In 2025, the population of Portland is projected to reach 622,882, making it the largest city in Oregon and a significant urban center in the United States according to World Population Review.

This growth reflects Portland’s appeal with its vibrant cultural scene, sustainable living initiatives, and economic opportunities.

The data suggests a steady increase in the metro area, with a population of 2,265,000 forecasted by 2025, marking a 0.98% rise from the previous year as noted by Macrotrends.

Table of Contents

ToggleKey Takeaways

Historical Population Trends

Portland’s population has grown steadily, outpacing the national average, and is expected to continue increasing, surpassing 3 million by 2040. A Forbes report ranks it as the 10th fastest-growing U.S. metro area. Though growth slowed during the recession, it has rebounded with rising home values and job opportunities.

Originally inhabited by Upper Chinook Indians, Portland was founded in 1843 when William Overton and Asa Lovejoy claimed the land. A coin toss in 1845 named the city after Portland, Maine. Incorporated in 1851 with 800 residents, it grew to 17,500 by 1879.

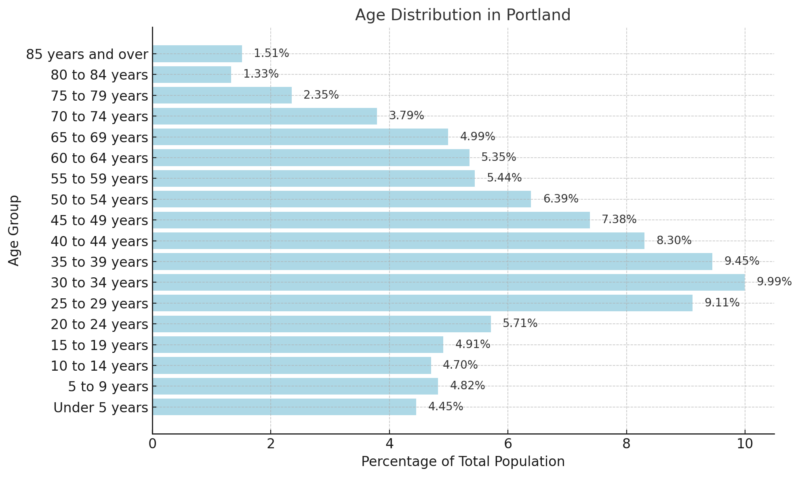

Age Distribution

As per the 2018-2022 ACS 5-Year Estimates, the median age in Portland, OR is 38.3 years. The population is distributed as follows: 13.97% are under 15 years old, 19.73% fall between 15 and 29 years, 52.30% are between 30 and 64 years, 12.46% are aged 65 to 84, and 1.51% are 85 years or older.

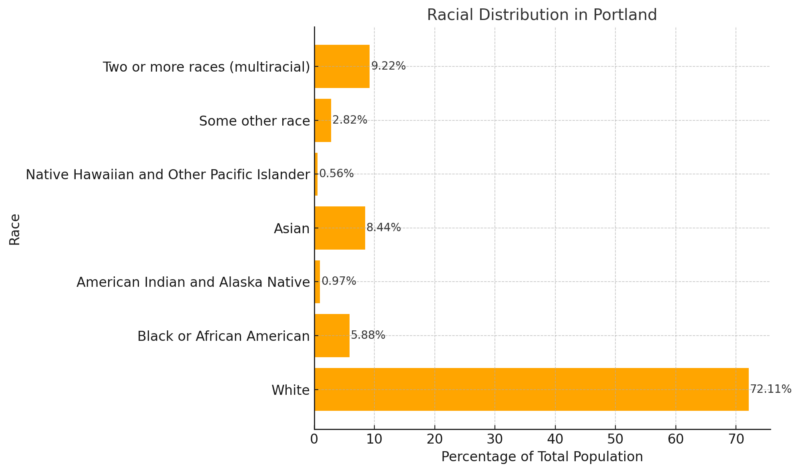

Racial Distribution

Portland’s racial makeup is predominantly White, accounting for 72.11% of the population, making it the most represented racial group in the city. The Black or African American population comprises 5.88%, which is lower than the national average but still a significant minority group in Portland according to Neilsberg.

The Asian community represents 8.44% of the population, contributing to the city’s growing diversity, particularly in cultural and economic sectors. American Indian and Alaska Native residents make up less than 1% (0.97%), while Native Hawaiian and Other Pacific Islanders account for just 0.56%, indicating a smaller presence of these groups.

Individuals identifying as some other race comprise 2.82% of Portland’s population, while multiracial individuals (two or more races) make up 9.22%, reflecting an increasing trend of racial diversity and interethnic identities.

Gender Distribution

Neilsberg notes that Portland’s population is almost evenly split between males (49.83%) and females (50.17%), with a slightly higher number of females.

This near balance suggests a stable gender demographic without significant disparities.

Portland’s population distribution in 2025 reveals significant insights into how its residents are spread across various neighborhoods, age groups, and ethnic backgrounds. Each aspect provides a better understanding of the city’s demographic composition and its changes over time.

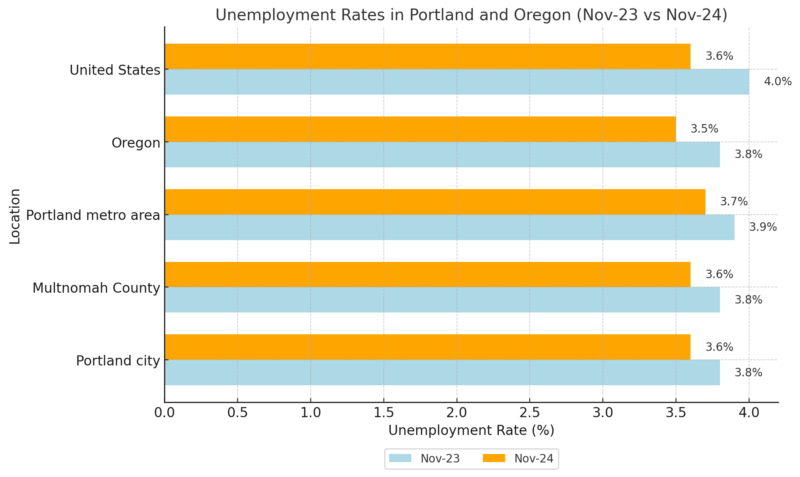

Unemployment Rates

Unemployment rates in Portland and Oregon have declined modestly over the past year, reflecting job market stability. Oregon’s rate (3.5%) is slightly lower than the national average (3.6%), indicating a relatively strong labor force according to BLS.

* Portland’s unemployment rate is 3.4%.

* Oregon’s unemployment rate is 3.6%.

* Oregon lost 8,300 jobs in November in the business and construction sectors and gained 5,300 jobs in government and healthcare.

* The U.S. added 216,000 jobs in December nationwide. pic.twitter.com/uFnP29V6f9— VanderHouwen (@VanderTweet) January 22, 2024

However, the marginal decrease suggests that while job growth is present, it may be slowing due to market saturation or economic adjustments. The improvement in employment likely aligns with rising wages and increased hiring across multiple sectors.

Average Weekly Wages

Location

Average Weekly Wage ($)

% Difference from U.S. Average

United States

1,390

–

Portland metro area

1,476

+6.2%

Portland metro workers earn 6.2% more than the national average in weekly wages, reflecting a competitive job market with strong demand in key industries like technology, healthcare, and financial services.

This wage growth is indicative of a strong local economy, though it also suggests higher living costs that could offset purchasing power.

Employment by Industry (Year-Over-Year Change)

Industry

Employment (in thousands) Nov 2024

Change from Nov 2023 (thousands)

% Change

Total nonfarm

1,246.6

+6.5

+0.5%

Mining and logging

1.1

0.0

0.0%

Construction

160.5

+3.0

+1.9%

Manufacturing

209.6

+12.1

+6.1%

Trade, transportation, and utilities

112.2

-3.9

-3.4%

Information

72.1

-0.1

-0.1%

Financial activities

194.2

+1.1

+0.6%

Professional and business services

230.7

+0.8

+0.3%

Education and health services

25.3

0.0

0.0%

Leisure and hospitality

77.1

-4.2

-5.2%

Other services

121.8

-1.4

-1.1%

The manufacturing sector saw the most significant growth at +6.1%, adding 12,100 jobs, indicating increased industrial activity, possibly linked to supply chain improvements or new business investments. Construction also performed well (+1.9%), which could be attributed to ongoing infrastructure and housing development projects.

However, trade, transportation, and utilities (-3.4%) and leisure and hospitality (-5.2%) experienced job losses, possibly due to seasonal employment fluctuations, automation, or shifting consumer behaviors. The information sector (-0.1%) remained flat, reflecting possible slowdowns in tech and media hiring.

Overall, while job growth remains positive, declines in certain industries highlight potential weaknesses in consumer demand and operational shifts.

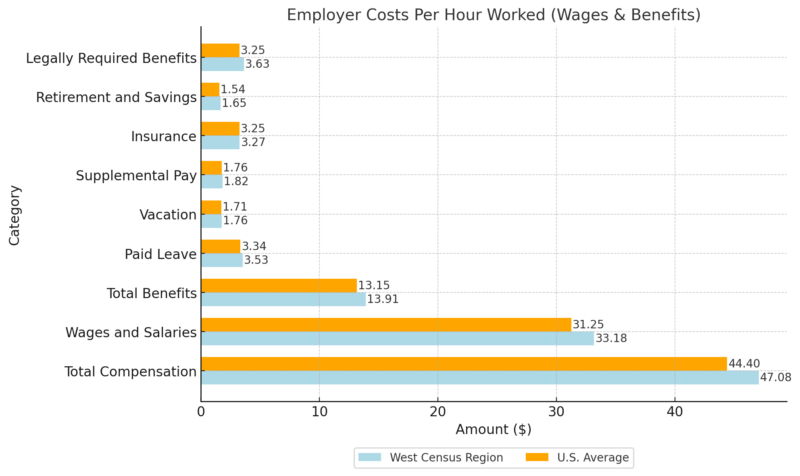

Employer Costs Per Hour Worked (Wages & Benefits)

Employers in the West Census Region (including Portland) pay 6% more in total compensation than the national average. This higher cost is primarily due to increased wages (+6.2%), stronger retirement contributions (+7.1%), and higher legally required benefits (+11.7%).

The latter could be linked to state-mandated programs such as paid leave, workers’ compensation, or payroll taxes.

The data suggests that while workers benefit from better compensation, businesses in the region may face higher labor costs, which could impact hiring trends and long-term job growth.

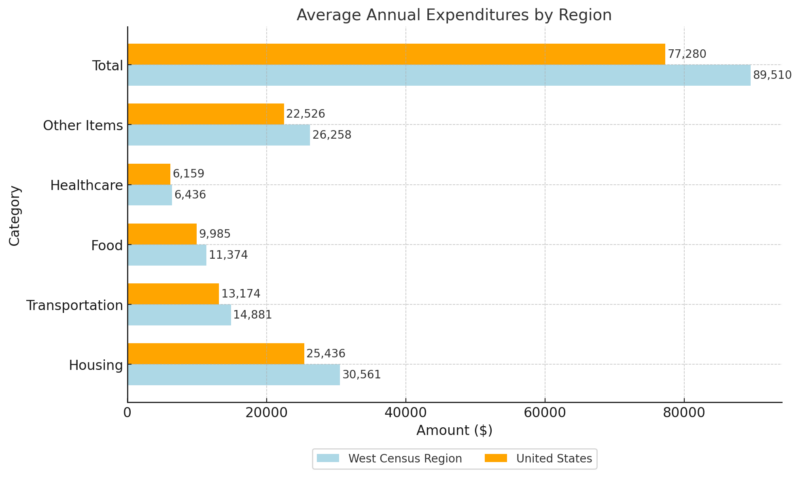

Average Annual Expenditures by Region

Households in the West spend 15.8% more annually compared to the national average. The biggest contributor is housing costs (+20.1%), which aligns with Portland’s rising home values and rental prices.

Food (+13.9%) and transportation (+12.9%) costs are also notably higher, suggesting increased living expenses driven by inflation and urban cost pressures.

Despite higher wages, the elevated cost of living could erode financial stability for lower-income households, potentially driving migration to more affordable regions.

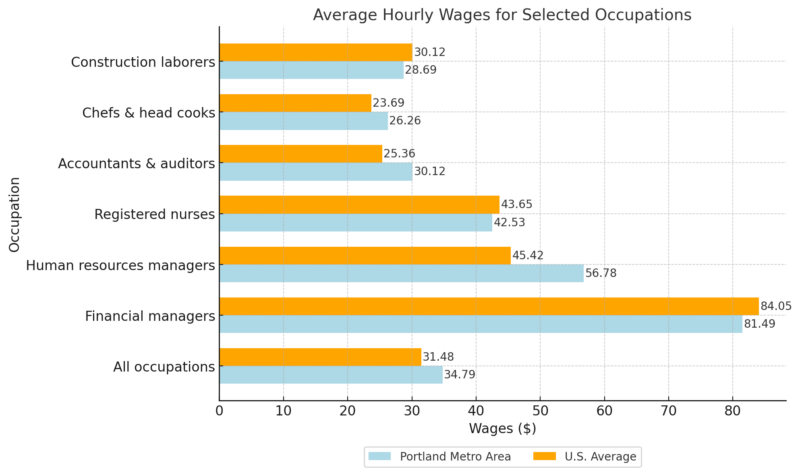

Average Hourly Wages for Selected Occupations

Overall, wages in Portland are 10.5% higher than the national average, particularly for professional roles like HR managers (+25%) and accountants (+18.8%). However, salaries for registered nurses (-2.6%) and construction laborers (-4.8%) lag behind, indicating potential labor shortages or industry constraints in those fields.

Key Housing Market Metrics

Metric

Value

YoY Change (%)

Median Sale Price

$488,500

-0.29%

Number of Homes Sold

528

+11.2%

Median Days on Market

51 days

+16 days

Sale-to-List Price Ratio

98.6%

+0.3 pt

Homes Sold Above List Price

25.2%

-0.28 pt

Homes with Price Drops

18.4%

+3.3 pt

- Sales volume is up (+11.2% YoY), indicating steady buyer demand despite a slowdown in pricing growth according to Redfin.

- Homes are sitting on the market longer (51 days vs. 35 days last year), signaling that buyers may be negotiating more or waiting for better deals.

- The sale-to-list price ratio of 98.6% suggests that most homes sell close to the asking price, though slight underbidding is common.

- More sellers are reducing prices (18.4%), showing that the market is adjusting to shifting demand and affordability concerns.

Competitive Market Dynamics

Factor

Value

Market Competitiveness

Somewhat Competitive

Average Time on Market

39 days

Highly Competitive Listings

Sell in ~10 days

Typical Selling Discount

1% below list price

Hot Homes

Sell for 1% above list price

The average time on the market is 39 days, slightly better than the overall median of 51 days, indicating that well-priced and attractive properties sell faster.

Hot homes sell within 10 days and may go for 1% above the list price, highlighting the demand for premium or well-located properties.

Despite the overall cooling, competition persists in certain segments, particularly in sought-after neighborhoods.

Comparison to National Housing Trends

- Portland’s median sale price is 14% higher than the national average, reflecting the city’s desirability and cost of living.

- Overall home values in Portland are 18% above the national average, likely due to limited housing supply and high demand in metro areas.

- Despite national trends of slowing price growth, Portland’s price per square foot is still rising (+2.0% YoY), indicating persistent value appreciation.

Comparison with Other Major Cities

In 2025, Portland’s population is estimated to be 650,963. This figure places it as the 25th most populous city in the United States, as well as the sixth most populous city on the West Coast.

For context, Los Angeles continues to be a major hub, with its population surpassing 4 million. Seattle, another significant West Coast city, has a population of over 755,000.

Population Estimates (2025):

City

Estimated Population

Portland

650,963

Los Angeles

4,000,000+

Seattle

755,000+

San Francisco

~875,000

San Diego

~1,450,000

Compared to Portland, San Francisco and San Diego have larger populations. However, Portland’s strategic location and lifestyle offerings make it a notable choice for residents.

Portland’s growth is attributed to its reputation as one of the greenest cities globally. This appeals to those prioritizing sustainability and a balanced urban life.

Key Points:

- Portland ranks 25th in population among U.S. cities.

- It stands as the sixth largest on the West Coast.

- The city’s green initiatives contribute to its appeal.

Portland’s progress highlights the shifting dynamics of urban living preferences, especially in environmental considerations.

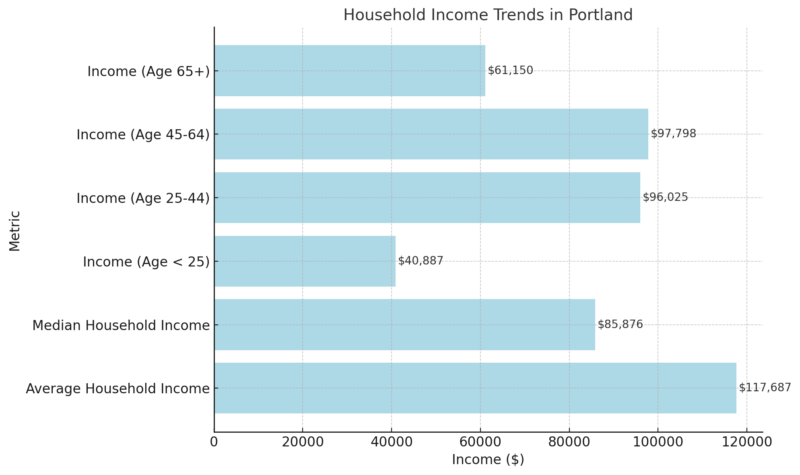

Household Income Trends

Both average and median household incomes have seen significant increases of 10.0% and 9.4% year-over-year (YoY), respectively, reflecting rising wages and economic expansion in Portland according to Point2Homes.

Younger workers (under 25) earn significantly less, with a median income of $40,887, likely due to entry-level jobs and lack of experience.

The prime working-age group (25-44 years) earns nearly $96,025, a substantial increase, reflecting career progression and higher-paying job opportunities.

Older workers (45-64 years) have the highest earnings at $97,798, benefiting from career stability and accumulated experience.

Seniors (65+ years old) see a drop in income to $61,150, which may indicate reliance on retirement income rather than active employment.

Poverty Level Trends

Metric

Value

Y-o-Y Change (%)

People Below Poverty Level

-3

N/A

People Above the Poverty Level

551,538

+0.2%

The number of people above the poverty line increased by 0.2%, suggesting a slight improvement in financial conditions, but not a dramatic shift.

The poverty rate remains relatively unchanged, which may indicate that income gains are not yet significantly impacting lower-income groups.

Immigrant & Refugee Statistics in Portland

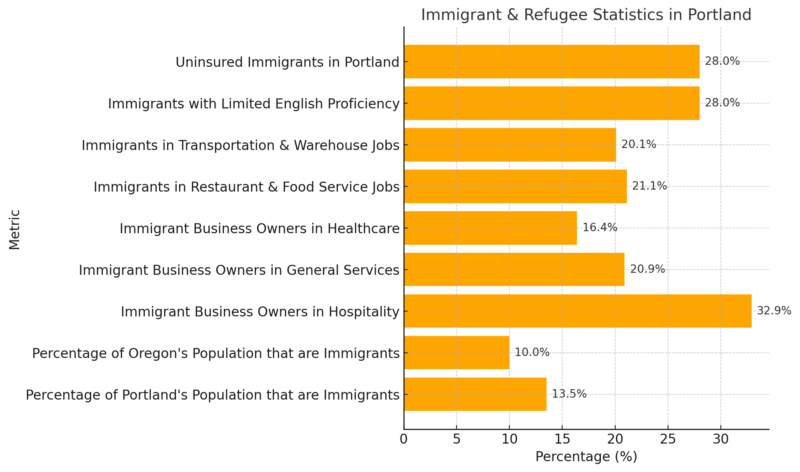

Immigrants play a crucial role in Portland’s economy, making up 32.9% of hospitality business owners, which means they significantly contribute to the restaurant, hotel, and bar industry according to Portland.gov.

Beyond hospitality, immigrants also own 20.9% of general services businesses and 16.4% of healthcare businesses, showing strong entrepreneurship across multiple sectors.

In the workforce, immigrants are overrepresented in essential jobs, with 21.1% of restaurant & food service workers and 20.1% of transportation & warehouse workers.

Their presence in these industries highlights their critical role in keeping the city functioning, despite facing economic and social barriers.

Language barriers are significant, with 28% of immigrants (24,510 people) having limited English proficiency.

The most spoken languages among non-English speakers are Spanish (32%), Vietnamese (21.3%), Chinese (13.7%), Russian (8.8%), and Ukrainian (3.3%).

Lack of language accessibility limits economic opportunities, emergency assistance, and healthcare access for these communities.

Methodology

- Population data was sourced from World Population Review and Macrotrends for 2025 projections.

- Housing and market trends were derived from Redfin and MLS listings, reflecting sales data and pricing shifts.

- Employment and wage statistics were compiled from BLS and local economic reports.

- Income distribution and poverty levels were extracted from ACS 5-Year Estimates and Point2Homes.

- Immigrant contributions and challenges were assessed through New American Economy and Portland.gov reports.

- Cost of living comparisons were made using regional economic surveys and census data.

References

- World Population Review – Portland Population 2025

- Macrotrends – Portland Metro Area Population 2025

- Redfin – Portland Housing Market

- Neilsberg – Portland Population by Age

- Neilsberg – Portland Population by Race

- Neilsberg – Portland Population by Gender

- Bureau of Labor Statistics (BLS) – Portland Economic Summary

- Point2Homes – Portland Demographics & Income Trends

- Portland.gov – About the Immigrant & Refugee Program

- PopulationU – Portland Green Initiatives

Related Posts:

- Houston Population 2025 - Growth Trends and Projections

- Oklahoma City Population 2025 - Growth Trends and…

- Jacksonville Population 2025 - Growth Trends and Projections

- Columbus Population 2025 - Growth Trends and Projections

- Nashville Population 2025 - Growth and Future Projections

- Seattle Population 2025 - Key Trends and Projections