afford coverage.

For the ax year, the penalty is calculated as the higher of 2.5 percent of household income, after deductions, or $695 per uninsured adult and $347.50 per uninsured child. The total percentage-based penalty cannot exceed the average annual cost of a bronze-tier plan sold through the state marketplace.

Rhode Island’s system is notable for its detailed monthly proration. Each uncovered month counts as one-twelfth of the annual penalty. However, a short coverage gap of one or two consecutive months is fully exempt, a provision designed to accommodate job transitions.

Penalty revenue supports state affordability programs and helps stabilize HealthSource RI’s risk pool.

Massachusetts

Massachusetts has the oldest individual mandate in the country, predating the ACA by several years. Residents aged 18 and older must maintain coverage that meets minimum creditable coverage (MCC) standards throughout the year.

Unlike most other states, Massachusetts applies the mandate regardless of whether an individual is required to file a state tax return. The penalty is assessed monthly and increases with income, age, and length of time uninsured. However, it is capped at half the cost of the lowest-priced plan available to the individual.

Curious about your potential health insurance costs? Use the Health Connector’s “Get an Estimate” tool to see what plans you qualify for and how much you can save.

Get started today at https://t.co/ADAUTLkJRj #GetCovered pic.twitter.com/g8AOPKef63— Massachusetts Health Connector (@HealthConnector) October 11, 2024

Short gaps of up to three consecutive months are exempt. Additional exemptions apply when coverage is deemed unaffordable under the Massachusetts Health Connector affordability schedule, or when income falls below 150 percent of the federal poverty level.

Massachusetts suspended enforcement when the federal penalty was active and resumed it once the federal penalty dropped to zero.

District of Columbia

Washington, D.C., enforces its mandate through DC Health Link, the district’s marketplace. Residents of all ages must have qualifying coverage, and even a single day of coverage in a month counts as insured for that month.

For a full year without coverage, the penalty is the higher of 2.5 percent of income above the DC filing threshold, or $745 per uninsured adult and $372.50 per uninsured child, with a family cap of $2,235 under the flat-fee method according ot the Healthinsurance.

As with other states, percentage-based penalties are capped at the average cost of a bronze-level plan.

Exemptions are available for low income, religious objections, hardship, and unaffordable coverage, with some exemptions claimed on the tax return and others processed through DC Health Link.

Vermont’s Mandate without A Penalty

Vermont technically requires residents aged 18 and older to have health insurance, but there is no financial penalty for noncompliance. The law functions primarily as a reporting requirement.

Residents must indicate whether they had coverage when filing state taxes, but no payment is assessed if they did not.

In practical terms, Vermont does not enforce health insurance coverage through punitive measures, making it an outlier among mandate states.

States Without Health Insurance Mandates

In every other U.S. state, there is no legal requirement to carry health insurance in 2025. Residents can go uninsured without facing state or federal tax penalties. This includes large states such as Texas, Florida, New York, and Pennsylvania.

That said, the absence of a mandate does not mean coverage is risk-free to forgo. Medical debt remains one of the leading causes of financial distress in the U.S., and uninsured individuals pay substantially higher out-of-pocket costs when care is needed.

How Penalties Compare Across Mandate States

Location

Mandate in effect

Penalty structure

Monthly proration

Bronze plan cap

California

Yes

$900 per adult or 2.5% income

Yes

Yes

New Jersey

Yes

Income and household-based

Yes

Yes

Rhode Island

Yes

$695 per adult or 2.5% income

Yes

Yes

Massachusetts

Yes

Income and age-based

Yes

Yes

Washington, D.C.

Yes

$745 per adult or 2.5% income

Yes

Yes

Vermont

Yes (no penalty)

None

N/A

N/A

Employer Coverage And HRAs Under State Mandates

@cjnlegalnurse 9/4/25 Health coverage costs are about to hit their highest spike since 2010 🚨 Employers brace for a 6.5% jump in 2026, and workers could be paying more out-of-pocket. #HealthcareCrisis #NursingPerspective #HealthInsurance #fyp #creatorsearchinsights ♬ original sound – Cambria Nwosu, DNP, RN, LNC

Most people who have employer-sponsored group health insurance automatically satisfy state mandates. Problems arise primarily for workers at small or midsize employers that do not offer group plans.

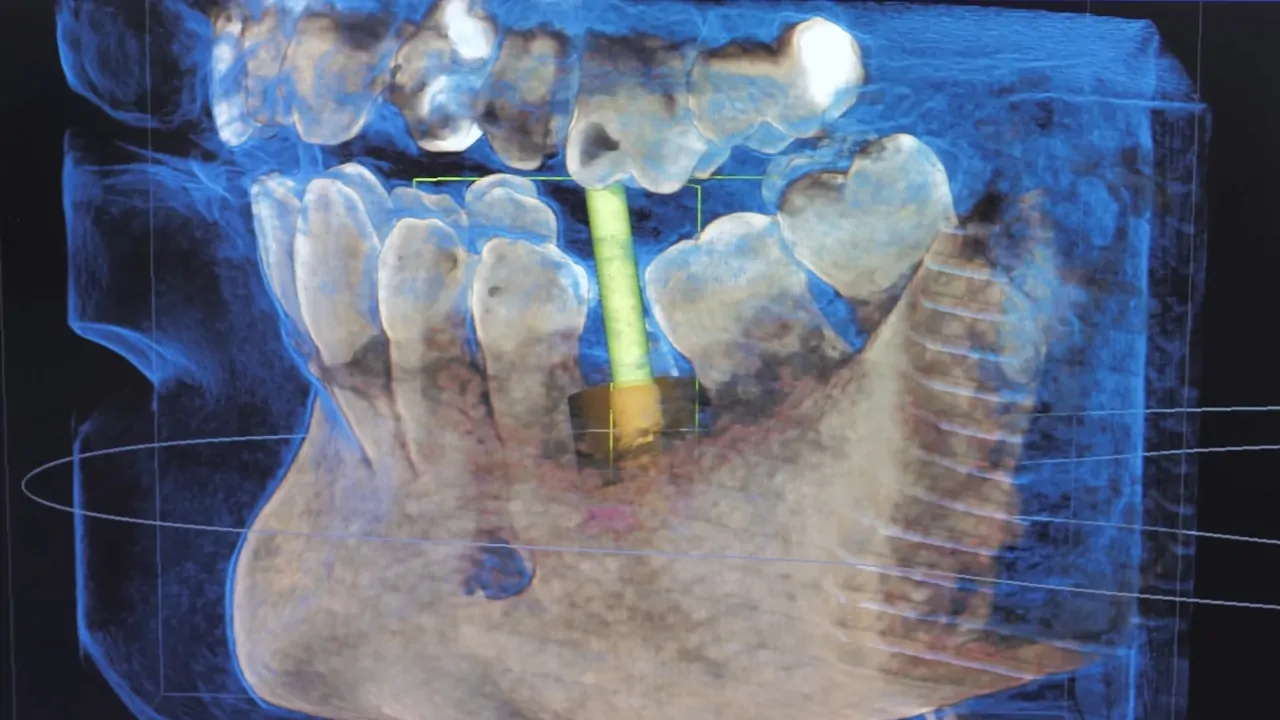

In those cases, stand-alone health reimbursement arrangements, specifically ICHRA and QSEHRA, have become a common compliance tool. These arrangements allow employers to reimburse employees for individual health insurance premiums and qualifying medical expenses on a tax-free basis.

Participation in an ICHRA or QSEHRA generally requires the employee to maintain qualifying individual coverage, which in turn satisfies state mandate requirements. From a compliance standpoint, the key issue is affordability.

If an employer’s HRA allowance is deemed affordable under federal rules, employees typically cannot claim premium tax credits on the marketplace. If it is unaffordable, different coordination rules apply depending on the type of HRA.

While HRAs are not mandatory, they have become one of the more practical ways for employers to support coverage without sponsoring a traditional group plan, particularly in states with individual mandates.

Why State Mandates Still Exist

States that retained or adopted mandates did so primarily for economic reasons rather than ideological ones. Insurance markets function best when enrollment includes a broad mix of risk profiles.

Without a mandate, healthier individuals are more likely to opt out, driving up premiums for everyone else.

Penalty revenue is also used strategically. In California, New Jersey, and Rhode Island, mandate funds help finance reinsurance programs that reduce insurer risk and stabilize premiums.

In practical terms, residents in mandate states often pay lower average individual-market premiums than they otherwise would.

Bottom Line

In 2025, only California, New Jersey, Rhode Island, Massachusetts, and Washington, D.C. actively require health insurance coverage with enforceable penalties. Vermont has a mandate without consequences.

Everywhere else, health insurance is legally optional. Private plans often offer broader provider access, while public options prioritize standardized benefits and income-based eligibility.

If you live in a mandate state, coverage decisions directly affect your state tax liability. If you do not, the decision is purely financial and medical rather than legal. Understanding where your state stands is essential because once penalties are assessed, they are difficult to reverse retroactively.

Related Posts:

- Private vs. Public Health Insurance - Which Covers…

- Which States Have the Highest and Lowest Income Tax in 2025?

- Which U.S. States Have the Most People Aged 85 and Older?

- Health Insurance Coverage - National Health…

- US Health Insurance System Is Driving Americans to the Brink

- US States With the Highest Homeowners Insurance…