The Lebanese Pound (LBP) currently holds the record as the lowest-value currency in the world, with street rates hitting between 91,000 and 150,000 LBP for 1 USD in 2025. It has even surpassed the Iranian Rial in devaluation due to severe hyperinflation and economic collapse.

Following closely are currencies like the Iranian Rial, Vietnamese Dong, and Sierra Leonean Leone, all trading in the tens to hundreds of thousands per dollar.

Currencies drop in value primarily due to inflation, unstable political environments, economic mismanagement, and sanctions. This means ordinary citizens often need bags of cash for simple purchases, while savings rapidly lose value.

Table of Contents

Toggle1. Lebanese Pound (LBP)

Lebanon’s currency collapse is a visible outcome of decades of corruption, sectarian deadlock, and poor economic planning. Since 2019, the LBP has lost more than 98% of its value as hyperinflation surged beyond 150–200% annually according to the World Bank.

The collapse started when the Banque du Liban could no longer sustain the LBP’s peg to the USD due to drained foreign reserves, a result of subsidized imports and unproductive debt-fueled spending. Political inaction has paralyzed reforms, while the 2020 Beirut port explosion destroyed key infrastructure and trust in governance.

Remittances from the diaspora, once a stabilizing force, slowed as global economic conditions tightened, leading to further USD shortages. Families now face skyrocketing food, fuel, and medical costs, while wages paid in LBP lose value within days. Landlords and merchants demand USD, and black-market rates dictate daily life.

Unemployment has soared past 40%, pushing 80% of the population into poverty, while basic services collapse under power outages, water shortages, and hospital closures, trapping the nation in a humanitarian crisis layered over its currency collapse.

Metric

Value

Street Rate (2025)

91,000–150,000 LBP = 1 USD

Inflation (2025 est.)

150–200%

GDP (nominal)

~ USD 17 billion

Unemployment

40–45%

Foreign Reserves

Critically low

Main Economic Issues

Banking collapse, corruption, and political paralysis

2. Iranian Rial (IRR)

Iran’s currency has suffered under the weight of international sanctions, mismanagement, corruption, and economic isolation for decades, as noted by Al Jazeera. The Iranian Rial has two rates: an official rate (~420,000 IRR per USD) and a street rate that has crossed 1,000,000 IRR per USD in 2025, reflecting market realities amid sanctions and shortages.

Iran’s heavy dependence on oil exports has left it vulnerable to price fluctuations and trade restrictions, cutting off crucial foreign currency inflows. Inflation, often 35–50% annually, is fueled by government money printing to cover deficits while trying to maintain fuel and bread subsidies for a population facing high living costs.

Political instability, paired with deep-rooted corruption, undermines foreign investment and domestic business confidence.

The economy’s informal dollarization creates parallel markets, where imported medicines and electronics are unaffordable for many Iranians, while middle-class savings in Rial lose value rapidly. The government has discussed redenomination for years, but deeper reforms remain stalled, keeping the Rial trapped in a downward spiral.

Metric

Value

Official Rate (2025)

~420,000 IRR = 1 USD

Street Rate (2025)

1,000,000+ IRR = 1 USD

Inflation (2025 est.)

35–50%

GDP (nominal)

~ USD 370 billion

Unemployment

~11% (underreported)

Foreign Reserves

Limited and partially inaccessible

Main Economic Issues

Sanctions, oil dependency, and corruption

3. Vietnamese Dong (VND)

BREAKING 🚨: Vietnam

The Vietnamese Dong has fallen to an all-time low against the U.S. Dollar pic.twitter.com/7VqikXRFqC

— Barchart (@Barchart) May 25, 2024

Vietnam’s Dong remains low in numerical value (24,500–26,000 VND per USD), but unlike others, it is not collapsing. This low unit value is a result of historical issuance practices rather than hyperinflation or structural collapse.

Vietnam’s economy is one of the fastest-growing in Asia, with consistent GDP growth rates of 6–7% annually, driven by manufacturing, exports, and foreign direct investment. Inflation is controlled, averaging 3–4% in recent years, while the government maintains stability without redenominating the Dong.

Vietnam’s foreign reserves ($130 billion) and strong export sectors in electronics, textiles, and agriculture support currency stability.

The low denomination does not significantly affect daily transactions internally, but for visitors, it requires handling large amounts of currency for routine purchases. This stability, despite a low unit value, demonstrates how a currency can remain “weak” in digits while the economy thrives in practical terms.

Metric

Value

Rate (2025)

24,500–26,000 VND = 1 USD

Inflation (2025 est.)

3–4%

GDP (nominal)

~ USD 433 billion

Unemployment

~2.3%

Foreign Reserves

~ USD 130 billion

Main Economic Strengths

Export-driven, stable policy, FDI

4. Sierra Leonean Leone (SLL)

The Leone is among the weakest currencies globally, trading at around 19,750–22,800 SLL per USD, driven by structural economic weaknesses, political instability, and high inflation.

Sierra Leone relies heavily on mining exports (diamonds, gold, bauxite) but has struggled with low global commodity prices, inadequate diversification, and poor infrastructure.

Inflation rates have hovered between 30–40% as the government grapples with fiscal deficits and external debt servicing challenges, the World Bank noted.

Political instability and governance challenges have limited foreign investment and hindered economic reforms, while the country’s dependency on imports for fuel and food puts continuous pressure on its foreign reserves.

These factors collectively undermine confidence in Leone, forcing locals to use USD when possible while enduring daily price volatility on essential goods.

Metric

Value

Rate (2025)

19,750–22,800 SLL = 1 USD

Inflation (2025 est.)

30–40%

GDP (nominal)

~ USD 4 billion

Unemployment

~15–20% (youth higher)

Foreign Reserves

Very limited

Main Economic Issues

Dependency on mining, import reliance

5. Laotian Kip (LAK)

Laos’ Kip, at around 21,600–21,624 LAK per USD, has depreciated due to rising inflation, trade imbalances, limited foreign reserves, and reliance on imported fuel and goods. Inflation in Laos rose to nearly 28% in 2025 as global energy prices and local inefficiencies strained household purchasing power.

The economy heavily depends on hydropower and raw material exports, with limited diversification, making it vulnerable to external shocks. Foreign investment has grown in sectors like hydropower and agriculture, but the lack of infrastructure, currency management issues, and debt to China for Belt and Road projects contribute to pressure on the Kip.

The government has tried to stabilize the Kip by controlling exchange markets and import licensing, but persistent trade deficits undermine these efforts.

Metric

Value

Rate (2025)

21,600–21,624 LAK = 1 USD

Inflation (2025 est.)

28%

GDP (nominal)

~ USD 17 billion

Unemployment

~20%

Foreign Reserves

Low and pressured

Main Economic Issues

Import dependence, limited diversification

6. Indonesian Rupiah (IDR)

The Rupiah, trading around 16,500–16,540 IDR per USD, has a low numeric value primarily due to historical reasons, not economic collapse. Indonesia’s economy is Southeast Asia’s largest, with a GDP exceeding $1.5 trillion and stable growth rates of 5% annually. Inflation remains under control (2.5–3%) as the central bank balances growth with currency stability.

The Rupiah’s low denomination reflects historical inflation episodes in the 1960s but does not signal present instability. Indonesia has substantial foreign reserves (~$130 billion) and a diversified economy driven by manufacturing, services, and a growing digital sector.

However, it still faces challenges such as infrastructure gaps, corruption, and reliance on commodity exports like coal and palm oil, which can influence foreign exchange pressures during global market volatility.

Metric

Value

Rate (2025)

16,500–16,540 IDR = 1 USD

Inflation (2025 est.)

2.5–3%

GDP (nominal)

USD 1.5 trillionD

Unemployment

~5%

Foreign Reserves

USD 130 billion

Main Economic Strengths

Diversified economy, stable policies

7. Uzbekistani Som (UZS)

The Uzbekistani Som, trading around 12,600–12,925 UZS per USD in 2025, represents a case of controlled, gradual devaluation during economic transition rather than collapse.

Since gaining independence from the Soviet Union, Uzbekistan has shifted from a closed, state-controlled economy to a market-oriented one, gradually liberalizing its foreign exchange regime and reducing reliance on black-market rates.

Inflation remains high compared to developed markets, around 10–12% in 2025, as subsidies on energy and food are phased out and import costs remain significant.

However, this inflation is paired with GDP growth of 5–6% annually, driven by natural gas, gold, and cotton exports, along with growing sectors like tourism and textiles.

Structural issues persist, including underdeveloped infrastructure, state control in key sectors, and bureaucratic inefficiencies.

Despite these challenges, the Som’s low value is part of a deliberate strategy to align with export competitiveness while maintaining macroeconomic stability. The country’s foreign reserves (~$36 billion) help manage exchange rates, and remittance inflows from Uzbeks working abroad provide additional foreign currency buffers.

Metric

Value

Rate (2025)

12,600–12,925 UZS = 1 USD

Inflation (2025 est.)

10–12%

GDP (nominal)

USD 90 billionD

Unemployment

~9%

Foreign Reserves

USD 36 billion

Main Economic Notes

Transitioning market economy, gradual liberalization

8. Guinean Franc (GNF)

The Guinean Franc, at around 8,660 GNF per USD in 2025, reflects deep structural challenges in a resource-rich yet underdeveloped economy.

Guinea holds some of the world’s largest bauxite reserves and significant gold and diamond resources, but weak infrastructure, corruption, and political instability limit the benefits of these assets, according to Reuters. Inflation in Guinea averages around 11%, driven by import dependency for essential goods, currency volatility, and governance challenges.

Political transitions have often been turbulent, with military takeovers and contested elections affecting policy continuity and investor confidence. The economy is largely undiversified, heavily relying on mining exports, while agriculture remains subsistence-level for much of the population.

Limited foreign reserves and high external debt service obligations put pressure on the Franc’s stability, while the government struggles to maintain social spending amid tight budgets. Despite these constraints, Guinea’s mining sector offers growth potential if governance improves, but until then, the GNF’s low value remains tied to structural economic fragility.

Metric

Value

Rate (2025)

~8,660 GNF = 1 USD

Inflation (2025 est.)

11%

GDP (nominal)

USD 17 billion

Unemployment

~13%

Foreign Reserves

Low and volatile

Main Economic Issues

Governance, infrastructure gaps, and export reliance

9. Paraguayan Guarani (PYG)

The Paraguayan Guarani, trading at around 7,992 PYG per USD, holds the position as one of the weakest currencies in South America in terms of numerical value, yet Paraguay’s economic fundamentals remain relatively stable.

Inflation is controlled, averaging 4% annually, while GDP grows at a moderate pace of 3–4%, driven by agriculture (soybeans, beef) and energy exports (notably hydroelectric power from Itaipú and Yacyretá dams), according to the IMF.

Paraguay has maintained a stable macroeconomic environment with low external debt, prudent fiscal management, and manageable public debt levels. The Guarani’s low numerical value is a historical remnant, not reflective of economic collapse.

However, challenges remain: a large informal sector, limited industrial diversification, and dependency on weather conditions affecting agricultural output. Despite these challenges, Paraguay maintains investor confidence, and the Guarani’s value remains steady in real terms while appearing weak numerically.

Metric

Value

Rate (2025)

~7,992 PYG = 1 USD

Inflation (2025 est.)

4%

GDP (nominal)

~ USD 50 billion

Unemployment

~6%

Foreign Reserves

Stable

Main Economic Notes

Agriculture-based, stable policy

10. Ugandan Shilling (UGX)

The Ugandan Shilling, trading around 3,660 UGX per USD, rounds out the list of the world’s lowest-value currencies by unit, yet Uganda’s macroeconomic environment is relatively stable. Inflation is well-managed, averaging 3–4%, supported by prudent central bank policies and improved fiscal discipline.

Uganda’s economy, with a GDP of around $50 billion, is driven by agriculture (coffee, tea, fish), services, and a budding oil sector expected to boost growth in the coming years.

Challenges remain in the form of infrastructure gaps, high youth unemployment (around 13–18%), and vulnerability to external shocks such as commodity price swings and climate-related disruptions.

The low numerical value of the Shilling is primarily historical and manageable, allowing for economic transactions without the instability seen in hyperinflationary environments.

However, debt service pressures and the need for foreign currency for imports continue to influence exchange rate dynamics.

Metric

Value

Rate (2025)

~3,660 UGX = 1 USD

Inflation (2025 est.)

3–4%

GDP (nominal)

~ USD 50 billion

Unemployment

~13–18% (youth higher)

Foreign Reserves

Stable but modest

Main Economic Notes

Agriculture-driven, stable policy

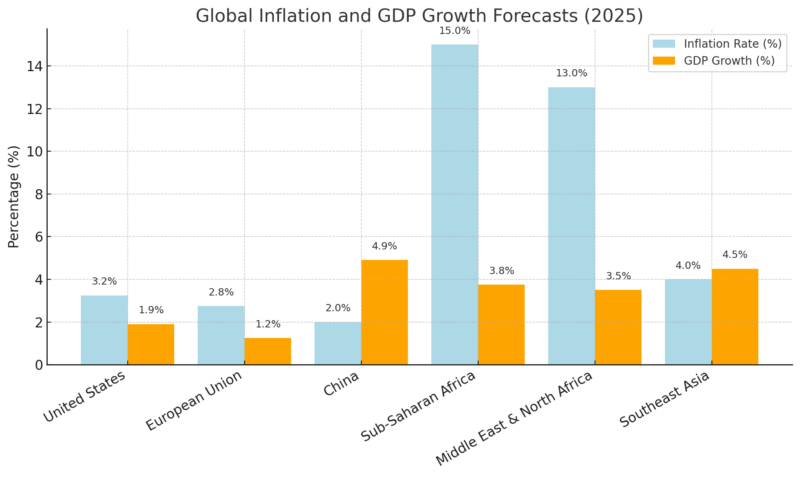

Global Inflation and Recession Pressures (2024–2025)

The global economy in 2024–2025 has been under pressure from persistent inflation, slowing growth, and the long-term aftermath of the COVID-19 pandemic, combined with geopolitical tensions.

Inflation peaked globally in 2022–2023, with the U.S., EU, and many emerging markets experiencing their highest rates in four decades, driven by energy price shocks, disrupted supply chains, and post-pandemic demand spikes.

By 2025, inflation will have eased in developed markets to 3–4% annually, but will remain above central bank targets.

The Federal Reserve, ECB, and other central banks implemented aggressive interest rate hikes throughout 2023–2024, slowing credit growth and consumer demand to rein in inflation, leading to slower GDP growth and concerns over shallow recessions in multiple regions, according to the European Central Bank.

In contrast, many developing nations face stubbornly high inflation rates (10–40% annually) due to weak currencies, high import costs, and dependency on commodities for foreign currency income.

Geopolitical tensions (such as Russia-Ukraine, Middle East instability, and U.S.-China trade disputes) have continued to influence global energy and food prices, keeping inflation risks alive in fragile economies.

The Regional Impact on Weak Currencies

Middle East: Inflation and Sanctions

In countries like Lebanon, Iran, and Syria, chronic inflation is exacerbated by sanctions and political instability. Sanctions block foreign investment and trade, reducing foreign currency inflows while pushing governments to print more local currency to fund subsidies and wages, fueling hyperinflation, as noted by the Middle East Institute. Oil-producing countries face fluctuating revenues, making fiscal planning difficult.

For instance, Iran’s dependence on oil (80%+ of exports) and limited foreign reserves have left it vulnerable to external shocks, while Lebanon’s banking collapse and reliance on imports mean it cannot stabilize its currency without international aid and reforms.

Sub-Saharan Africa: Commodity Dependence and Structural Challenges

Countries like Sierra Leone, Guinea, and Uganda face high inflation driven by their reliance on food and fuel imports, fluctuating global commodity prices, and weak currencies. Their economies often depend on a narrow export base (gold, diamonds, bauxite, coffee) with limited industrialization, making them vulnerable to global demand shifts.

Political instability and governance challenges discourage foreign direct investment, while foreign debt obligations consume scarce foreign currency, forcing local currencies to devalue to cover gaps.

Southeast Asia: Stability Despite Low Denominations

Countries like Vietnam, Laos, and Indonesia showcase how low unit values do not equate to instability. These nations maintain macroeconomic stability through prudent fiscal management, strong export sectors, and foreign reserves.

Vietnam and Indonesia, in particular, have diversified manufacturing bases and attract foreign investment, supporting currency stability even with low-denomination currencies.

Inflation in these regions is more controlled (3–5%), allowing central banks to balance growth and stability, showing that a low-value currency can still function efficiently when backed by sound economic management.

Factors Driving Inflation and Recession Risks in Weak-Currency Economies

1. Commodity Price Volatility

Most low-currency nations depend on exporting a few commodities (oil, gold, minerals, coffee). A drop in prices reduces foreign currency inflows, pressuring local currencies while increasing the cost of imports, leading to inflation.

2. Fiscal Deficits and Debt

Governments with high spending needs and low tax bases borrow heavily or print money to cover deficits, eroding currency value and fueling inflation.

3. Political Instability

Frequent coups, corruption, and policy inconsistency deter investment and undermine economic planning, leading to capital flight and currency devaluation.

4. Import Dependency

Reliance on imported fuel, food, and medicines in weak production economies forces continual demand for foreign currency, straining reserves and weakening local currencies.

5. Monetary Policy and Central Bank Independence

Where central banks lack autonomy, political pressures often result in excessive money printing and currency manipulation that backfire, triggering hyperinflation and the divergence of black-market currencies.

Factor

Impact on Currency Stability

High Inflation

Reduces purchasing power, collapses value

Limited Exports

Weakens foreign currency inflows

High Imports

Creates demand for USD/foreign currencies

Political Instability

Erodes trust, triggers capital flight

Sanctions

Blocks trade and investment

Fiscal Deficits

Leads to money printing and devaluation

Commodity Dependency

Adds vulnerability to global price shifts

The Big Picture

- The global fight against inflation through interest rate hikes affects borrowing costs in weak currency nations, limiting their ability to service external debt without currency devaluation.

- Global economic slowdowns reduce demand for commodities, hurting export-dependent countries and reducing their access to foreign currency, leading to currency pressures.

- As climate change impacts agricultural yields, food imports become more expensive, directly affecting low-income, import-dependent nations, adding to inflation and currency weakness.

- Geopolitical conflicts disrupt supply chains and energy markets, spiking inflation in fragile states with no buffers to stabilize prices.

Conclusion

Currencies like the Lebanese Pound and Iranian Rial reflect deep structural crises, while the Vietnamese Dong and Indonesian Rupiah demonstrate that a low unit value does not mean instability when paired with sound policy.

However, global inflationary pressures, geopolitical instability, and commodity volatility shape the environment in which these currencies operate.

To navigate or invest in these environments, it is crucial to look beyond the exchange rate number and assess inflation trends, central bank policies, export structures, and political stability to understand true economic health.

Related Posts:

- US Inflation Rate in 2025 - What's Driving Prices…

- The World’s Largest City You’ve Never Heard Of - Why…

- US States with the Highest and Lowest Dental Care…

- 5 U.S. States With the Highest Population Growth in…

- 10 Lowest IQ States in US 2025 - Full Data,…

- Which States Have the Highest and Lowest Income Tax in 2025?