Market analysts expect the global orthodontics industry to hit $26 billion by 2032, and EMEA (Europe, the Middle East, and Africa) could claim as much as $10 billion of that total.

That means roughly one-third of the world’s orthodontic market will be shaped by clinics, patients, and companies operating across these regions.

Behind this growth are strong tailwinds: rising adult demand for clear aligners, rapid digitization of clinics, 3D printing adoption, and higher disposable incomes in the Gulf and parts of Africa.

Table of Contents

ToggleWhere EMEA Fits in the Global Orthodontic Picture

To understand EMEA’s place, it helps to start with the global baseline.

| Source | Global Market (2032) | 2025 Base | CAGR | Notes |

| Fortune Business Insights | $26.02 B | $8.45 B (2025) | 17.4 % | Includes aligners, brackets, and IC services |

| Persistence Market Research | $25.64 B | – | 17.5 % | Supplies only |

| IMARC Group | $9.91 B (2033) | – | 5.5 % | Conservative definition |

| Markets & Markets (Supplies only) | $10.96 B (2030) | $6.67 B (2024) | 8.9 % | Brackets, wires, etc. |

Europe alone is forecasted by Meticulous Research to reach $8.76 billion by 2032, growing at a 14.2 % CAGR, while Databridge Research puts European orthodontic supplies at $5 billion by 2032.

If these numbers hold, Europe will represent around one-third of total global orthodontic spending by the end of the decade, even before factoring in the Middle East and Africa.

Europe: The Powerhouse of EMEA Growth

1. Market Size and Forecast

Europe’s orthodontic industry is large and diverse, spanning traditional braces, digital aligners, and emerging 3D-printed retainers.

| Market Segment | 2024 Size | 2032–2033 Forecast | CAGR | Source |

| Total Orthodontics | ~$3.5–4 B | $8.76 B (2032) | 14.2 % | Meticulous Research |

| Orthodontic Supplies | $2.52 B | $5.00 B (2032) | 9 % | Databridge |

| Invisible / Clear Aligners | $1.32 B (2023) | ~$5 B (2030 est.) | 27 % | Grand View Research |

Europe’s clear aligner boom is undeniable, and demand for discreet treatment among adults is pushing double-digit growth.

At the same time, braces and wires still generate reliable recurring revenue, especially in price-sensitive markets like Eastern Europe or Southern Europe.

2. Key Drivers

- Adult adoption: Nearly half of new orthodontic patients in Western Europe are now adults, many drawn to clear aligners and ceramic brackets.

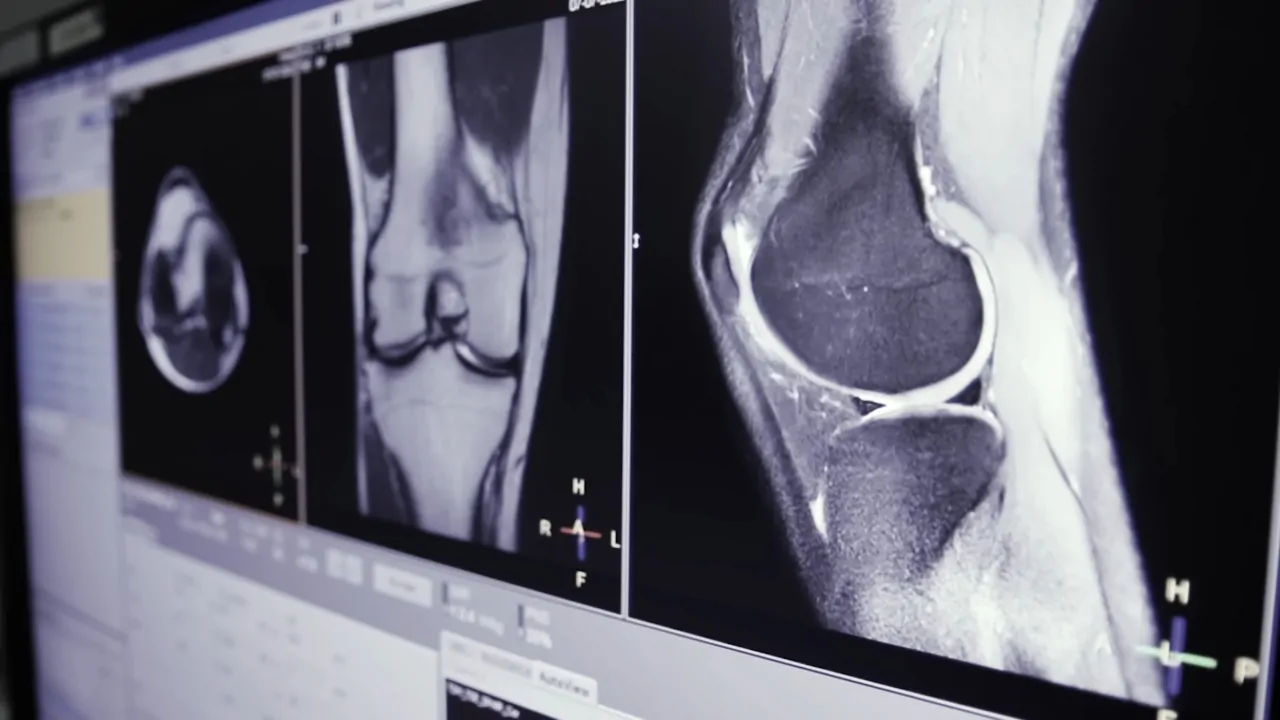

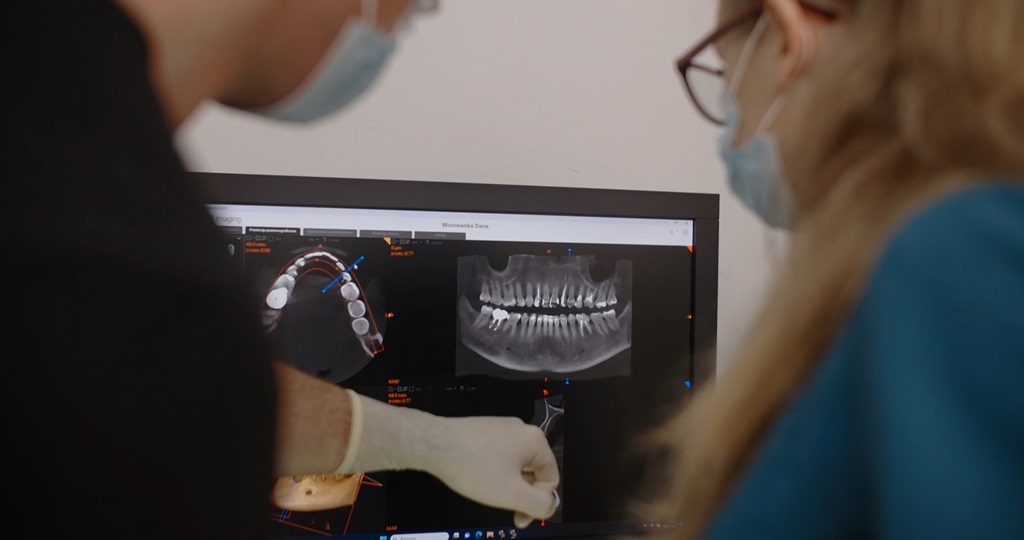

- Digital transformation: Clinics are moving toward intraoral scanning, AI-driven treatment planning, and remote monitoring.

- 3D printing: Local labs across Germany, France, and Scandinavia are printing retainers and appliances in-house.

- Steady reimbursement systems: Children’s orthodontics is often state-supported, while adult cases are privately funded, ensuring stable hybrid demand.

3. Challenges

- Strict regulation under the EU Medical Device Regulation (MDR).

- Rising competition from budget aligner brands.

- Economic sensitivity, treatments can be delayed when households tighten their budgets.

- Complex market access, each country has different approval, pricing, and insurance rules.

Still, Europe remains the most stable and predictable piece of the EMEA puzzle, a market where technology and trust matter as much as price.

The Middle East & Africa: High Growth, High Risk

While Europe offers structure and size, the Middle East and Africa (MEA) add the thrill of faster growth, albeit from a smaller base.

Estimated Market and Growth Outlook

| Subregion | 2025 Market Estimate | 2032 Forecast | CAGR | Notes |

| Middle East | $300–400 M | ~$1.0–1.2 B | 15–18 % | Driven by GCC healthcare investment |

| Africa | $100–150 M | ~$250–300 M | 12–15 % | Early-stage infrastructure growth |

| Total MEA | ~$0.4 B | ~$1.45 B (2032) | ~17 % | Aggregate scenario |

Growth Drivers

- Massive healthcare investments in Saudi Arabia, the UAE, and Qatar, including dental hubs.

- Medical tourism, patients from North Africa and Central Asia often travel to Gulf cities for advanced care.

- Rising youth populations and improving access to private insurance.

- Tech transfer from Europe, many manufacturers use Dubai or Istanbul as logistics hubs for regional expansion.

Constraints

- Limited insurance coverage for orthodontics.

- Shortage of trained orthodontists in several African nations.

- High import duties and currency volatility.

- Dependence on European or U.S. suppliers for materials.

The MEA region is volatile, but its growth curve is steeper than Europe’s, offering outsized returns for those who can navigate the regulatory and logistical terrain.

Segment-by-Segment Breakdown Across EMEA

| Segment | 2025 Market (Estimate) | 2032 Market (Estimate) | CAGR | Notes |

| Clear Aligners | $1.5 B | $5.0 B | 16–20 % | Driven by adult demand and digital workflows |

| Fixed Braces (Brackets/Wires) | $1.8 B | $3.5 B | 8–9 % | Still essential for complex cases |

| Retainers & Anchorage Systems | $0.4 B | $0.9 B | 10–11 % | Volume growth tied to total patient base |

| Digital Planning & Monitoring Software | $0.2 B | $0.9 B | 22–25 % | High-margin SaaS growth among clinics |

So by 2032, EMEA could easily become a $10 billion market, representing roughly one-third to two-fifths of global orthodontic revenue. The region’s orthodontic infrastructure is changing quickly. Clinics are increasingly connected, and digital workflows have shortened treatment planning from weeks to days. Examples of such transformation can be observed in modern practice networks across Western Europe and the Middle East — many adopting cloud-based systems, intraoral scanning, and 3D-print fabrication to streamline patient care. Across many countries, this same trend is reflected in modern practices like Smiles and Grins, where the use of digital treatment planning and streamlined workflows shows how patient-centered orthodontic care is evolving into a more efficient, technology-driven experience. No forecast is risk-free. EMEA’s growth trajectory depends on several fragile assumptions. The market will still grow, but the winners will be those who combine affordability, reliability, and compliance. What will the landscape look like by 2032? By 2032, orthodontics across Europe, the Middle East, and Africa won’t just be about straight teeth; it will be about digital access, cost efficiency, and smarter workflows. The EMEA market’s potential $10 billion value makes it one of the most strategic regions in the entire dental industry. The formula for success is clear Innovate locally, comply regionally, scale digitally.Putting It All Together: EMEA Market Size Scenarios to 2032

Year

Europe

MEA

Total EMEA

Share of Global ($26 B)

2025

$3.5 B

$0.4 B

$3.9 B

15 %

2027

$4.6 B

$0.6 B

$5.2 B

20 %

2029

$5.9 B

$0.8 B

$6.7 B

26 %

2030

$6.8 B

$1.0 B

$7.8 B

30 %

2032

$8.97 B

$1.45 B

$10.42 B

40 %

The Companies and Technologies Leading the Way

Established Giants

Regional & Emerging Players

Challenges Ahead

Risk Factor

Description

Potential Impact

Economic slowdown

Elective treatments are often delayed when disposable income drops

Lower short-term demand

Regulatory changes

MDR enforcement or import restrictions in MEA

Delays and added compliance costs

Price compression

More competition in aligners and braces

Margin erosion

Supply chain issues

Currency swings, import tariffs

Higher costs for clinics

Skill shortages

Not enough orthodontists in developing markets

Capacity bottlenecks

The Future of Orthodontics in EMEA

Final Thoughts

Related Posts: