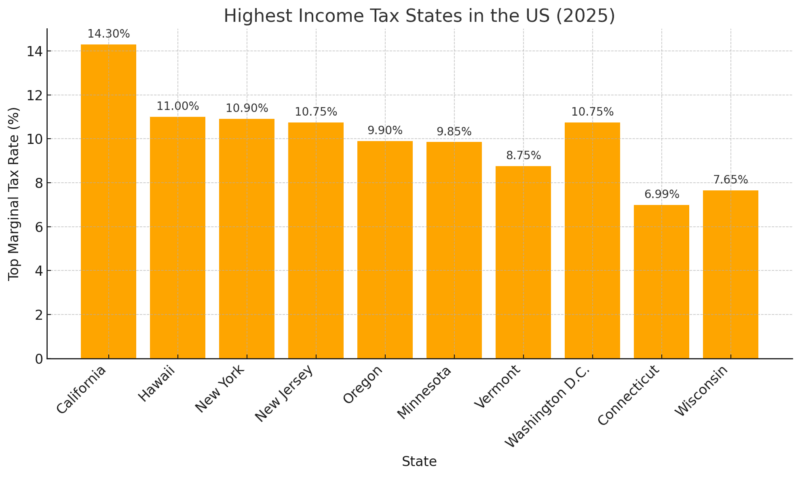

If you earn wages in the United States in 2025, your state of residence can swing your effective tax bill from 0 % to more than 14 %. At the top of the spectrum, California taxes income over $1 million at 13.3 %—and adds a 1 % mental-health surcharge, lifting the all-in marginal bite to 14.3 %. Just behind are Hawaii (11 %), New York (10.9 %, plus up to 3.9 % in New York City), and New Jersey (10.75 %).

At the other end, nine states—Alaska, Florida, Nevada, South Dakota, Texas, Washington, Wyoming, Tennessee, and New Hampshire—levy no tax on wage income at all. Among the states that do tax wages, the lowest advertised rates belong to Arizona and North Dakota (flat 2.5 %) and Indiana (3.15 %, scheduled to drop to 2.9 %).

The practical takeaway is straightforward:

- Move or work in a no-tax state, and you pay 0 % on wages, but you’ll likely face higher sales or property taxes (Texas, Florida, Washington) or volatile resource-based budgets (Alaska, Wyoming).

- Stay in a high-tax jurisdiction like California or New York and you shoulder double-digit rates, yet gain some of the country’s most extensive public services, from subsidized college tuition to large-scale transit systems.

For everyone else, the middle-ground states are racing to flatten and trim their rates—Iowa is already down to 3.8 % and Kentucky to 4 %—illustrating how intensely states now compete for mobile workers and retirees.

Knowing these headline numbers and the trade-offs hiding in sales, property, and business taxes is the single most important step in deciding where your next dollar of income will stretch the farthest in 2025.

Table of Contents

ToggleKey Takeaways

The 10 States With the Highest Income Taxes in 2025

These states impose the heaviest tax burden on individual income, often using progressive brackets that increase with income level.

Highest Income Tax States

California – Top Rate: 13.3% (+1% surcharge)

California holds the highest personal income tax rate in the country, reaching up to 13.3% on incomes over $1 million, and an additional 1% “mental health services” tax pushes the effective top marginal rate to 14.3%, according to sources. The state uses a progressive bracket system with rates starting at 1% for lower-income earners.

Income tax revenues account for more than 60% of California’s general fund, with the state collecting approximately $86 billion in personal income tax (PIT) by March 2025. These funds support large-scale public programs, including Medi-Cal, higher education, and extensive environmental and transportation projects.

Despite the high revenue intake, public dissatisfaction remains significant. A 2025 PPIC survey found that 90% of residents felt their federal and state taxes were inefficiently used. The state has also seen a net out-migration of higher earners; in 2023 alone, California lost 87,000 workers, 14% of whom moved to Texas.

Economic equity groups have flagged that even with progressive brackets, middle-income earners in expensive coastal cities like San Francisco and Los Angeles face a disproportionate cost-of-living burden that isn’t fully offset by tax credits or state services.

Hawaii – Top Rate: 11.0%

Hawaii is now on a path to go from being almost the most burdensome state for income taxes to one of the least.

More: https://t.co/j2GFrmA6Wl #HInews #StarAdvertiser

— Star-Advertiser (@StarAdvertiser) June 4, 2024

Hawaii revised its tax code in a multi-year reform that culminated in 2025, establishing a top rate of 11% on incomes over $325,000. It also lowered its lowest bracket to 1.4%, attempting to soften the burden for working-class residents.

Hawaii compensates for its lack of a general sales tax (it uses a general excise tax instead) by leaning more heavily on income-based revenue, which funds healthcare, education, and tourism maintenance services.

While residents benefit from certain tax credits, the state’s high cost of living—among the highest in the nation—makes the tax burden feel steeper than in similar-bracket states. Economists argue that for local families, the effective tax pressure when combined with housing and food costs is among the most regressive in the U.S., particularly outside the tourist economy.

New York – Top Rate: 10.9% (+ up to 3.9% NYC tax)

New York State imposes a 10.9% top marginal income tax, and for residents of New York City, an additional local tax of up to 3.88% can apply, bringing the total above 14% for top earners. These rates primarily apply to individuals earning over $25 million, while several lower brackets apply to middle-class households, as noted by the New York government.

The state’s tax system is highly progressive, and New York collects billions to fund mass transit (MTA), healthcare, public housing, and education.

However, the state is also experiencing a net migration loss of high-income individuals. Reports from Goldman Sachs and Bloomberg in 2024 noted a clear trend of wealthy residents moving to Florida and Texas.

High property taxes in counties like Westchester and Nassau further compound the overall burden. Despite the high tax intake, the crumbling infrastructure, and affordability issues have led to growing public discontent.

New Jersey – Top Rate: 10.75%

New Jersey’s top income tax rate of 10.75% kicks in for individuals earning over $1 million, under what’s colloquially known as the “millionaire’s tax.” The state uses a highly progressive tax structure and relies on personal income taxes for a large share of its general fund.

These revenues are earmarked for education, public pensions, and transit maintenance, especially NJ Transit.

The downside for residents is the combination of high income tax and some of the highest property taxes in the country, with an average effective rate exceeding 2%. A 2025 Monmouth University poll found 61% of residents felt overtaxed.

Some public employee unions argue these taxes are necessary to stabilize long-underfunded pension obligations, but critics argue the double tax burden is driving residents and businesses out.

Oregon – Top Rate: 9.9%

Oregon’s income tax system reaches a top marginal rate of 9.9% for individuals earning above $125,000, making it one of the most progressive in the Pacific Northwest. The state has no general sales tax, which puts the revenue weight squarely on income-based taxation.

This structure helps fund a wide array of public services, including Oregon Health Plan (OHP), K-12 education, and wildfire prevention programs. The absence of a sales tax gives some relief to lower-income residents, but middle-class earners still report feeling overburdened.

Critics argue that Oregon’s tax policy punishes wage earners more than those with capital gains or retirement income. In cities like Portland, where housing and energy costs have risen sharply, residents in the upper-middle bracket have little relief from deductions or credits.

The 2025 Oregon Economic Review noted that while the state’s progressive tax policy ensures robust safety nets, it may also discourage upper-income tech workers from relocating or staying long-term.

Minnesota – Top Rate: 9.85%

Minnesota levies a top marginal income tax rate of 9.85% on single filers earning over $193,000 and joint filers over $285,000. It uses a four-tier progressive system and supplements revenues with modest sales and property taxes.

The income tax funds a comprehensive social infrastructure, including one of the most generous public education systems in the Midwest, as well as state-subsidized healthcare and childcare assistance.

A 2025 Minneapolis Federal Reserve report suggested Minnesota’s tax system contributes to its relatively low poverty rate compared to neighboring states. However, small business groups have expressed concern that the rate discourages entrepreneurship, especially in professional services and tech sectors.

The state’s high winter utility costs also compound the effective living expenses for residents paying near the top bracket.

Vermont – Top Rate: 8.75%

Vermont’s top income tax bracket hits 8.75% for single filers earning more than $220,000. It’s one of the few states where over 40% of general revenue is derived directly from personal income taxes.

With a small population and a strong emphasis on community services, Vermont funds universal pre-K, aggressive climate action initiatives, and rural health programs.

Despite a progressive tax structure, Vermont is one of the most expensive states on a per-capita tax basis. The 2025 Tax Foundation’s State Burden Index placed it in the top five for overall state-local burden.

Many residents accept the high taxes in exchange for strong environmental protections and healthcare access, but others—especially retirees—are relocating to New Hampshire or Florida to avoid the ongoing tax climb.

Washington, D.C. – Top Rate: 10.75%

The District of Columbia taxes high-income residents at a top rate of 10.75%, applying to individuals earning over $1 million, as noted by DC GOV. While technically not a state, D.C.’s tax policies mirror those of large urban jurisdictions.

In addition to a progressive rate structure, the city offers numerous deductions and credits for childcare, housing, and earned income, which help balance the burden for low- and middle-income residents.

D.C.’s local government has leaned into taxing top earners to fund expanded social services, public housing repairs, and city-run education reforms. A 2024 Brookings Institution study noted D.C.’s tax code is among the most redistributive in the U.S., narrowing the income gap more effectively than many states.

However, small business owners and consultants have expressed frustration over audit practices and a shrinking pool of high-income earners post-pandemic.

Connecticut – Top Rate: 6.99%

Connecticut applies a top marginal income tax of 6.99% on individuals earning more than $500,000. While the top rate may appear modest compared to states like California or New York, Connecticut’s effective tax burden is compounded by high property taxes and significant local mill rates.

The state’s income tax is bracketed, with middle-income earners typically falling in the 5–6% range.

In recent years, Connecticut has faced fiscal pressure from underfunded pension obligations, prompting the legislature to push for higher contributions from top earners. The 2025 State Fiscal Health Index ranked Connecticut 48th in long-term solvency.

Many residents, especially in wealthy suburbs like Greenwich and Darien, have begun reorganizing assets or changing domicile to Florida. Still, Connecticut maintains some of the nation’s top public school districts, making it attractive to high-income families with school-age children.

Wisconsin – Top Rate: 7.65%

Wisconsin rounds out the top ten with a 7.65% top marginal tax rate, applying to single filers earning more than $304,000. It uses a progressive structure across four brackets. Although the state has traditionally leaned on income taxes, a new 2025 proposal is underway to flatten the structure, with the Governor-backed plans to lower the top rate to 7.1% by 2026.

Income tax revenues are used to support the University of Wisconsin system, public transportation, and rural healthcare initiatives. However, Wisconsin’s property taxes remain among the highest in the Midwest.

A University of Wisconsin fiscal policy review suggested that while tax burdens are moderate for lower brackets, the middle class pays more than in peer states like Michigan and Iowa when all local taxes are factored in.

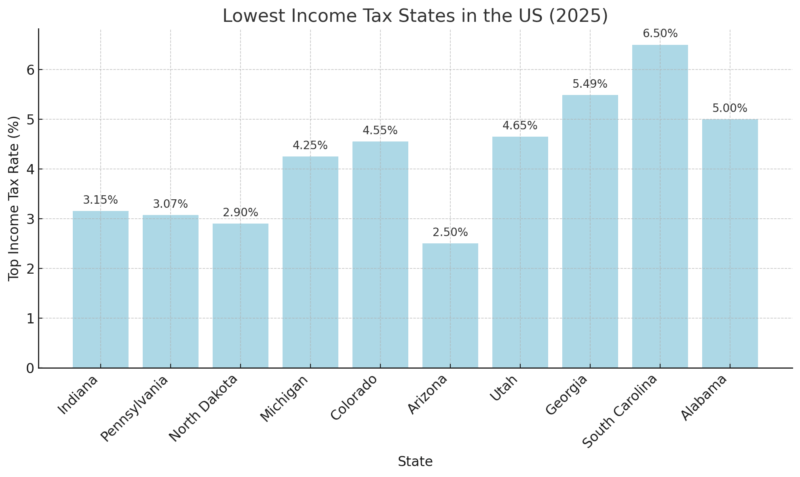

The 10 States With the Lowest (Non-Zero) Income Taxes in 2025

These states impose very low or flat income taxes, offering more predictable and reduced tax burdens, especially for middle-income earners.

Lowest Income Tax States

Pennsylvania – Flat Rate: 3.07%

Pennsylvania has one of the lowest flat income tax rates in the nation at 3.07%, unchanged for over two decades. The state uses a true flat tax, meaning all taxable income is taxed at the same rate regardless of income level, with very limited deductions or credits.

This simplicity makes it easy to administer, but it’s often criticized for being regressive, offering less relief to low-income earners. Pennsylvania also levies a Local Earned Income Tax (EIT) in most municipalities, typically around 1%, which bumps effective rates up slightly.

Despite the low state rate, combined tax burdens can still feel significant. Residents also contend with high property taxes in districts like Chester and Montgomery counties, and a 6% statewide sales tax (plus local add-ons in places like Philadelphia and Allegheny County).

Still, a 2024 WalletHub report ranked Pennsylvania in the top 10 for tax fairness, due to its predictability and lack of sudden changes. Retirees also benefit, as Pennsylvania exempts Social Security, pension income, and most retirement plan distributions from state tax.

Indiana – Flat Rate: 3.15% (phasing down to 2.9%)

Indiana’s current flat income tax rate stands at 3.15%, but under 2023 legislation, it’s scheduled to gradually drop to 2.9% by 2027 — one of the most aggressive reductions among midwestern states.

The flat rate applies uniformly, but Indiana also allows counties to levy their income taxes, which can add 0.5% to 3.0%, depending on where a taxpayer resides. This makes the combined effective rate higher than the state number suggests.

Nevertheless, Indiana has earned a reputation for fiscal stability and a low overall tax burden. A 2025 Kiplinger report highlighted it as one of the best states for middle-class families, with modest housing prices and a balanced budget.

However, groups like the Institute on Taxation and Economic Policy (ITEP) warn that low-income Hoosiers pay a disproportionate share when all taxes are considered, including sales and excise taxes on essentials like gas and groceries.

North Dakota – Top Rate: 2.9%

North Dakota significantly restructured its income tax code in 2023, reducing its top marginal rate to 2.9%, previously over 4.3% just two years earlier. The state retained its progressive system, but with only two brackets: 1.5% and 2.9%.

This simplified approach primarily benefits high earners while offering only modest relief for low-income households. The effective tax impact is softened by generous standard deductions and exemptions, especially for families.

While North Dakota’s income tax is among the lowest in the country, the state depends heavily on oil and gas severance taxes to fund public services. This energy revenue has helped maintain low personal taxes without dramatically cutting public spending.

A 2025 North Dakota Budget Office report showed over 45% of general revenue came from mineral-related sources, allowing the state to avoid broad-based tax hikes even during economic downturns.

Michigan – Flat Rate: 4.25%

Michigan imposes a flat 4.25% income tax, with no plans for rate reductions as of 2025. This flat rate applies to most taxable income, with limited itemized deductions. The state also collects a 6% sales tax, but property taxes are close to the national average.

Michigan briefly reduced its rate to 4.05% in 2023 under a revenue-trigger law, but this reduction was temporary and expired in 2024 due to revenue rebounds.

The state uses income tax revenue to fund education, infrastructure maintenance, and public employee pensions. A 2025 report from the Michigan Treasury noted that over 70% of state schools depend on income tax funds.

Some policy analysts argue the flat rate hurts lower-income families in Detroit and Flint, where average household income is far below the state median. However, Michigan’s low housing costs help offset the tax bite for many residents.

Colorado – Flat Rate: 4.55%

Colorado operates with a flat income tax of 4.55%, applying evenly across all income brackets. Unlike many flat-tax states, Colorado aligns its taxable income calculations closely with federal AGI (Adjusted Gross Income), which simplifies filings but reduces flexibility in applying state-specific deductions.

The state also maintains a TABOR (Taxpayer’s Bill of Rights) law, which limits the annual growth of state revenues and sometimes triggers rebates to taxpayers when collections exceed allowable limits.

Colorado’s economy has grown quickly in the past decade, but housing costs in Denver, Boulder, and Colorado Springs have skyrocketed. As a result, middle-income earners feel the squeeze despite the state’s moderate tax rate.

The combination of income tax, high property taxes in urban counties, and elevated living expenses makes the total tax impact highly location-dependent. Still, the state ranks well for small business friendliness and transparent tax administration.

Arizona – Flat Rate: 2.5%

Arizona implemented a major income tax overhaul in 2023, transitioning from a tiered system to a flat 2.5% rate, now one of the lowest in the country.

This reform was designed to attract residents and businesses from higher-tax states like California, and early 2025 reports from the Arizona Department of Revenue show strong in-migration and business formation in Phoenix, Scottsdale, and Tucson.

The flat tax applies to all personal income, and although it offers simplicity, critics argue it reduces the state’s flexibility to adjust revenues in economic downturns.

The 2.5% income tax is partially offset by relatively high sales taxes—Phoenix, for example, has a combined state and local sales tax rate of over 8.5%. A 2025 Arizona Center for Economic Progress report warned that low-income families end up paying a higher share of their income through consumption taxes.

Still, the state ranks high for retirees and remote workers, in part because it does not tax Social Security income and keeps total tax burdens moderate.

Utah – Flat Rate: 4.85%

Utah maintains a flat personal income tax rate of 4.85%, which applies across all income levels. The state made slight adjustments in 2024 to increase its earned income tax credit (EITC), aiming to help lower-income families under the flat system.

Utah is frequently cited as a model of “balanced taxation,” with moderate property and sales taxes that supplement income-based revenues, allowing for broad funding of education, infrastructure, and public health programs.

A 2025 Utah Foundation survey found that over 70% of residents felt the tax system was fair and efficient. The state’s strong fiscal management has helped it avoid major budget crises while maintaining an AAA credit rating.

However, housing inflation in Salt Lake City and surrounding counties continues to rise, placing pressure on middle-income residents who see their effective burden grow even with flat income rates.

Georgia – Top Rate: 5.49% (progressive)

Georgia operates a progressive tax system with a top marginal income tax rate of 5.49%, applied to single filers earning above $7,000 and joint filers above $10,000. In practice, most middle-income residents fall into this top bracket due to the low threshold, making it functionally close to a flat tax for the majority of workers.

Recent reforms aim to consolidate brackets and reduce the top rate to 5.39% by 2026, as part of a long-term goal of flattening the tax code.

Despite the relatively modest income tax rate, Georgia collects significant revenue from local property taxes and sales taxes—Atlanta’s total sales tax is among the highest in the Southeast.

According to a 2024 analysis by Georgia State University, effective tax burdens vary widely by county. High-income earners in suburban counties like Cobb and Gwinnett benefit most, while rural areas see less proportional benefit from public expenditures.

South Carolina – Top Rate: 6.5% (progressive)

South Carolina uses a progressive income tax system with a top rate of 6.5%, which kicks in at relatively low income levels—over $16,000 for individuals. The state recently restructured its brackets, reducing the top rate from 7% in 2022 and compressing the lower brackets to provide modest relief for middle-class taxpayers.

Income tax revenues support a large portion of public education and infrastructure spending, including major highway expansion projects.

South Carolina ranks as one of the more retiree-friendly states, as it exempts Social Security income and offers generous deductions on pensions. However, according to a 2025 South Carolina Policy Council review, the state’s reliance on regressive sales and excise taxes to fund shortfalls disproportionately impacts low-income households.

Charleston and Columbia also have some of the fastest-growing housing costs in the region, further complicating the tax burden.

Alabama – Top Rate: 5.0% (progressive)

Alabama has a progressive income tax system with a top marginal rate of 5.0%, applying to incomes over $3,000 for individuals and $6,000 for married couples filing jointly. Because the top rate begins at such a low threshold, most full-time workers pay at the highest rate, making Alabama’s income tax structure effectively flat for most people.

However, the state allows deductions for federal income tax paid, which can reduce liability for higher earners.

Alabama has one of the lowest overall tax collections per capita in the U.S., which translates into reduced funding for public services like education and healthcare. According to the 2025 NEA, the state’s K-12 spending per student ranks in the bottom 10 nationally.

Property taxes remain extremely low compared to the U.S. average, but residents often pay the price through poorer public infrastructure and limited social programs.

The 9 States with No Individual Income Tax (2025)

In addition to the low-tax states discussed above, nine U.S. states do not levy any individual income tax on wages as of 2025. These states are: Alaska, Florida, Nevada, South Dakota, Texas, Washington, Wyoming, Tennessee, and New Hampshire.

(New Hampshire and Washington tax certain investment gains but not wage income, as noted below.) Without taxing personal income, these states rely on other revenue sources and have crafted unique fiscal strategies to fund government services.

The table below summarizes these nine no-income-tax states, highlighting their primary alternative revenue sources and notable fiscal characteristics:

State

No-Income-Tax Since

Key Revenue Sources (No Income Tax)

Unique Fiscal Characteristics

Alaska

1980 (repealed income tax)

Oil & gas severance taxes; Investment earnings; Federal aid.

No state sales tax either (some local sales tax). Pays annual Permanent Fund Dividend to residents from oil revenues. Volatile revenue tied to oil prices; minimal taxes but very high per-capita federal funding.

Florida

Forever (no state income tax in history)

Sales tax (6% state + ~1% local); Tourism taxes (hotel, rental cars); Corporate tax (5.5%).

Relies heavily on booming tourism and population growth. Relatively high sales & use taxes, but low property taxes on average. No tax on retirement income attracts retirees.

Nevada

Forever

Sales tax (6.85% state + ~1.4% local avg); Gambling and casino taxes; Live entertainment and tourism fees.

The economy is fueled by Las Vegas tourism. Gaming taxes are a huge revenue source. No corporate income tax, but a gross receipts tax on large businesses (“Commerce Tax”). Low property taxes (~0.44% effective)

South Dakota

Forever

Sales tax (4.2% state + ~1.9% local); Gambling taxes (Deadwood casinos, video lottery); Severance taxes (small oil/gas); Federal grants.

Very small population; low spending. Consistently ranks as one of the most “business-friendly” tax climates. No corporate income tax either. Agriculture-heavy economy; high affordability rank.

Texas

Forever (no state income tax; constitutional ban)

Property taxes (high: ~1.47% effective rate); Sales tax (6.25% state + up to 2% local); Oil & gas severance taxes; Franchise tax (gross receipts ~0.75% on businesses).

High property taxes fund local schools (no state income,e but property tax ~1.68% avg). Rapid economic and population growth bolsters sales tax revenues. The Constitution requires a 2/3 vote to enact an income tax (highly unlikely).

Washington

Forever (no tax on earned income; new tax on capital gains in 2022)

Sales tax (6.5% state + up to ~3% local); Business & Occupation tax (gross receipts on businesses); Property taxes (0.76% effective); Capital Gains Tax (7% on stock/bond gains > $250k from 2022).

Thriving economy (tech, trade) yields strong sales/business tax revenue. The new capital gains tax (targeting wealthy investors) is unique among no-income-tax states. No personal income or corporate income tax, but B&O tax is significant. Higher cost of living and housing prices offsetthe lack of income tax (affordability rank 47th).

Wyoming

Forever

Minerals severance taxes (coal, oil, trona); Federal mineral royalties; Sales tax (4% state + ~1.4% local); Property tax (low, 0.55% effective).

Very resource-dependent budget (minerals fund >50% of state gov). Tiny population; low spending needs. No corporate income tax. Often ranked #1 in “tax climate” due to almost no taxes on income or corporate profits.

Tennessee

2021 (Hall income tax on dividends/interest fully repealed)

Sales tax (7% state + avg 2.55% local – nation’s highest combined ~9.55%); Franchise & excise taxes on businesses (6.5% excise on profits).

Until 2021 had a 6% tax on interest/dividends, now fully gone. Very high sales tax burden, but very low property tax (0.48% effective, one of the lowest). Attracting both businesses (Nashville boom) and retirees (no income tax on pensions).

New Hampshire

No tax on wage income (ever); phasing out 5% interest/dividends tax by 2027

Property taxes (very high: ~2.09% avg, 4th highest); Selective taxes: 8.5% business profits tax, 7.5% business enterprise (payroll) tax; 9% meals & rooms tax.

No sales tax and no broad income tax, so local governments rely on property taxes for schools – NH has some of the highest property taxes in the U.S.. Interest & Dividends Tax was 5% in 2020, now 3% in 2024, on track to hit 0% by 2027. Often attracts commuters who work in Boston but live tax-free in NH (aside from property tax).

How Do These Nine States Manage without An Income Tax?

They typically lean on a mix of other taxes and revenue streams. For many, sales and excise taxes are crucial – for example, Tennessee and Florida have very high sales tax rates, shifting the tax burden to consumption according to turbotax.intuit.com.

Property taxes are another pillar: Texas and New Hampshire, notably, have no wage tax but some of the highest property taxes in the nation. This can hit homeowners hard, but is a trade-off those states choose to makemake instead taxing income.

Resource-rich states like Alaska and Wyoming can fund government through severance taxes on oil, gas, and minerals, exporting much of the tax cost to out-of-state consumers of those resources. Alaska even goes so far as to pay a dividend to residents from its oil fund instead of taxes, but in lean budget years, it has had to consider implementing a sales tax or income tax (so far resisted).

Another strategy is keeping government spending relatively low. South Dakota and Wyoming have small populations and correspondingly lean public sectors; they rank high in “affordability” partly because public services (and taxes to fund them) are modest.

Florida and Texas have larger budgets but also booming economies and populations to generate revenue through tourism, sales, and business taxes. Florida, for instance, benefits from millions of tourists who pay sales and taxesl taxe,– effectively taxing non-residents to fund resident services.

Texas uses a statewide gross receipts tax on businesses (the franchise tax) and allocates significant portions of sales tax to state needs, while local entities rely on property taxes for schools.

The absence of an income tax certainly benefits certain taxpayers the most: generally, high earners and those with substantial investment income or retirement income see the greatest savings.

A wealthy entrepreneur or professional in, say, Seattle or Miami gets to keep every additional dollar they make (aside from federal taxes), whereas in California or New York, a chunk would go to the state.

This has made states like Florida and Texas magnets for wealthy individuals and companies – recent IRS migration data show those states gaining high-income households from high-tax states, as noted by Heritage.org.

Retirees also find no-income-tax states attractive: not only is their pension/Social Security free from state tax, but many no-tax states (Florida, Texas, Tennessee) also have warm climates and other retiree amenities.

That said, lower and middle-income residents can benefit too – they avoid state tax withholding on wages, which can make a meaningful difference in monthly take-home pay.

What Are the Trade-Offs in Public Services?

Without income tax revenue, some of these states face tight budgets or rely on more regressive taxes, which can affect public services. For example, New Hampshire’s very high property taxes create disparities in school funding (towns with a rich tax base vs. those without, leading to legal battles over education funding).

Texas, lacking an income tax, historically spent less per pupil on education and less on social services than many states (though it has improved teacher pay in recent years using surplus funds).

Florida leans heavily on sales tax and tourism dollars, which generally keep up in good times but can dip in recessions (or pandemics, as seen in 2020) – Florida compensates with relatively low spending per capita on things like public welfare.

Bottom Line

@ducklingsproductions These are the states with lowest tax rates🤓🤓 #fyp #usa ♬ original sound – Ducklings

In summary, the nine no-income-tax states demonstrate that it’s quite possible to run state governments without taxing wages, but each does so in its own way, whether through taxing consumption, natural resources, or businesses, and often with careful control of expenditures.

Residents in these states often enjoy the psychological and financial benefit of no state tax withholding on paychecks, which is a strong selling point.

The trade-off is usually higher taxes in other areas (like the sales tax you pay at the store or the property tax built into your mortgage) and sometimes leaner public services or higher user fees (like toll roads, higher state university tuitions, etc., to make up for lost broad tax revenue).

Each no-tax state strikes a different balance: New Hampshire, for example, foregoes both income and sales tax but then has sky-high property taxes and business taxes, essentially shifting the load onto property owners and businesses.

Washington taxes corporate gross receipts and capital gains to capture revenue from wealthy companies and investors instead of wages. Alaska heavily relies on oil and federal money, giving its residents both no taxes and annual checks, but is extremely sensitive to oil market swings.

Related Posts:

- Which States Require You To Have Health Insurance in 2025?

- Which U.S. States Have the Most People Aged 85 and Older?

- Bipolar Disorder Hospitalizations 2025 - Which…

- US States with the Highest and Lowest Dental Care…

- 5 U.S. States With the Highest Population Growth in…

- 5 States With the Highest and 5 Lowest Healthcare…